This is how insane things have become.

The post Another Day, Another All-Time Record appeared first on King World News.

from King World News https://ift.tt/3jBLmfp

Top Finance And Economic News Today. Your one stop site for news about USA and global economy, gold, silver, investing, geo politics, mining stocks. We cover news about and from Jim Rogers, Jim (James) Rickards, Mike Maloney, Peter Schiff, Greg Mannarino, Greg Hunter, SGT Report, Robert Kiyosaki, Martin Armstrong, Bo Polny, Eric King, King World News, Bix Weir, Paul Craig Roberts, Dollar Vigilante and many more.

This is how insane things have become.

The post Another Day, Another All-Time Record appeared first on King World News.

As we get ready to kickoff trading in the month of September, look at what is happening with gold, silver, US dollar and stocks.

The post CHECKMATE FOR GOLD & SILVER BEARS? Look At What Is Happening With Gold, Silver, US Dollar And Stocks appeared first on King World News.

from Daily Market Wisdom with Nick Santiago

For more than 20 years, Master Trader Nick Santiago has been beating the markets. He’s made some incredible calls along the way and now he’s looking to spread the word. There’s no reason that the average trader should be coming up short. So now we’ve started a daily show to bring you up to date on the latest market developments. Nick will be sharing trades and concepts and discussing current trends. Today we discuss:

1. Apple (AAPL) and & TSLA (TSLA) both split this morning. Remember, a split does not really change anything. The market cap is still the same. It should be noted that both of these stocks ran up into the split so they could be due for a pullback of some sort very soon. Stocks are clearly overbought. When will Tesla be put into the S&P 500? That’s the question. Short sellers have lost at least $25 billion in Tesla. Musk is the master of the news flow.

2. This is the final trading week before the Labor Day holiday. So volume trends are expected to be very light. Barring any major geopolitical events, I don’t look for much upside or downside this week. Just a quiet week overall.

3. Mixed tape today. Indexes down except NASDAQ which is 50 points. JV squad is on duty. The A Team is watching closely on their phones.

4. Gold and Silver: gold is down on the future. Silver futures up half a buck. Volume has been up in the sector while the broader market is down. New speculators are being attracted. Silver is stronger on the charts than gold. Once silver breaks $30 we go to $35.25 and $50 is getting closer. A lot of work to do. Again, it broke out from a low, very bullish. Above its 20 day moving average. Gold is just below its 20 day moving average.

For more info, go to InTheMoneyStocks.com.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Bank of England is considering negative interest rates – it doesn’t need to yet (000)

Major central banks around the world have used QE, including the US Federal Reserve and the European Central Bank, as an effective way to boost liquidity and confidence in markets, while allowing financial institutions to rebalance their portfolios. It has helped central banks to prevent deflation – a negative spiral of falling prices, increasing debt burdens and insolvencies.

Justice Dept. Never Fully Examined Trump’s Ties to Russia, Ex-Officials Say (tmn)

A bipartisan report by the Republican-led Senate Intelligence Committee released this month came the closest to an examination of the president’s links to Russia. Senators depicted extensive ties between Trump associates and Russia, identified a close associate of a former Trump campaign chairman as a Russian intelligence officer and outlined how allegations about Mr. Trump’s encounters with women during trips to Moscow could be used to compromise him. But the senators acknowledged they lacked access to the full picture, particularly any insight into Mr. Trump’s finances.

“This Might Be The Weirdest Market I’ve Ever Seen” – Charting The Market’s Descent Into Insanity (CleanEnergyFan)

In other words, we have become a reflexive market of derivatives, where option flow dictates the action of underlying securities. We first noted the flood of option activity in July when we showed a Goldman chart which observed a “historic inversion”: for the first time ever, the average daily value of options traded exceeded shares with July single stock options volumes tracking 114% of shares volumes. This trend has only accelerated since.

Between Crypto, Libra, Stablecoins, And Digital Dollars, Congress Introduced 35 ‘Blockchain’ Bills (Sparky1)

Meanwhile, China seemed to accelerate its vision and ongoing projects toward developing its own central bank digital currency. As Covid-19 sparked not only a pandemic but an economic crisis, the notion of helping people with relief in the form of stimulus checks became popular. With Congress still stinging from the impression in 2008-2009 during the Global Financial Crisis that taxpayer money was used to bail out the very same large financial institutions who caused the crisis, the direction in early 2020 culminated in the CARES Act, which created a taxpayer rebate check of $1,200 for all Americans.

Police reforms face defeat as California Democrats block George Floyd-inspired bills (tmn)

This crucial bill by Steve Bradford, D-Gardena, would allow California to decertify police officers who break the law or engage in serious misconduct. Forty-five states already have the power to do this, but not “progressive” California, where dangerous or criminal officers can simply take their badge and gun and move to another police force. “Criminal Cops,” an investigation conducted by a consortium of California media outlets including McClatchy, highlighted the problem last year.

Bradford blasted fellow lawmakers who hesitated to support his bill despite their public expressions of support for police reform during George Floyd protests.

‘Three little pigs’: Musk’s Neuralink puts computer chips in animal brains (Sparky1)

Musk did not provide a timeline for those treatments, appearing to retreat from earlier statements that human trials would begin by the end of this year. Neuralink’s first clinical trials with a small number of human patients would be aimed at treating paralysis or paraplegia, the company’s head surgeon Dr. Matthew MacDougall said.

Rob Kirby: The End Of The Central Bank Has Come (pinecarr)

Central Bank System Should Change Now

Stephen Miller’s Dystopian America (000)

Language is a tool for shaping minds, and Mr. Miller knows how to weaponize it. It’s why he draws from books like Mr. Raspail’s to shape rhetoric. It’s why, in 2015, he asked writers at Breitbart to produce an article about the parallels between the book and real life that painted the book as prophetic. It’s also why he inserts vivid, gory descriptions of crimes ostensibly committed by migrants into Mr. Trump’s speeches.

Portland Shooting Amplifies Tensions in Presidential Race (tmn)

Mr. Trump on Sunday morning posted or reposted a barrage of tweets about the clashes in Portland, with many of them assailing the city’s Democratic mayor, Ted Wheeler. The president retweeted a video showing his supporters shooting paintballs and using pepper spray on crowds in Portland before the fatal shooting. Mr. Trump wrote that “the big backlash going on in Portland cannot be unexpected,” a remarkable instance of a president seeming to support confrontation rather than calming a volatile situation.

Forecasting Intellingence: After The Conventions (James W.)

According to this pollster, Lee Carter, who ran focus group polling throughout the two conventions, independent/swing voters connected with the Republicans in a way they didn’t with the Democrats. See here and here.

In particular, the Republican attempt to soften Trump’s image worked well with independent voters, along with GOP messaging on the economy and crime. I expect the Republicans to continue to hammer the Democrats on the perception that they are weak on law and order, lack patriotism and are a risk to a post-Covid recovery in the economy.

Leonard Cohen’s estate slams Republicans’ use of ‘Hallelujah’ as bid to politicize (Sparky1)

Cohen’s estate said in a statement that it was “surprised and dismayed” the song had been used, saying it had specifically denied the RNC’s request to do so.

It said it was exploring legal options and called the RNC’s decision a “rather brazen attempt to politicize and exploit in such an egregious manner ‘Hallelujah’, one of the most important songs in the Cohen song catalogue.”

