Sometimes an otherwise-forgettable movie will be lifted up out of obscurity by the internet and made into a useful meme.

In the movie Zoolander Will Ferrell’s character, ‘Jacobim Mugatu,’ screams the line “I feel like I’m taking crazy pills!” because it seems nobody else sees what he does.

I have that feeling nearly every day now. And it’s getting more frequent and intense.

To the point where, some days, it feels like I’m in danger of overdosing on crazy pills.

Crazy Pill #1

Financial bubbles happen. History is full of them. It’s just that they’re just not supposed to happen more than once a generation.

How can so many people have completely forgotten the painful lessons of not one, but two, recent bubbles?

The bursting of the DotCom bubble in 2000 was traumatic. “Eyeballs” were favored for a time over “earnings.” But then investors woke up to the fact that all of their rationalizations for the sky-high valuations of profitless companies were actually ridiculous.

Okay, fine. Lesson learned. Earnings are actually important.

But here we go, again, less than 20 years after the DotCom bubble (and only 10 years post-subprime bubble — both far less than a full generation later to allow the keepers of the memories a chance to die off) with exactly the same dynamic at play:

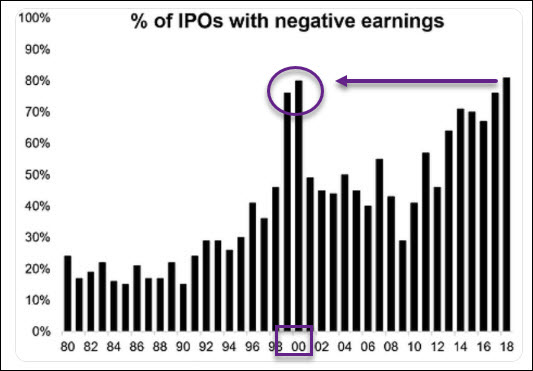

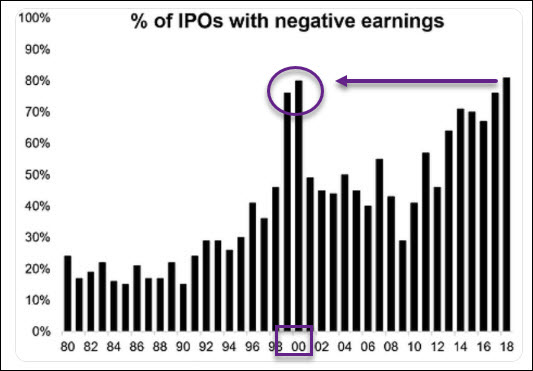

In the pre-financialization era that ended a few decades ago, a more normal mix would have been roughly 15% of IPOs with negative earnings. Today it’s nearly 80%.

Just as it was in 2000.

By way of example, let’s look at Uber and Lyft. Both companies aren’t just unprofitable, but wildly so. The more these companies make in revenue, the greater the accompanying losses:

(Source)

This is the very essence of a broken business model. It’s no different – literally, exactly the same – as a circa-1999 DotCom losing gobs of money on a pie-in-the-sky business scheme that sounded great but didn’t actually work.

No matter to Lyft’s stock price, though, as the market (or ““market”” as I refer to it because it’s so deformed it needs double quote marks to signify that condition) now values this cash-burning furnace at $18.9 billion:

Lyft’s stock price just keeps going higher, no matter the losses. One can only imagine how much higher it will explode if Lyft manages to somehow turn in slightly-less-than-negative-as-last-time earnings next quarter.

What matters during an asset price bubble is not the rational, but the rationalizations. Uber and Lyft are “transforming transportation” and “reducing urban congestion” even though taxis already existed and there’s zero evidence of the latter.

Wolf Richter said it very well in a recent piece:

Anything goes: story stocks, momentum stocks, hyperventilation stocks, consensual hallucination stocks, and financial engineering stocks that generate mind-boggling share prices that give these companies incomprehensible market capitalizations, and the mere mention of “fundamentals” gets naysayers ridiculed and thrown out.

It’s like the whole market has gone nuts.

(Source)

The full quote that goes with the meme is “Doesn’t anyone notice this?!? I feel like I’m taking crazy pills!!”

How can people not notice what’s going on?

Crazy Pill #2

I keep reading articles where hapless financial journalists try earnestly to make sense of a world that is now senseless.

It must be terribly frustrating to be see the impact the central bank bubble is having on distorting the markets, but your editors disallow you to point any of that out to your readers.

