by Kerry Lutz

Financial Survival Network

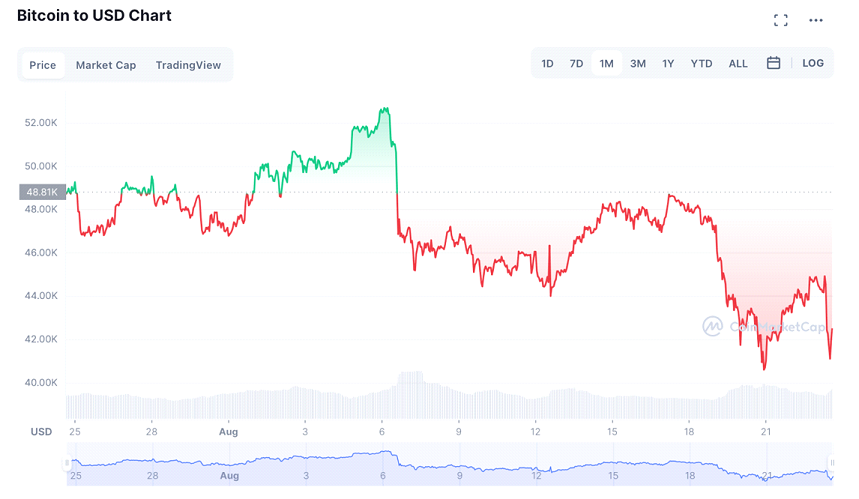

The big news in cryptos today is that China has declared all virtual (crypto) currency transactions to be illegal. It used to be so goes California, so goes the country. Now it’s so goes China, so goes the world. The rumor-mill is working overtime on what country will be the next to ban crypto-currencies. Will it be Germany, France, India, or fill in the blank? We’ve been long-term bears on cryptos for the simple reason that they threaten the most elemental power of sovereign states, the ability print money. From this power, virtually all other powers now flow. Whether it’s government contracts, military financing, schools, every function of government is directly dependent upon its ability to manage its currency.

The big news in cryptos today is that China has declared all virtual (crypto) currency transactions to be illegal. It used to be so goes California, so goes the country. Now it’s so goes China, so goes the world. The rumor-mill is working overtime on what country will be the next to ban crypto-currencies. Will it be Germany, France, India, or fill in the blank? We’ve been long-term bears on cryptos for the simple reason that they threaten the most elemental power of sovereign states, the ability print money. From this power, virtually all other powers now flow. Whether it’s government contracts, military financing, schools, every function of government is directly dependent upon its ability to manage its currency.

There are several fronts on the war on cryptos. First is the legal front. Authoritarian regimes like China will just implement complete bans. Emerging authoritarian states, such as the US, Australia and Western Europe might refrain from outright bans and just attempt to tax crypto profits into oblivion. In the end, the net result is the same, decreased activity in cryptos and declining crypto prices.

There’s a second front in the sovereign crypto war, technological warfare. We’ve been in the era of mass surveillance for nearly two decades. This means that every data bit that flows through every computer in the world is subject to capture, recording and analysis. Due to advanced encryption methods, at different times, some of this data may not be readable. However, emerging quantum computing may very well make encryption obsolete.

As a result of this mass spying, governments know where virtually every crypto-currency node is located. It is certain possible for them to remotely disable these units, thereby ending crypto trading. It’s been shown that these nodes can be eclipsed rather easily. In extreme cases, as in China, police and army can be deployed to physically disable them, with just a knock on the door.

China’s first step towards ending private cryptos should be a wakeup call to all crypto traders that the party is over. While some insignificant countries will embrace cryptos, the rest of the so-called civilized world will not tolerate freely trading independent cryptos, at least in the long run.

Therefore, people will have to take a closer look at the traditional wealth storage mechanism, i.e. gold and silver. Once the public understands that the crypto game is over, expect a large tsunami of funds flowing into precious metals. Capital will always find a way.

Regards,

Kerry Lutz

from Kerry Lutz Podcasts – Financial Survival Network https://ift.tt/3CHdA23