How Extremes Become More Extreme, Triggering Collapse (CleanEnergyFan)

Feedback loops are one such dynamic. Somewhat counter-intuitively, when feedback arises to moderate the intensity of a trend, that’s negative feedback. When feedback intensifies the trend, it’s positive feedback.

Why is this counter-intuitive? If a bad trend is moderated by negative feedback, that’s good (positive). If a bad trend gathers momentum due to positive feedback, that’s bad (negative).

Glen Greenwald: Is the US Social Fabric Unraveling? (yogmonster)

This week on System Update, host Glenn Greenwald examines the crumbling of the US social fabric. Glenn explores the rise in so-called Deaths of Despair, and examines the symptoms of deep unhappiness across in America – from suicide to drug overdoses – and how this long-term trend has acutely intensified with the Covid pandemic.

Sweden’s handling of the pandemic has been heavily criticized by public health officials and infectious-disease experts as reckless — the country has among the highest infection and death rates in the world. It also hasn’t escaped the deep economic problems resulting from the pandemic.

But Sweden’s approach has gained support among some conservatives who argue that social distancing restrictions are crushing the economy and infringing on people’s liberties.

Boeing testing new sanitation technology on SC-made plane (000)

“What we’re trying to do really is provide that confidence to the flying public that it is safe to fly on our airplanes,” technical leader for Boeing’s ecoDemonstrator program Doug Christensen said. “We look at the critical, high-value technologies that need to be demonstrated on airplanes and that’s what we are lining up for the next round of testing.”

Boeing is also testing an anti-microbial coating which is sprayed on surfaces to kill bacteria.

Hair Loss an Unexpected COVID Misery for Many (Jan U.)

The American Academy of Dermatology says hair loss can be caused by genetics, age, hormonal imbalances, other health conditions, medication and, of course, stress. Experts say the type most COVID-19 patients are having is called telogen effluvium, a temporary form caused by a physical or emotional stress, high fever, illness or weight loss of more than 20 pounds — symptoms common with the virus. Telogen effluvium involves shedding all over the head — not just on the crown like male pattern baldness — and it’s far more than the 50 to 100 hairs people typically lose daily.

Statins Linked to Reduced Mortality in COVID-19 (Heather)

Treatment with statins was associated with a reduced risk of a severe or fatal course of COVID-19 by 30%, a meta-analysis of four published studies has shown.

A second Trump term would mean severe and irreversible changes in the climate (MS)

Hitting the 1.5° target would require the world to reduce its greenhouse gas emissions 50 percent by 2030 and to net zero by 2050. Doing so would require industrial mobilization beginning immediately. Even hitting 2° would be desperately difficult at this point. There is no longer any time for delay; this is the last decade in which it is still possible.

We know that the US doing its part to reach net zero by 2050 would not be enough, in itself, to limit global temperature rise. By the same token, we know it is wildly unlikely that the rest of the world will be able to organize to meet that goal without US leadership. And in the face of active US undermining and opposition, it will be all but impossible.

Brazil’s Pantanal, world’s largest wetland, burns from above and below (Sparky1)

Firefighters across Brazil are battling raging towers of flames from the Amazon rainforest to the Cerrado savannah, but the fires beneath their feet are a particular challenge in the Pantanal. The only way to combat an underground fires is to dig a trench around it, said state firefighter Lieutenant Isaac Wihby.

“But how do you do that if you have a line of fire that’s 20 kilometers long? It’s not viable,” he said.

Click to read the PM Daily Market Commentary

Provided daily by the Peak Prosperity Gold & Silver Group

Article suggestions for the Daily Digest can be sent to dd@peakprosperity.com. All suggestions are filtered by the Daily Digest team and preference is given to those that are in alignment with the message of the Crash Course and the "3 Es."

The post Daily Digest 8/31 – Charting The Market’s Descent Into Insanity, How Extremes Become More Extreme appeared first on Peak Prosperity.

Here is a look at Warren Buffett's latest move, Euphoric Land, plus gold and silver.

The post Warren Buffett’s Latest Move, Euphoric Land, Plus Gold & Silver appeared first on King World News.

Today the man who predicted the global collapse and has become legendary for his predictions on QE and historic moves in currencies and metals warned we are now headed for a 2nd collapse that will be even more terrifying.

The post Man Who Predicted The Global Collapse Just Warned We Are Headed For A 2nd Collapse That Will Be Even More Terrifying appeared first on King World News.

Today one of the greats in the business predicted $20,000+ gold and also discussed the real reason why silver will skyrocket above $200.

The post BUCKLE UP: $20,000+ Gold And The Real Reason Silver Will Skyrocket Above $200 appeared first on King World News.

In landmark shift, Fed rewrites approach to inflation, labor market (tmn)

The change suggests the U.S. central bank’s key overnight interest rate, already near zero, will stay there for potentially years to come as policymakers woo higher inflation.

“It’s no news that (Fed Chair Jerome) Powell doesn’t want to raise interest rates,” said Vincent Reinhart, chief economist at Mellon. What is news, Reinhart said, is that the Fed has now enshrined a degree of tolerance for inflation in its guiding document.

At the end of July, Senate Democrats blocked a Republican bill that would have extended federal unemployment benefits but cut the $600 a week amount to $200 through the rest of 2020. The bill never made it to the House of Representatives.

Senate Republicans also shut down a $3 trillion stimulus measure Democrats tried to pass. The measure was approved in the House in May and would have included an extension on the full $600 a week benefit until January 2021.

REPORT: Gilded Giving 2020: How Wealth Inequality Distorts Philanthropy and Imperils Democracy (000)

Over the last two decades, charitable giving has been on a steady upward trajectory. But this growth has masked a troubling trend: Charity is becoming increasingly undemocratic, with organizations relying more on larger donations from a smaller number of wealthy donors, while receiving shrinking amounts of revenue from donors at lower-and middle-income levels.

Ailing Abe quits as Japan PM as COVID-19 slams economy, key goals unmet (tmn)

Despite the deepening concerns about his health, news of Abe’s resignation sent tremors through Tokyo financial markets. Japan’s main stock market, which has more than doubled under Abe, fell some 2% before recovering, while the yen rose on concerns of a return to deflation.

“I cannot continue being prime minister if I do not have the confidence that I can carry out the job entrusted to me by the people,” Abe, 65, told a news conference as he announced his decision.

Nikkei tumbles, yen firms on news Japan’s Abe will resign (Sparky1)

“It is hard to see much of a silver lining (of Abe’s term as PM) but he did provide stability and managed (U.S. President Donald) Trump, which other world leaders have found has not been easy. He did stand up for free trade with his EU deal and rescued TPP, but those stand out as small accomplishments given his bold promises that ‘Japan is Back’.”

Definitive Eurasian Alliance Is Closer Than You Think (westcoastjan)

Comparing China’s economic velocity now with the US is like comparing a Maserati Gran Turismo Sport (with a V8 Ferrari engine) with a Toyota Camry. China, proportionately, holds a larger reservoir of very well educated young generations; an accelerated rural-urban migration; increased poverty eradication; more savings; a cultural sense of deferred gratification; more – Confucianist – social discipline; and infinitely more respect for the rationally educated mind. The process of China increasingly trading with itself will be more than enough to keep the necessary sustainable development momentum going.

Banks eye layoffs as short-term crisis ends, long-term costs emerge (Sparky1)

“No question, layoffs (will) come across the board for all the banks,” said Barry Schwartz, chief investment officer at Toronto-based Baskin Wealth Management, which invests in JPMorgan Chase and other large Canadian banks.