A recent WSJ article noted that investors poured money into bond funds at a record pace in the first half of 2019. It then went on to explain this as a sign that investors might be cautious about the economy.

Sure, that’s probably a fair conclusion during normal times. But not when crazy pills are being served buffet-style by the world’s central banks.

Instead, we have to note that the world now has a whopping $13.7 trillion in negative yielding bonds – meaning record high bond prices – and negative earning IPOs both existing simultaneously.

When investors are cautious, they move money out of stocks and into bonds. That’s what the journalist was grasping for, but that’s not what’s happening now. Money is flooding into both stocks and bonds. It’s concurrently a risk-on and a risk-off environment — which means its actually neither.

It’s a bubble.

A magnificently-deformed time of massive monetary excesses.

We’re currently witnessing a massive blow-off top that will end in something quite akin to the Dark Ages – a time of systemic breakdown when we’ll be lucky to preserve the pinnacles of our current technological achievements. But let’s save that idea for later.

To make the “Bubble!” claim more concrete, let me burrow in a bit. Switzerland’s government bond market will serve nicely as a case in point:

Swiss 50-yr yield falls below 0%, entire Swiss curve now negative

July 25, 2019

(Reuters) – Swiss 50-year borrowing costs fell below 0% on Thursday for first time since August 2016, meaning Switzerland’s entire government bond market now trades with negative yields.

The 50-year yield fell 2.6 basis points to minus 0.014%.

(Source)

Pick any Swiss bond of any maturity and you’ll have to pay the Swiss government for the luxury of buying and holding that bond.

In the case of the 50-year bond, you’d pay $1,000 today for the pleasure of having the Swiss government promise to pay you back $993 in the year 2069.

Heck, even if the bond was paying 0% vs. a negative amount, that would mean that your money has no value. You give an entity your money and they give you back exactly the same amount 50 years later.

But with negative interest rates, you’re getting even less than that back.

I could possibly make sense of that if we knew that the amount of circulating money was going to fall over time, so there were fewer claims against more ‘things’ over time. That is, deflation.

But we’re in the exact opposite world with global central banks easing like mad at the moment and promising even more. Rate cuts. And more QE. And making serious comments about maybe buying equities directly. Or maybe just print up money and distribute it via MMT. The central banks have promised in word and deed that they’ll do whatever it takes!

Against that backdrop, what can we make of the hundreds and thousands of individual “investors” that are actually buying the Swiss 50-year bond at a negative yield of -0.014%?

If they hold that bond to maturity, they’re going to get less money back than they put in AND the purchasing power of that money is going to be seriously diminished. What sane person would make that deal?

Again, doesn’t anybody notice this?

Crazy Pill #3

By far the largest crazy pill I am taking, a horse-sized one that feels larger than my throat, concerns the serious consequences with society’s addiction to perpetual economic growth.

Edward Abbey said it best:

That’s what we’ve got now.

There’s nothing wrong with growth per se. But if it becomes the mission instead of the strategy, then it’s cancerous and self-destructive.

Virtually nobody in power ever questions the “need” for economic growth. It’s a universally understood imperative, especially among the banking class.

Despite already having supremely frothy stock prices and negative bond yields that require mega-doses of crazy pills to even contemplate, the world’s central banks are desperately scrambling to justify easing more — to drive stock and bond prices to even frothier heights.

And for what exactly? What’s so urgent, right here and now, about getting even more growth?

In nature, seasons come and go. The sun rises and sets. But if it were up to the central banks, the sun would stay perched at its mid-summer noon apex forever. Think of the corn yields!

Maybe we can invent a pill that will banish sleep. Think of the extra productivity of the resulting 80-hour work week!

Meanwhile, casually scanning the headlines we notice multiplying ecological breakdowns like these:

Individually any one of these might be explained away as a fluke. But collectively? They clearly shout that something is terribly wrong with the natural world resulting from our current monomaniacal pursuit of growth.

The current trajectory of the environmental data is frightening. People either are aware of this, ignorant of it, or in denial about it. Anybody of my age (mid 50’s) who spent time outside as a kid, or has noticed the recent dearth of insects on the screen door on summer nights, can see with their own eyes how the natural world of insects and migratory birds has been collapsing.

Doesn’t anybody else notice this?

To me, it’s just a simple statement of fact to say that the economy is a subset of the natural world. No ecology = no economy. No oysters in the bay means no oyster fishery. No soil means no farming.

