from Kerry Lutz's Financial Survival Network

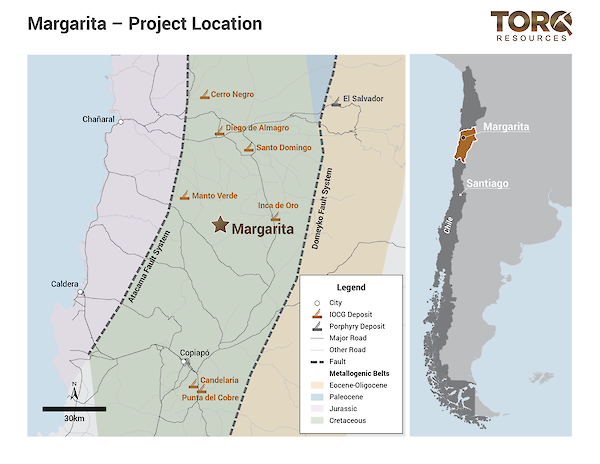

Torq Resources (TSXV: TORQ | OTCQX: TRBMF) is a junior exploration company building a premium copper and gold portfolio in Chile. The company’s management team has raised over $650M and monetized successes in three previous exploration companies. In this interview, Executive Chairman Shawn Wallace explains that Torq has recently acquired the option to earn a 100% interest in the Margarita Iron-Oxide-Copper-Gold project located in Chile, 65 kilometres north of the city of Copiapo.

The Margarita project is located within the prolific Coastal Cordillera belt that hosts the world-class Candelaria (Lundin Mining Corp.) and Manto Verde (Mantos Copper Holding) IOCG mines, and porphyry-skarn deposits such as Santo Domingo (Capstone Mining Corp.) and Inca de Oro (PanAust/Codelco). Shawn shared that the company is focused on acquiring and exploring large copper-gold projects because of their outsized value-creating potential if Torq is successful: “it sounds outlandish because we’re sitting here at a $50 million market cap, but you can turn it into a billion dollar company in very, very little time.”

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

TRANSCRIPT:

Bill Powers: My guest today is Shawn Wallace, Executive Chairman of Torq Resources. Shawn, welcome onto the program and you just acquired a very prospective copper-gold project there in Chile. Talk us through this. What is the significance and what should investors look for?

Shawn Wallace: Great. Well, thank you Bill. When I came on last time, I talked about that we’d assembled a team and we’d found a way to work amid this pandemic and the restriction of travel and so forth. We really believed that was the right move but now we’re starting to see the fruit that bears. The speed with which the things that we’re trying to achieve in Chile has really taken on a much better cadence. And you saw that with the news release that we just put out with the acquisition of the Margarita copper-gold project.

The significance of it is that it is the kickoff asset for the company. We said we were going to do this and this is sort of the first really tangible piece of achievement, if you will, that we were actually acquiring things, finding ways to deliver value and unearth the value. It also is the first in what’s going to be a number of acquisitions in this space. We’re going to build out a portfolio of assets that have the capability to become large scale, the type of assets that Pierre Lassonde was referring to that he likes so much. We feel very much the same way.

Bill: This project is in Chile. Why did you settle on Chile for this project? And also maybe talk about the belt that it’s in, because my understanding it’s a very prospective belt.

Shawn: Yeah. Some of the Cordillera belts, there’s a bunch of mines on it, big, profitable, long-term mines. Again, one of the characteristics of the big copper-gold projects. One thing, this one’s only 65 kilometers North of Copiapo, a hundred flights a day fly in there. It’s a fantastic place to be able to sort of have close by for infrastructure and so forth. You know, obviously Chile’s got a long and storied mining history. It’s full of very, very competent technical people. The mode of doing business down there, it lines up with us so we can get things done. You don’t always find that when you go to different jurisdiction, so fortunately Chile is a place like that. They have rigorous regulations, as they should, as we do here in North America, and I’m all for that. But as long as you have a set of rules that you know what you have to do and you just go do it.