Banks have to cut costs because of expected credit issues, as well as low interest rates and regulatory pressure to trim dividends, he said.

A scroll down the Portland Police twitter feed shows stabbings, shootings, and robberies occurring across the city every day, sometimes multiple shootings in a single day.

And who does vichy “mayor” Ted Wheeler blame for the downfall of the city? Right wing Trump supporters, of course, using strawman arguments of “white nationalists” who “threaten” Portlanders, while saying nothing of the violent leftists who have been engaging in violence and destruction 90 consecutive nights.

Minneapolis Law Preventing Business Owners from Protecting Their Own Property Backfires Horribly (thc0655)

Now, many business owners are running up against this regulation as they seek to protect their reopened stores from future flare-ups of violence. (The earlier riots destroyed at least 1,500 Minneapolis businesses.) Liquor store owner John Wolf saw his store looted after rioters broke in through his windows and stole more than $1 million in alcohol. He’s fuming at the city regulations that stop him from protecting his property.

“Times have changed,” Wolf told the Star-Tribune. “I am going to spend millions of dollars to bring my business back, and I don’t want to buy 20 window panes and have them broken the first day. Property owners should have options on how to protect themselves.”

Coca-Cola to cut thousands of jobs as coronavirus hits sales (Sparky1)

The plan to cut jobs come at a time when the number of Americans filing new claims for unemployment benefits hovered around 1 million last week, with the government confirming that the economy suffered its sharpest contraction in at least 73 years in the second quarter.

United Airlines Holdings Inc (UAL.O) signaled on Thursday it was preparing the biggest pilot furloughs in its history, saying it needed to cut about 21% of total pilot jobs due to a slump in air travel.

Incidents of widespread looting and soaring homicide figures in Chicago have made national news during an already tumultuous year. As a result, some say residents in affluent neighborhoods downtown, and on the North Side, no longer feel safe in the city’s epicenter and are looking to move away. Aldermen say they see their constituents leaving the city, and it’s a concern echoed by some real estate agents and the head of a sizable property management firm.

It’s still too soon to get an accurate measure of an actual shift in population, and such a change could be driven by a number of factors — from restless residents looking for more spacious homes in the suburbs due to COVID-19, to remote work allowing more employees to live anywhere they please.

CDC warned the public against wearing valved facemasks — while recommending them to health workers (Jonathan H.)

To be fair, no face covering, short of a properly-fitted N95 respirator, can claim to completely prevent coronavirus’ spread. Surgical masks are not designed to create a perfect seal, or to filter out 95 percent of virus particles, and they cannot be fit-tested. Those masks, as well as loose-fitting cotton masks, leave gaps that leak air. They could also leak virus particles, as people breathe in and out. It doesn’t take scientists in a lab to see this. Look at just about any random group of mask-wearing people in a store or on the street and observe that large gaps beside the nose or under the ears are visible, and that these are obviously far larger and probably of far greater consequence than the tiny vents on an exhale valve. The zealous focus on valves seems to be a case of missing the forest for a few trees.

Antiviral used to treat cat coronavirus also works against SARS-CoV-2 (000)

The work to test the drug against the coronavirus that causes COVID-19 was a co-operative effort between four U of A laboratories, run by Lemieux, Vederas, biochemistry professor Howard Young and the founding director of the Li Ka Shing Institute of Virology, Lorne Tyrrell. Some of the experiments were carried out by the Stanford Synchrotron Radiation Lightsource Structural Molecular Biology program.

Coronavirus in Vacant Apartment Implicates Toilet in Spread (Sparky1)

The scientists conducted “an on-site tracer simulation experiment” to see whether the virus could be spread through waste pipes via tiny airborne particles that can be created by the force of a toilet flush. They found such particles, called aerosols, in bathrooms 10 and 12 levels above the Covid-19 cases. Two cases were confirmed on each of those floors in early February, raising concern that SARS-CoV-2-laden particles from stool had drifted into their homes via plumbing.

The End of the Oil Age Is Upon Us (Roger B.)

Villamizar is currently Head of Strategy for the Americas at Kaiserwetter Energy Asset Management, an energy investment firm based in Hamburg, Madrid, and New York. His analysis is co-authored with Randy Willoughby, a professor of political science at San Diego University, and Vicente Lopez-Ibor Mayor, previously founding Chairman of Europe’s largest solar energy company Lightsource BP (owned by oil and gas giant BP) and a former Commissioner at Spain’s National Energy Commission. Their study is due to be published later this year by Durham University’s School of Government and International Affairs.

After the COVID-19 crisis, they revised their forecasts—finding that the pandemic has reinforced the trends they had previously identified. In their updated text, they argue that the remaining years of the 21st century and beyond will be marked by a “slow but permanent decline in demand for plenty of oil resources.”

California’s Green Energy Dark Age (thc0655)

Green advocates insist that their ‘virtual power plants’ can still handle everything, routing power from the solar panels on Bob’s roof in Marin to compensate for a wind farm going offline. This power shell game looks very futuristic in presentations, but the energy grid isn’t data. Power can’t just be treated like file sharing no matter how much energy consultants insist that it can.

The Democrats and their media allies who caused this mess are pretending to be baffled.

Hurricane Laura smashes parts of Louisiana and Texas, killing 6 and leaving widespread wind damage (tmn)

Laura, later downgraded to a tropical storm, was about 35 miles south of Little Rock, Arkansas, with sustained winds of 40 mph as of 7 p.m. CT Thursday. But it made landfall around 1 a.m. with sustained winds of 150 mph, devastating southern Louisiana communities for miles.

While there were widespread reports of wind damage, some communities were also beset by storm surge. US Coast Guard aerial video showed flooding in Cameron along the coast.

Click to read the PM Daily Market Commentary

Provided daily by the Peak Prosperity Gold & Silver Group

Article suggestions for the Daily Digest can be sent to dd@peakprosperity.com. All suggestions are filtered by the Daily Digest team and preference is given to those that are in alignment with the message of the Crash Course and the "3 Es."

The post Daily Digest 8/29 – Banks Eye Layoffs As Short Term Crisis Ends, Millions Struggling To Make Ends Meet Without Additional Unemployment Benefits appeared first on Peak Prosperity.

What is about to happen in gold, silver, and the mining shares is going to surprise a lot of people.

The post What Is About To Happen In Gold, Silver, And The Mining Shares Is Going To Surprise A Lot Of People appeared first on King World News.

James Turk: Founder & Lead Director of Goldmoney, Inc (Toronto Exchange XAU) - His latest venture is Lend & Borrow Trust Company Ltd., an online peer-to-peer lending platform that brings lenders and borrowers together by enabling customers to borrow CAD, USD, GBP, EUR or CHF using their gold and silver as collateral for security to the lender…

The post James Turk: Broadcast Interview – Available Now appeared first on King World News.

James Turk: Founder & Lead Director of Goldmoney, Inc (Toronto Exchange XAU) - His latest venture is Lend & Borrow Trust Company Ltd., an online peer-to-peer lending platform that brings lenders and borrowers together by enabling customers to borrow CAD, USD, GBP, EUR or CHF using their gold and silver as collateral for security to the lender…

The post James Turk appeared first on King World News.