But the way things are currently configured, within every political and financial institution, along with their compliant media presstitutes, the one and only goal is more GDP growth.

Which means more throughput of ‘stuff’. Resources + energy = more stuff.

When times get tough and GDP starts looking like it might (gasp!) fall, the State freaks out and floods the world with more money and more credit to cattle-prod the economy back to ‘health’.

The implicit, if not explicit, assumption contained therein is that some sort of salvation, or broad social good, results from perpetual GDP growth.

That was coincidentally true during the 1700’s, 1800’s and most of the 1900’s. But it’s absolutely not true anymore in the 2000’s. The blind pursuit of growth is now diminishing society’s prospects, not enhancing them. But the keepers of power have not managed to adjust to this new reality.

At least not publicly. Though you should see the number of rich people and high-level government institutions that are preparing for massive disruptions by building world-class bug-out shelters and stocking up years of provisions.

You might consider doing the same. Just in case.

I certainly have.

Conclusion

Being at peace with today’s status quo requires taking crazy pills. Lots and lots of them.

Such is the nature of late-stage bubbles.

It’s also the nature of civilizations that have run their narrative past the breaking point. Late-empire Romans needed crazy pills to believe in Emperor Caligula. So did the Aztecs when they embraced Cortez.

Towards the end, the leadership of a dwindling civilization isn’t the cause the decline, but reflective of it. Once the narrative thread no longer makes any sense, having defective leadership is a requirement. It’s something the culture demands in order to keep the perverted status quo going.

This is why I’m strictly apolitical. It matters not to me whether it would have been Trump or Clinton in the White House. Either/both would have been similarly defective leaders. We are badly off the rails at this point, and our political system reflects that.

Similarly, I’m agnostic about who heads the central banks around the world. Draghi was loathsome, but Lagarde won’t be any better. Powell certainly speaks more clearly than Greenspan, but he’s literally no different.

Today we have a small cabal of unelected officials, many without any real-world operating experience (such as starting and managing a productive business) setting the prices of not just money, but of every financial asset. And after they “serve the public” they then rotate into the exact same banks and financial firms that most benefited from their “service.”

How is any of that different from the way the Soviet Union set crop targets and prices? It’s not.

The bottom line is this: Nothing will change until the system breaks.

It’s a 100% guarantee that somewhere between here and 2069 interest rates will be either very far north of -0.014% and/or the Swiss franc (and other fiat currency) has become worthless.

It’s a further guarantee that more cities and, possibly entire countries, will run out of fresh water. Agricultural soils will become vastly less productive. And the world will be well past peak oil.

In Part 2: The Antidote To This Insanity, we provide direct steps you can take right now to persevere, and potentially prosper, through what’s ahead. And to be ‘part of the solution’ vs among those still contributing to the catastrophes our culture is creating.

It’s entirely possible that ecosystem collapse will render whole new swaths of the globe uninhabitable to humans.

But, by all means, buy as much Uber and Lyft stock as you want.

But if you do, be sure to chug down a handful of crazy pills first.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access).

The post Overdosing On Crazy Pills appeared first on Peak Prosperity.

from Peak Prosperity https://ift.tt/2YafloA

Gold and silver have broken out. What’s next? We know that the stock market has continued to go up, the US Dollar has been strengthening and gold has been going up. Why is this happening? We’re starting to see select junior miners breaking out as well. It looks like the worm has turned. We also discuss the Baltimore situation and why American cities are crumbling. It all began during the civil unrest of the 1960’s. The combination of rampant crime and forced busing led to white flight. Most cities have yet to recover. And when you take a look at Baltimore, you can’t help but notice billions of aid dollars have been wasted or stolen. So it’s great that someone is finally calling them out and being honest about the situation. Let’s hope it continues and eventually change.

Gold and silver have broken out. What’s next? We know that the stock market has continued to go up, the US Dollar has been strengthening and gold has been going up. Why is this happening? We’re starting to see select junior miners breaking out as well. It looks like the worm has turned. We also discuss the Baltimore situation and why American cities are crumbling. It all began during the civil unrest of the 1960’s. The combination of rampant crime and forced busing led to white flight. Most cities have yet to recover. And when you take a look at Baltimore, you can’t help but notice billions of aid dollars have been wasted or stolen. So it’s great that someone is finally calling them out and being honest about the situation. Let’s hope it continues and eventually change. We sat down with

We sat down with

Pat Donnelly provides an update on

Pat Donnelly provides an update on

The current economic situation, at least according to

The current economic situation, at least according to