Bill: There are some historic drill holes, I understand. Talk us through what is this data that you get with the project mean to you? And also why didn’t the previous group advance it? What’s a little more of the history of the project?

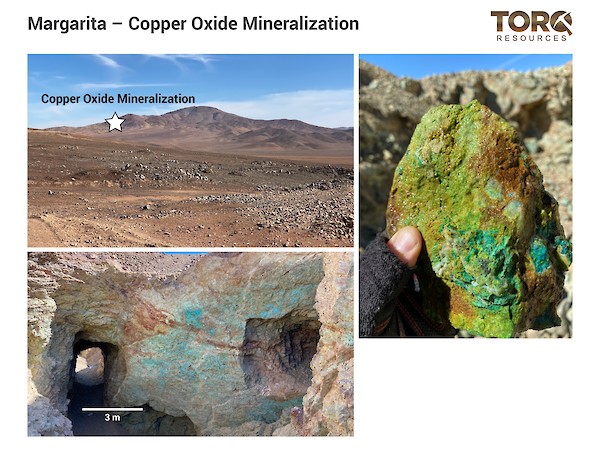

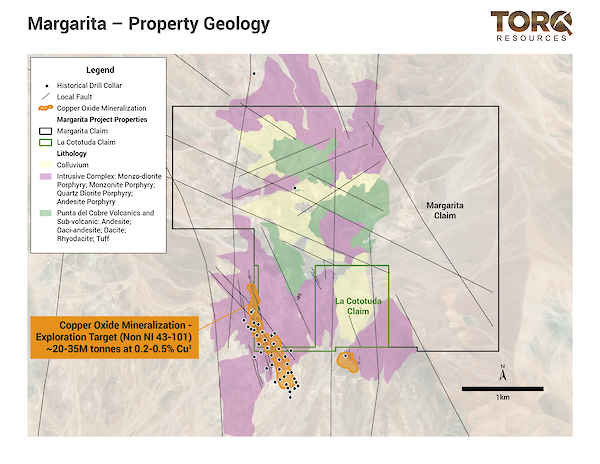

Shawn: Well, the project was being held by a family for the last several years, and so there wasn’t a whole lot that was done, and often in countries like Chile, you find families that are almost institutions, if you will, in their own area. So, it makes it interesting to try to acquire it from that kind of a structure. There hasn’t been a lot of drilling on those projects. Certainly there has been no drill testing of what we’re after. You’ll see referenced in the news release that there is like a copper oxide resource, it’s not NI43-101 compliant so I can’t rattle off the numbers, but it’s about a half a percent copper. But that’s not why we’re there, but it is why we’re there because we’re not there to mine that, we don’t think that’s the end of the story. We think that near-surface oxide had to come from somewhere.

There’s some geophysics that’s been done on the project that indicates that that thesis is headed in the right direction. So the first thing we’re going to do when we get there is it go tighten up the geophysics spacing. It’s a method called IP. It’s been used for a long time. I’ve worked with it for 35 years on all various porphyry projects I’ve worked. A lot of them are mines now. It’s an extremely effective way just for that specific type of deposit. So yeah, we’re really quite optimistic. And we’re also happy that we have a project here that, you know, look, it’s either going to be there or it’s not. And because we’re going after large scale projects like this, they’re also easier to explore because you’re not going after some discreet, thin gold veins. I’ve done that also. And while it can be very exciting, it is a bit more nail-biting. Here, the science behind it is a little more straightforward. And also you’re not looking for needles in haystacks, you’re looking for the haystack.

Bill: So we’re basically looking at some surface work then in Q2 and then drilling in Q3? Would that be the expectation?

Shawn: Yeah, I think we’ll be up and drilling in three to four months. We’ll have to go through a small permitting process, but it’s not like, again, not like other jurisdictions where that can take months and months and months. People are getting permits there, drills are available. It’s at a lower elevation, this particular project, so we’ll be able to work most of the year. There’s times that are better than others, but you can do it. It’s not like in the high Cordillera area where sometimes you just can’t get there. There’s too much snow.