If you have not yet read Part 1: Suddenly Fear Of Social Unrest Is Everywhere, available free to all readers, please click here to read it first.As mentioned, one of the top concerns we're hearing our readers express is the increasingly likelihood of major social unrest breaking out. And as long as the current policies driving the expanding wealth inequality gap continue, we agree that's a very valid concern. So, what can you today to reduce your vulnerability should unrest and the threat of violence/looting come to your community? The good news is: A lot. Below, we've compiled the most effective, practical actions and best practices you should consider taking now to safeguard your loved ones, your home, and your wealth from the "mob threat". First, and most important, start by... _______________ Why is this full report restricted to Peak Prosperity’s premium subscribers? Two main reasons: One — we reserve our best analysis and most directive guidance for the paying members whose financial support makes operating this site possible. Also, given that some of this material is our "best guess" thinking or can be overly revealing of the details of our personal actions, we're only willing to share that with this private audience. We wouldn't feel comfortable having that level of speculative/private information out in the public realm. And Two — one of the many benefits of premium membership is closer access to the experts on this site. If you’re not yet a premium member but would like to become one and access this full report, as well as *all* of our premium content, click the button below to subscribe:

The post Protecting Yourself, Your Loved Ones & Your Home From Social Unrest appeared first on Peak Prosperity.

In a year that has experienced a global pandemic, Depression-level job losses, a bevy of large-scale natural disasters from wildfires to Cat 4 hurricanes to derechos, the #1 current concern we’re now hearing from our readers isn’t any of these.

Instead, it’s the danger of social unrest breaking out in their local community.

Anyone with eyes can see that the mercury is rising across America. The riots that follow the deaths of folks like George Floyd and now Jacob Blake, the current violence in Kenosha, Seattle’s lawless autonomous zone, the movement to ‘defund the police’, the anger behind the surge of ‘cancel culture’ — the nation’s social fabric is suddenly stretched taut and starting to tear at the seams.

Is it any surprise that gun sales are up 72%(!) vs last year, with first-time buyers driving a material percentage of that increase:

According to a report by the Washington Post, the National Sports Shooting Foundation says that first-time gun buyers played a heavy role in the increase. Women and black Americans have also shown interest in arming themselves this year.

“Nearly 5 million Americans purchased a firearm for the very first time in 2020. NSSF surveyed firearm retailers which reported that 40% of sales were conducted to purchasers who have never previously owned a firearm,” the organization said in its analysis, which tracked background checks associated with the sale of a firearm reported by the FBI’s National Instant Background Check System.

“This is a tectonic shift in the firearm and ammunition industry marketplace and complete transformation of today’s gun-owning community,” said Lawrence G. Keane, a senior vice president at the foundation. “These first-time buyers represent a group of people who, until now, were agnostic regarding firearm ownership. That’s rapidly changing…

(Source)

This rise in public ire is something we’ve been warning of for years here at PeakProsperity.com. While there are many serious injustices that exist in today’s society, we believe the root cause for the majority of them lies in the misguided and frequently immoral policies perpetrated by the Federal Reserve and Congress — policies that reward the already-rich at the expense of the general public.

2020 has revealed this truth clearly in the response to the covid-19 pandemic. With the $5+ trillion unleashed between the monetary and fiscal “rescue” stimulus efforts, the battle cry from our “leaders” has been: Defend the rich!

Despite an unprecedented decline in economic activity, asset prices have more than recovered their losses and many are now back at all-time-highs in what has been the shortest-lived bear market history:

We have been referring to these detrimental policies as the Leave No Billionaire Behind (LIBB) program, as they’ve resulted in a massive boom for the uber-wealthy, while the rest of America has lost tens of millions of jobs and received meager to no assistance.

To get a sense of the gargantuan disparity between the haves and the have-nots, watch this 2-minute video:

And these policies aren’t going away. In fact, as Fed Chairman Jerome Powell stated yesterday, our leaders are doubling- and tripling-down on them.

In my recent interview with former Fed insider Danielle DiMartino-Booth, she interprets Powell’s comments yesterday as nothing less than a public commitment to “do even more” of what the Fed has been doing since 2009.

So if you think creating a zombie economy that enriches the elites while screwing the rest of us has been bad, boy, you ain’t seen nothin’ yet…

This is why my fellow co-founder Chris Martenson and I share this quote by Plutarch so often. If we continue the status quo trajectory, history is extremely clear on what will follow:

There is a line of intolerance that, once crossed, will turn the desperate masses against the few benefitting so vastly from today’s system.

Skeptical it could happen? History begs to differ. The list of social revolutions, uprisings and rebellions is so long it makes your head spin. Even the number that have happened just within the past decade is staggeringly large

And with an upcoming US Presidential election as divisive as this one? Not only will a large part of America be angry at the outcome, whomever wins, imagine what would happen should the results be contested in a protracted dispute (as has already been hinted at by both parties)? It would be the equivalent of tossing a grenade into the already-overstuffed powder keg.

So, are there steps you can today to reduce your vulnerability should unrest and the threat of violence/looting come to your community?

The answer is fortunately: yes.

In Part 2: Protecting Yourself, Your Loved Ones, Your Home & Your Money From Social Unrest, we’ve compiled the most effective, practical actions and best practices for you to consider taking now to safeguard your loved ones, your home, and your wealth from “mob threat”.

If you’re as concerned about social unrest as many of our readers, you need to assess your biggest areas of vulnerability and actively decide which are worth taking action on today.

Because only those preparations you’ve already put in place are the ones available once crisis hits.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access).

The post Suddenly Fear Of Social Unrest Is Everywhere appeared first on Peak Prosperity.

It appears that we may see another major short squeeze in the gold market as the bullion banks are now desperate to get all of the physical gold they can to prevent a looming failure crisis.

The post ANOTHER GOLD SQUEEZE? Bullion Banks “Need All The Physical Gold They Can Get To Prevent A Looming Failure Crisis” appeared first on King World News.

On the heels of a strong rally in the metals on Friday, what is happening right now in the silver market may send gold and silver prices soaring.

The post What Is Happening Right Now In The Silver Market May Send Gold & Silver Prices Soaring appeared first on King World News.

from Daily Market Wisdom with Nick Santiago

For more than 20 years, Master Trader Nick Santiago has been beating the markets. He’s made some incredible calls along the way and now he’s looking to spread the word. There’s no reason that the average trader should be coming up short. So now we’ve started a daily show to bring you up to date on the latest market developments. Nick will be sharing trades and concepts and discussing current trends. Today we discuss:

For more than 20 years, Master Trader Nick Santiago has been beating the markets. He’s made some incredible calls along the way and now he’s looking to spread the word. There’s no reason that the average trader should be coming up short. So now we’ve started a daily show to bring you up to date on the latest market developments. Nick will be sharing trades and concepts and discussing current trends. Today we discuss:

1. Quiet friday, markets are up. Volume light. They’re all in the Hamptons now. End of August. Last Friday. Labor is on 9-7-20. End of the week. Markets are up. Broad based move overall. Weakness in biotech and select names. Financials are not required to move the markets, but it would help. Markets have rallied up without the financials. JP Morgan at $102, up way up from low but no longer near it’s high. If the financials could lead it would be a positive. Housing remains very strong. Homebuilders are at or near highs. Need to consolidate. No new money for them at this point. Overbought.

2. Took some profits yesterday. Charles Schwab and TBT, bet on higher yields. Letting those stocks. Nick is calling for higher rates. The market will decide when rates go higher. Not screaming higher, but much higher than now.

