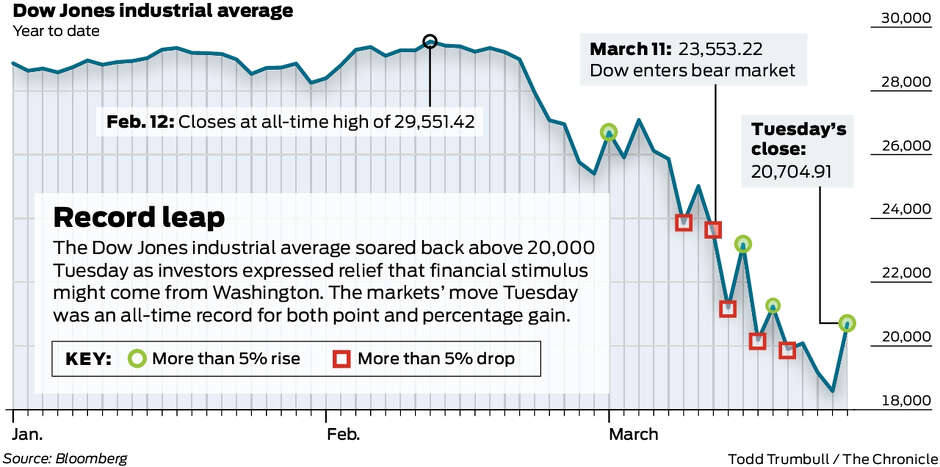

After last week’s continued meltdown, stocks rebounded sharply earlier this week, with Tuesday’s gains setting an all-time one-day record for both point and percentage gain:

Questions we’re now hearing from PP.com readers over the past few days include:

- Given the announced QE and $2 trillion stimulus package, is the bottom now in?

- With the news that physical supply of gold is “running out”, what does that mean for gold & silver prices? For the mining stocks?

- What steps should investors like me be taking now?

To answer these questions, I just recorded another brief interview with the lead partners at New Harbor Financial, the financial advisor Peak Prosperity endorses.

While the S&P 500 remains down -25% since the February highs, New Harbor’s general portfolio is up over the same period. THAT’S the power of conservative management and prudent risk mitigation.

In the short video below, they emphasize that it’s not too late to take smart steps with your portfolio against further market downside:

Anyone interested in scheduling a free consultation and portfolio review with Mike and John can do so by clicking here.

And if you’re one of the many readers brand new to Peak Prosperity over the past few weeks, we strongly urge you get your financial situation in order in parallel with your physical coronavirus preparations.

We recommend you do so in partnership with a professional financial advisor who understands the macro risks to the market that we discuss on this website. If you’ve already got one, great.

But if not, consider talking to the team at New Harbor. We’ve set up this ‘free consultation’ relationship with them to help folks exactly like you.

The post Market Mayhem Update: Is It Safe To Re-Enter? appeared first on Peak Prosperity.

from Peak Prosperity https://ift.tt/2Jgr0s6