Bill: You referenced future acquisitions. You’re in the works of acquiring more projects because exploration is high risk, high reward. Sometimes you think it looks good on surface, but it’s not there underneath. So investors aren’t just looking at a one project company, are they?

Shawn: No, absolutely not. I mean, obviously today that’s where we are because we only have one project landed, but I would like to encourage people to stay tuned because there’s a lot more to come from us.

Bill: A question I had as I read through the press release is, I’m obviously an investor in your other companies, Sombrero Resources, for example, which is in Peru and has a big copper-gold project there. The question was, in my head, well why didn’t they just roll this project into that company? And I’m sure other investors might think the same because you and your group control several companies. Why did this project land specifically in Torq Resources?

Shawn: Well, there’s a number of reasons. One, we had made the decision, you referenced the companies we have in Peru, but that came from Auryn, and at that time we rationalized the split of Auryn into three distinct entities for very specific reasons. And they were sort of set up in a way that really wouldn’t have made sense to marry a Chilean asset with a Peruvian one. Sombrero is a fantastic opportunity. I’m very excited about that one coming to market. And when you think about it, the other reason that we split the company up was because we were being undervalued. When you stuff all those assets in one company, all those jurisdictions in one company, it’s confusing. Some people don’t want copper in Peru and gold in Quebec, and so that’s why we had to get it into a more focused configuration of companies, if you will.

So then it wouldn’t make any sense then to go and muddy the waters again by adding this Chilean thing with the Peruvian assets. We’ve decided to go back to the way we always did things. Auryn is atypical for us. The reason we stuffed so many assets in is because a couple of those were takeovers that we did. The reason we did that was because we had currency in Auryn. Torq didn’t really have currency, it was our sister company, it sort of sat there with cash in it, but if we would have undertaken some of those takeovers we did in Auryn with Torq, the dilution would have been not in our favor and certainly not in our shareholders’ favor.

Bill: The treasury sits right now in Torq as you mentioned, it’s cash of $C9 million, is that right?

Shawn: It’s about eight and a half million right now.

Bill: Okay. And so with that money on hand, obviously you don’t need to raise money right now, but what type of drill program are we looking at? You usually go big at big targets, right?

Shawn: Yeah. We go big, but again, the good news on this stuff is that you can cover a lot ground with fewer drills, if that makes sense. You can have big spacing. If you’re a few hundred meters apart with a drill hole, well there’s not going to be a high-grade gold vein down the middle on one of these that you’re going to miss, so you don’t have to do this tight spacing. So here you can take big step outs, and then once you get a sniff of something, then you tighten it up and try and figure out the deposit. I think we have an approved budget of about $4 million from the Board. That always could be amended. If we start having success obviously we’ll spend more quickly. But certainly to your point, we are financed. If we start making other acquisitions, obviously, which we said we’re going to do, there will be need for additional capital at some point, but certainly not in the immediate term.

Bill: Shawn, final question. Your and Ivan Bebek’s companies historically traded at premium because of your past success, also because as I’ve observed, how you raise money, you get some of the lowest cost of capital and least diluted financings out there in the junior space. So investors should factor that in when they look at your market cap right now, which I think is around $50 million. Talk to us about if you’re successful and you discover what you want to, what would that mean for your market cap valuation?

Shawn: Well, I mean, this is the reason we’re going for these things, and it sounds outlandish because we’re sitting here at 50 million market cap, but you can turn it into a billion dollar company in very, very little time. The downside to these types of deposits, they’re so big, there’s only a handful of companies on earth who would then perhaps be your suitor to take you over. But that’s okay. I think there’s enough of a demand for these base and precious metals. Copper-gold is, I think, is a real sweet spot to be.

from Kerry Lutz Podcasts – Financial Survival Network https://ift.tt/3vmtpby