3. Gold and silver going higher again. Zig zag pattern down to get in. Sell-off yesterday and now it’s up $48 on the future. Gold/Silver up 2.5%. The higher the price of gold gets, the bigger the moves that will come. Could happen on the downside too, but overall they’re heading higher. Consolidations don’t have a set duration. Test candles are extremely bullish.

4. This coming week should be light volume with pre-holiday session.

For more info, go to InTheMoneyStocks.com.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

from Kerry Lutz's Financial Survival Network

Click Here to Listen to the Audio

John D. O’Connor is a highly successful Attorney, and author of, A G-Man’s Life: The FBI, Being Deep Throat and the Struggle for Honor in Washington. His latest book is titled, Postgate: How the Washington Post Betrayed Deep Throat, Covered Up Watergate, and Began Today’s Partisan Advocacy Journalism. He joins the program today to discuss the investigation into Crossfire Hurricane. Who knew what, and when? The noose is closing quickly around key players involved in the scandal.

Sign up (on the right side) for the free weekly newsletter.

from Kerry Lutz's Financial Survival Network

Click Here to Listen to the Audio

Kathy Barnette is a conservative, Black, mother, and wife. She is a veteran, a former adjunct Professor of Corporate Finance, a conference speaker, and a Conservative political commentator. She served her country proudly for ten years in the Armed Forces Reserves, where she was accepted into Officer Candidacy School. Her corporate career includes working with two major financial institutions and in corporate America. Kathy sat on the Board of a pregnancy crisis center for five years.

We discuss the two party conventions that just took place. The contrast couldn’t be greater, one is a grim picture of America, the other an example of hope and greatness. The Dems didn’t mention one word about the riots, why is that? America is truly at a crossroads.

Sign up (on the right side) for the free weekly newsletter.

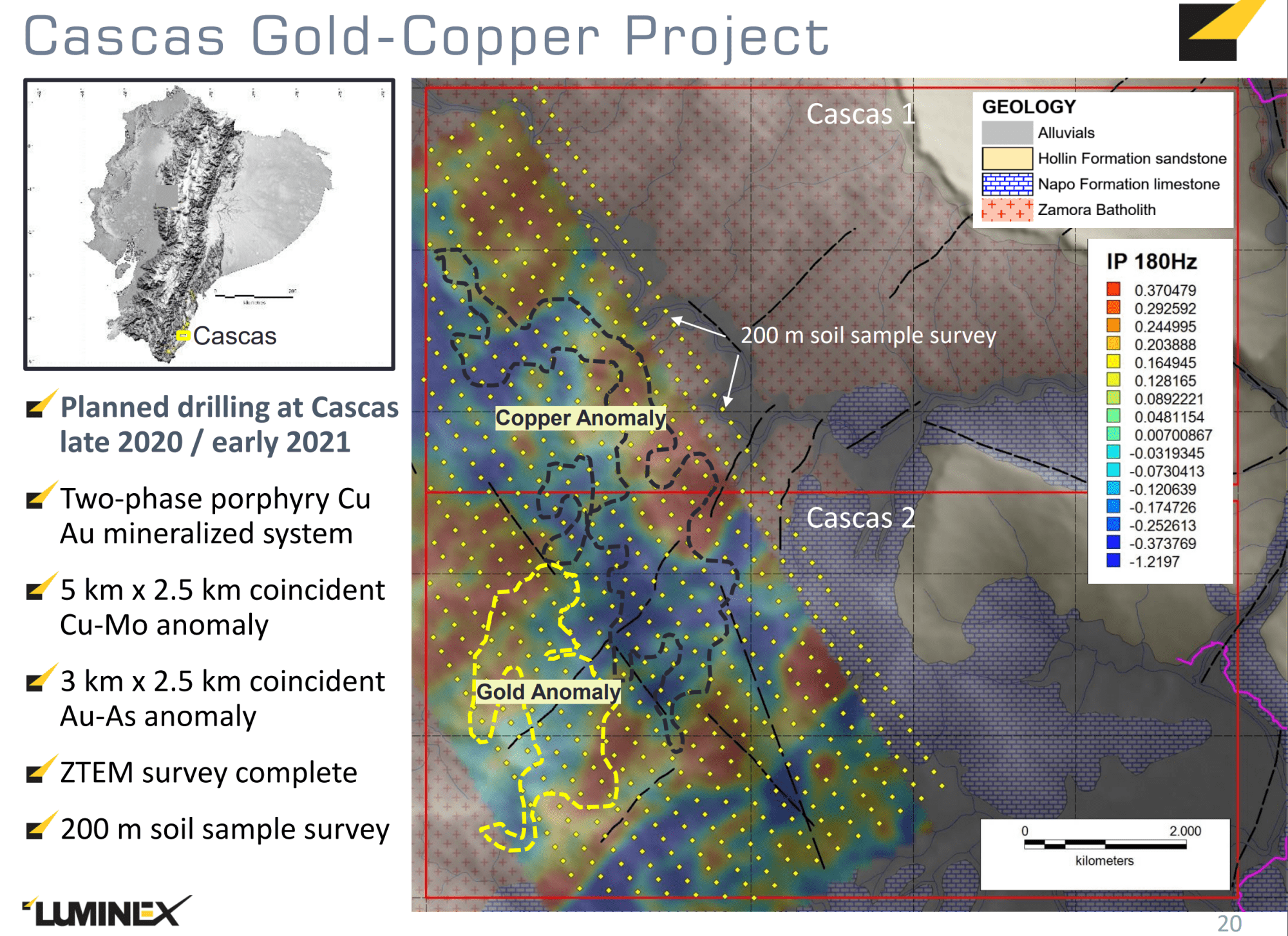

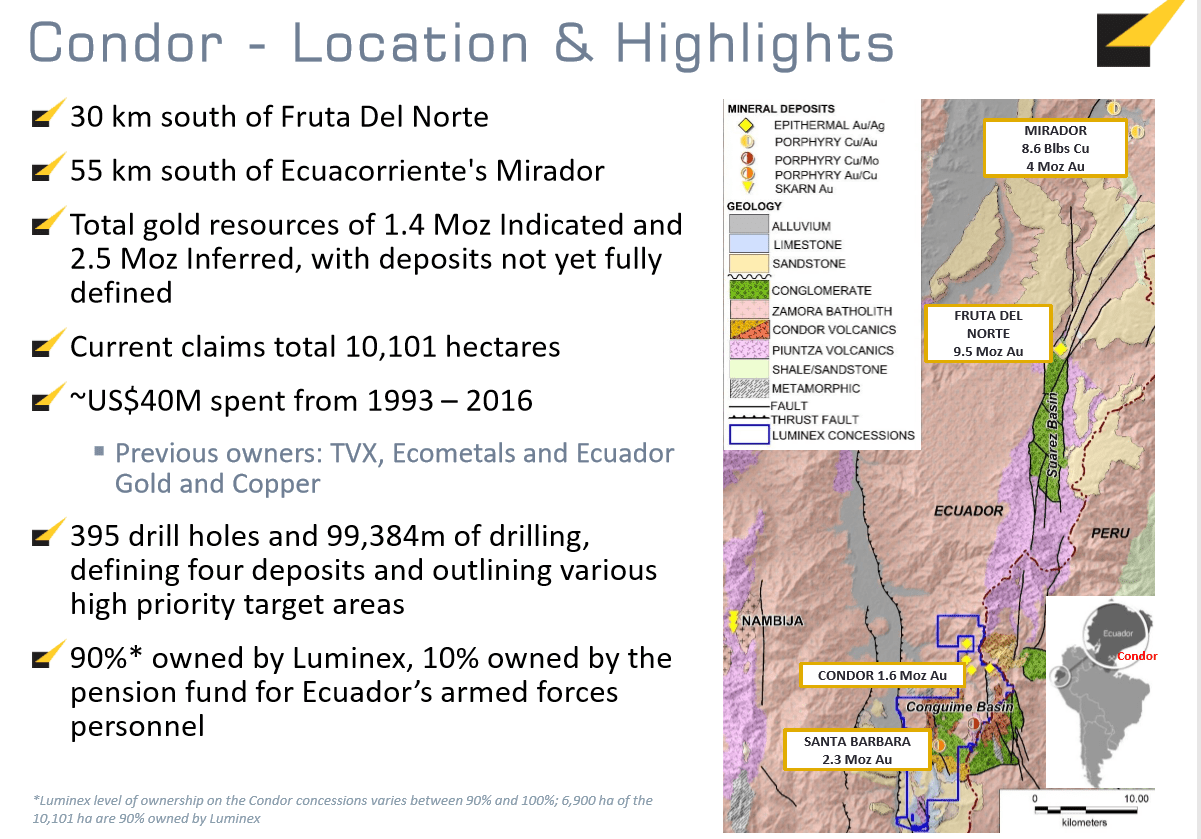

In this interview, Luminex Resources (TSXV: LR | OTC: LUMIF) President Diego Benalcazar and CEO Marshall Koval provide a company update and explain why their Cascas gold-copper target so prospective. Luminex will begin drilling the Cascas project in late 2020 or early 2021. Diego explains that the company is currently building the onsite camp after having developed a strong relationship with the local community. Marshall elaborates on the excellent, recent drill and metallurgical results from the Condor project (5M gold oz). Marshall also recaps the upcoming catalysts for Luminex as the company hopes to have four projects with drill rigs turning before year-end.

Click Here to Listen to the Audio

Continue Reading at MiningStockEducation.com…

0:00 Introduction

1:40 Potential of Cascas large gold-copper project

5:10 Why has Cascas not been drilled yet?

6:16 Gaining trust of locals prior to drilling Cascas

8:51 Cascas drill permits

9:59 Accessing Cascas and building the camp

10:54 Balancing greenfield and advanced-stage projects

13:41 How many drills will Luminex have running?

14:05 Excellent drill results at Condor project

15:28 Positive metallurgical results at Condor project

18:28 Balancing Condor’s expansion drilling and engineering work

TRANSCRIPT:

Bill Powers: The market doesn’t know much about the Cascas project yet. Why are you excited about this property and what is the potential that you see?

Diego Benalcazar: We have been keen to select proliferous ground in Ecuador. And basically what we have in Cascas is part of a legacy of exploration work that was done in the past. Bits and pieces of information from a few companies doing detailed geological mapping and some sampling. But what we had as far as knowledge of the area in Cascas really helped us define the size and location of these sessions. Basically what has been found through these efforts, which are basically initial exploration efforts is a two phase porphyry copper gold mineralized system. This system is very, very important in size. It’s one of those anomalies that compliment basically the idea that we are in elephant porphyry country, and most of these porphyry systems do have expressions of epithermal type minerals.

In our case, we do have a well-defined anomalies of corporate in the Northern part and copper anomalies combined, or printed to copper anomalies in the Southern part of Cascas too. The system, as we are finding, has five kilometers by two and a half kilometers, a coincidence anomaly of copper-moly and a three times 2.5 kilometer coincidence of gold arsenic anomaly. When we started the program, the project had some legacy information from running aero-magnetics and radio metrics ariel survey. It had some soil and rock geochemistry, but very basic. We’ve complimented all that information by doing some detail geological mapping, structural mapping. Early in the year we finished flying a ZTEM electromagnetic airborne system. And now we are in the process of sampling a soil grid, which is 300 times 300 meters in distance per location of every sampling station. So we’re about to finish collecting 670 soil samples for geochemistry and complimenting that with about a hundred rock geochemistry samples.

Bill: The Lumina Group has experienced above average success when it comes to finding deposits. So is what you described part of the process that you go about to minimize risk of missing. When you initiate a big program like this?

Diego: The only way that you can be better aiming at a good target is when you do systematic work. And this is just what we do. We do step by step. The process that really will respond to trying to depict and narrow the area that will deserve a drilling in the future. And even when you come to drilling you start with scout drilling to test initially the area.

Bill: How come no other companies have drilled this target yet? What’s a little more of the history of the property?

Diego: First of all, Ecuador is not a mining tradition country. So it’s only in the past 15 years that after major discoveries Ecuador turned out to be a destination of investment. This area in particular has been very, very remote. The access to the area by road to the edge of the Eastern part of the concession was only built eight years ago. So basically, this being so remote and being ancestral territory for local Pomeranian people, we have done a very interesting job into complimenting our efforts of exploration by running interesting community programs that’s why basically there was not truly a barrier of interest to anybody, but it was so remote and so unknown and Ecuador was not truly a mining and exploration destination.

Marshall: This is Marshall. You know, Diego is being a little bit modest here because one of the key aspects of getting into a remote area in an indigenous territory is how you really deal with the people and gaining trust. And we pride ourselves as a company of having robust social programs, social, environmental, good governance. And Diego was firsthand on the ground helping us work over a long period of time to get this access. So it isn’t a total barrier, but the trust is a key issue and maybe Diego can detail some of those steps that we took and how we got there.

Diego: Well you’re dealing with a cultural vision, which is totally different from the Western vision we do have about the environment and how life develops in trying to really land your ideas into what they need and what they’d like to do and have, and who they would like to get associated in a way with. It takes a long time. And building that trust is really trying to talk their language and not as a matter of saying and it’s only possible when you step by step prove that you are there to provide a better situation in terms of health and income, and also to help them enhance their productivity in different areas.

So, for us, it was an effort of more than a year and a half of talking to the many different institutions that is, it’s sort of an indigenous political structure that you need to talk from the level of the higher hierarchy to the local households. And they all function with the authority of the higher hierarchy level. And so it’s step by step and coming from top down until you can really prove that you’re doing any efforts to put them to have a benefit of the company walking around, exploring, and at the end provide jobs.

Bill: So, it’s about trust I’m hearing you say, not just about giving them things that they physically need.

Diego: They don’t go for that truly. They don’t go for that. That was the old, the old-fashioned way of trying to accommodate yourself. And that’s not going to really create a long term relationship. The only way that you can really work with them is with functional components of a social program,

Bill: What does it look like for drill permits for a project like this? How was it working with the Ecuadorian government over drill permit?

Diego: We’ve had some difficulties from the government to understand the need to expedite permits in time. But knowing that this is a complex situation the mine’s ministry did create a solution for that matter, which is called the scout drilling program. You can under early stage or early exploration stage in a concession, you can apply for a scout drilling permit until you finish obtaining the environmental license. So prior to the environmental license with the scout drilling, you are allowed to drill up to 40 platforms in as many drill holes you could do from 40 platforms. So that’s the way we have been developing our grassroots projects. And as a matter of fact this has proven to be the solution to many of the companies getting a domiciled in Ecuador.

Bill: I assume you would have to build some roads to get the drills in there. What’s that process like? And how far along are you

Diego: We don’t like building roads? Actually, we will be bring in more non portable rigs. The only road that comes into the town will help us bring by truck the major elements from their own. Everything is brought in by hand. So what we do, and also the law does a control that we use on the very narrow tracks where you have to either hand pull or hand bring the equipment in. But also we make a good use of the rivers coming in. So we are floating the equipment and we are bringing up and down the required goods for the camp, and this the way that we also bring the samples out of the concession.

Bill: Marshall, you have these Greenfield projects like Cascas, which has a blue sky potential, but then you also have a 5 million ounce and growing gold deposit on your hands with Condor. So at the executive level, how do you make a decision of where to put your efforts and spend the money: greenfield versus this existing project?

Marshall: Yeah, that’s a really good question, Bill. We’re blessed in that we went into Ecuador very early. Diego was the key component of our team starting back in 2013. And as you’ll recall, we have The Congrejos Project and Lumina Gold, our sister company. And we had built up all these assets through acquisitions of Ecuador Gold and Copper. And then when they opened up the concession system in 2016, 2017 timeframe, we acquired a lot of highly perspective project. So along those lines, we looked at being primarily a gold player, but because of our history and Lumina Copper, we acquired some really good copper projects. We spun those off in JVs with Anglo American and it was BHP. And so that sort of left us focused on gold.

We have other targets besides the condo project and the Cascas, but Condor and Cascas are two most prospective areas. Obviously the 5 million ounce resource at Condor is well-advanced, we’re doing metallurgical work. We’re starting to look at scoping PEA studies where we’re doing some initial look at infrastructure and engineering and hope to advance that. But really when it comes down to it, it’s always good to have another pipeline project in the prospectivity that Cascas has in this quite large gold anomaly that Diego was talking about really begs to be drilled. And so for us, it’s a relatively low cost exploration program with a high degree of potential success. So we’re really excited to get out and get Cascas drilled. Meanwhile, we’ve continued with our operations at Condor and the Camp zone moving the project along. We have a drill going right now. We have a second drill available and with COVID we’re slowed down a bit, but we’re moving along. So that’s really how you look at things. I think if we had a situation where we hadn’t done so much work with the community at Cascas, we wouldn’t even envision drilling right now, but we are so far advanced that we’ve got good protocols for health and safety with the community and with our projects that we feel pretty comfortable continuing to work at Cascas like we are now.

Bill: In terms of catalyst for the company, you would have at least four projects with drills running then right now, right? Condor Cascas and your two JVs.

Marshall: The plans are to drill all of those. COVID has slowed down both Anglo and BHP who had plans to be drilling this year. It still may happen. At Condor we are drilling, and then hopefully by year end, we’ll drill the target at Cascas.

Bill: Marshall, What more can you share about the excellent drill results that you put out since we last talked? One of the press headlines said Luminex intersects 25 meters of 3.3 grams per tons gold at the Camp zone. What’s the significance of this?

Marshall: Yeah, that was pretty interesting. We have sort of drilled about 500 meters along strike of the camp zone and about 600 meters vertical. A lot of the mineralization is related to these rhyolites that have been intruded. And you get breccia zones, both in the hanging wall and foot wall above and below the rhyolite. And we have been primarily testing the hanging wall side, the upper side of these rhyolites and this last hole that you referred to, we’ve got deeper into the deposit. And we found that the mineralization is not only in the upper hanging wall and in the rhyolite itself where it’s been broken up, but it continues into the foot walls. So that was towards the tail end of our drilling. I believe the last hole we publish was hole number 33. And so we’ve been really happy with that. So now we’re looking at going back to the Northwest and looking at some shallower targets on some areas that we’ve recently got access to, and we’ll continue to look at drilling there.

Bill: You also did some initial engineering work with metallurgical results that you announced. It says 95% gold recoveries and 80% silver recoveries. Can you elaborate on this a little please?

Marshall: I’ve been in the mining industry some 40 plus years, and I’ve done a lot of metallurgical work and a lot of projects. And the camp zone itself is one of the better metallurgical responses that we’ve seen and laboratory testing. We had 300 kilos of core samples sent to a laboratory in Lima from 14 holes. And if you look at, we had a low grade, high grade and a medium grade sample that we did. And if you look at how in current metal prices gold is probably 85% of the revenues and silver is another sort of 6-7%. So about 91-92% of the revenues of the camp zone is going to come from golden silver. And we’ve got excellent response on that. You recover sort of 33-34% of gold in a gravity concentrate alone.

There’s coarse gold. We’ve actually seen visible gold in the core. And then the rest of it, you run through a leaching cycle through a CIL treatment plant where you leech bulk concentrates after the gravity circuits. That gives us the 95% gold recovery. And then there’s also after you leach it, you’ve got the potential to recover lead and zinc in a concentrate. So if you look at silver gravity, CIL and lead zinc concentrate, you recover about 80% of the silver, 56% of the lead and 62% of the zinc. And the other thing that was kind of interesting, it was pretty low cyanide consumption.

So all those things bode real well for real positive metallurgical response. And also finally it didn’t require real fine grinding to liberate the gold. You liberated about 97% of the gold in a fairly course ball mill circuit, so that bodes really well for the metallurgy at the camp zone. And we’ve done other metallurgy historically at Los Cuyes, Solidad, and in Santa Barbara, some of the other resource areas at Condor. The metallurgy there is usually 80% to 90% gold recoveries for most of those areas. So metallurgically the Condor Project has shown us a very good response to gold recoveries and other metals.

Bill: What is the plan for balancing engineering studies with expansion drilling? Can you speak to that? What should investors expect with this project?

Marshall: So we’ve done some work to try to extend the strike length and we’re doing some drilling that has been sort of step out drilling quite a ways, trying to define other areas where the camp zone might continue. We know more or less where the camp zone is now. And with the resource estimate that we published recently the real focus is less so much on drilling today, but stepping back and trying to scope a project that we can move forward with a PEA. Probably looking at around the $1,500 an ounce gold range as a base case. And so we’re working with mining engineers. We’ve got these metallurgical results now. So, the project shifted a bit away from just an all out drilling program. We’ll continue to drill as we go along. But now we’re trying to focus on, can we define an engineering project that looks good? Haywood has done some research. They put forth their plans and what they viewed the potential project might look like in a production scenario. And we’re doing our own work internally as well.

Bill: So as investors look towards the end of 2020, are there any other catalysts for the company that they should be aware of?

Marshall: Well, I think as I mentioned earlier, our partners in BHP and Anglo, and hopefully they’ll be able to get to the field. I know they both want to start drilling. They’ve already defined drill targets. BHP at Tarqui has a program defined in the real high-grade copper areas sort of work that we’ve done has been plus 1% copper and rock out crop and soils. So they’ll be drilling that target. And then Anglo American has defined a geophysical anomaly that’s real prospective for copper, and they’ve done a lot of surface geology and such a prospect called Medusa. And hopefully we’ll see them drilling as well. So I think if we weren’t in the COVID area, we’d have, like you mentioned earlier in the next little bit by the end of the year, have four drill rigs going on four different projects. And hopefully that’ll still happen sooner than later.

Insanity is doing the same thing over and over again, but expecting different results.

Federal Reserve Chairman Jerome Powell announced on Thursday that the Fed will now shift its focus from hitting inflation targets and instead prioritize closing “unemployment shortfalls”.

This gives it the aircover to do “whatever it takes” until the unemployment rate is back down into the low single digits. Inflation can now run hotter than 2%, rates can stay at 0% (or go negative) for the next decade+, more QE…. all is fair game now in the pursuit of lower unemployment.

Essentially, the Fed is now tripling-down on the same failed policies that have created today’s zombie economy and the worst economic inequality in our nation’s history.

Perhaps the folks at the Fed are smarter than we think, and there’s actually a grand plan they’re pursuing that’s going to work out to society’s benefit?

Sadly no, reveals this week’s expert guest, Danielle DiMartino-Booth. Danielle knows the Fed inside and out, as she worked as a consultant for nearly a decade to Richard Fischer, President of the Federal Reserve Bank of Dallas, including helping deal with the Great Financial Crisis. She knows how the organization runs, as well as the specific people running it.

And her assessment is that the Fed is trapped in a nightmare of its own making and is merely playing for time at this point. Everything it throws at the situation is designed to hopefully get the system to limp through the next quarter or two without breaking, at which point they’ll scramble to come up with the next short-term “solution”.

In the video below, Danielle breaks down the important takeaways and repercussions of Chairman Powell’s Jackson Hole speech and vents her frustration at both his duplicity with the public and the media’s cowardly refusal to hold him to account.

As our other recent guest experts have warned, Danielle confirms this is an exceptionally treacherous time in the markets for investors, as the Fed’s intervention has and continues to deform and distort prices far beyond reason:

<

Anyone interested in scheduling a free consultation and portfolio review with Mike Preston and John Llodra and their team at New Harbor Financial can do so by clicking here.

And if you’re one of the many readers brand new to Peak Prosperity over the past few months, we strongly urge you get your financial situation in order in parallel with your ongoing physical coronavirus preparations.

We recommend you do so in partnership with a professional financial advisor who understands the macro risks to the market that we discuss on this website. If you’ve already got one, great.

But if not, consider talking to the team at New Harbor. We’ve set up this ‘free consultation’ relationship with them to help folks exactly like you.

The post The Fed’s Big Lie appeared first on Peak Prosperity.

This is Good News Friday, where we find some good economic, energy, and environmental news and share it with PP readers. Please send any positive news to dd@peakprosperity.com with subject header "Good News Friday." We will save and post weekly. Enjoy!

When Your Best Friend Gives Birth to Your Babies—All 4 of Them (tmn)

Before we even decided, we had to get buy-in from both of our families. My family, of course, was like Wow, that’s amazing; of course we’re supportive. But we were more concerned about Deb’s family and how they would feel, because it’s her body. Her family was concerned about how she’d feel giving the kids to me, but her entire family was supportive and has never stopped being part of our life.

Students take a stand against ‘No Mask Monday’ protests (Jayann G.)

“Everybody’s got their own opinions, obviously,” said Enterprise High Principal Calvin Holt. “It’s a really emotionally charged issue.”

Holt said some students got wind of the protest and took time to reach out to each other and the community to stop it from happening.

In a video he shared on Instagram, the 24-year-old hid a message in a bottle for his brother. While working with a metal detector in their yard, Henry came across it.

That message, full of love and praise, was Will’s way of “proposing” to Henry. As the 22-year-old realized what was happening, he leaped into his brother’s arms and embraced him.

Plane built on Mumbai rooftop takes to the skies (tmn)

When Indian pilot Amol Yadav told his family and friends that he wanted to build an aeroplane on the roof of his apartment building in Mumbai, no-one thought he could pull it off.

Universal basic income seems to improve employment and well-being (000)

However, the effect of basic income was complicated by legislation known as the “activation model”, which the Finnish government introduced at the beginning of 2018. It made the conditions for accessing unemployment benefits stricter.

The timing made it difficult to separate the effects of the basic income experiment from the policy change, said Ylikännö. “We can only say that the employment effect that we observed was as a joint result of the experiment and activation model,” she said.

Highlighting the group of discovered artifacts was a fragment of a 15th-century illuminated manuscript, the gold leaf of its text still intact. A medieval manuscripts specialist at Cambridge University’s library identified the fragment as belonging to psalm 39 from an early Latin translation of the bible called the Vulgate.

It likely belonged to a small prayer book, the specialist explained, which may have been used for secret Catholic masses before being stashed when the queen’s men came knocking. In a similar vein was a remnant from a 16th-century Spanish romance book, the type of which English Catholics of the period would often read as religious material wasn’t available in their home country.

Memorial to enslaved laborers spontaneously inaugurated at the university of virginia (tmn)

UVA students catalyzed a memorial to honor the lives of the enslaved community in 2010 with initiatives to raise awareness about the history of slavery at the university. The following year, they formed a student-run competition for a memorial to enslaved laborers. The president’s commission on slavery and the university (PCSU) was then formed in 2013 to explore and report on the history of slavery on UVA grounds. As a result of this work, UVA formally commissioned the memorial to enslaved laborers in 2016.

The End Of Oil Is Near (Bill M.)

In contrast to an agenda that doubles down on dirty fuels, a wealth of green recovery programs aim to keep fossil fuels in the ground as part of a just transition to a sustainable and equitable economy. If these policies prevail, the industry will rapidly shrink to a fraction of its former stature. Thus, as at no other time since the industry’s inception, the actions taken now by the public and by policymakers will determine oil’s fate.

The Greenpeace activists are right. Whether the pandemic marks the end of oil “is up to you.”

Insurance giant Suncorp to end coverage and finance for oil and gas industry (Bill M.)

Major Australian insurer Suncorp will end any financing or insuring of the oil and gas industry by 2025, adding to the group’s existing ban on support for new thermal coal projects.

The insurer revealed on Friday it had already stopped insuring, underwriting or directly investing in new oil and gas projects and would phase out underwriting and financing existing oil and gas businesses by 2025.

Eighty years after Hindenburg, startup pitches hydrogen flight (Roger B.)

So Eremenko’s startup, called Universal Hydrogen Co., has developed Kevlar-coated, pill-shaped pods — about 7 feet in length and 3 in diameter — filled with hydrogen. The pods are designed to double as a storage container for transporting the hydrogen, by truck, train or other means, and a gas tank when loaded into a plane. If filled with water, each would hold about 208 gallons, and they can be stacked in racks so that 54 would fit inside a standard freight shipping container. They can even be loaded into a plane with a forklift, he said. The point is that airports wouldn’t need pipelines or underground tanks.

Feeling Isolated in Their Neighbourhood, This Couple Planted a Seed. Oh, How It Bloomed (westcoastjan)

Then, one day, Barry Jung was at work building a garden space in his front yard and noticed that passersby were stopping to look. Next to the row of adjacent houses all set behind lawns and hedges, the Jungs’ vegetable and fruit garden must’ve looked almost naked.

“People started coming and asking, ‘What are you doing, aren’t you afraid that people will steal your vegetables?’” said Joan Jung. “And it invited this curiosity. We found that through the garden, people started having conversations.”

Click to read the PM Daily Market Commentary

Provided daily by the Peak Prosperity Gold & Silver Group

Article suggestions for the Daily Digest can be sent to dd@peakprosperity.com. All suggestions are filtered by the Daily Digest team and preference is given to those that are in alignment with the message of the Crash Course and the "3 Es."

The post Daily Digest 8/28 – Good News Friday: Oil’s Dominance Is Waning, Students Stand for Masks in Schools appeared first on Peak Prosperity.