from Kerry Lutz's Financial Survival Network

Executive Chairman Gerald Panneton discusses Gold Terra’s (TSXV: YGT – OTC: YGTFF – FSE:TX0) updated gold resource in this interview. The company increased its resource by 64% to 1.2M AuOz at its Yellowknife City Gold Project in Canada’s Northwest Territories. Gerald also talks about the significance of Gold Terra’s recently completed financing as well as the ongoing 12,000-metre drill program immediately adjacent to the high-grade former-producing Con Mine (5+M AuOz). Gold Terra recently acquired an option on this property from its owner Newmont. The Con Mine produced approximately 5.1 million ounces of gold between 1946 and 2005 at an amazing grade of 15 g/t, and over widths of up to 100 metres. Gerald said that the first batch of results from this drill program will be out within a few weeks.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

TRANSCRIPT:

Bill Powers: Thanks for tuning into Mining Stock Education. I’m your host Bill Powers in today’s show. We’re going to be getting an update from Gold Terra Resource Corp’s executive chairman, Gerald Panneton. He is a returning guest. We’ve been covering this company for almost a year now, and they are pursuing five plus million ounces of high-grade gold, just outside the city of Yellowknife in Canada’s Northwest territories. So Gerald welcome back onto the program. Your company just put out a press release. You have significantly increased your inferred resources on your project there. Walk us through this press release and what is the significance that investors should know?

Gerald Panneton: Thank you, Bill. And thank you very much for inviting me on your show again. It’s always a pleasure to be able to talk of our progress in the Yellowknife city project, which is run with Gold Terra Resources Corporation. As you know, we have a huge land position, 800 square kilometers. The company has been working for many years before I joined some time ago. And some of the discovery they made in the past where the old Crestaurum deposit, which was discovered in the thirties and Sam Otto discovery there, which was done by TerraX not long time ago. And these two deposits were drilled last year during our 20,000 meters program actually, we did about roughly 16,000 to 17,000 meters of drilling all those two deposit while we were waiting to complete the agreement with Newmont to get onto the Campbell Shear. So the drilling we’ve done last year came with two important things.

We increased the resource. The deposit are still open in some direction, mainly at depth and to the North for Sam Otto and Crestaurum to the South and to the North. So we’re very happy that we took our resource from 700,000 ounces to 1.2 million ounces with basically, 15,000 to 16,000 meters of drilling. So when you look at it, we spend $3 million of drilling at CAD$200/metre to get half a million ounces more, which basically comes up to $6 an ounce. So our discovery rate, when you add onto a deposit at $6, an ounce is a very good return on your investment. And these deposits are not the core or the important things of our operation, but they are very important if we call them incremental ounces. What I mean is that once we have found our high-grade deposit of say 2 or 3 million ounces or more in the Campbell Shear area, these two deposit, even if they reach half a million ounces or a million ounces, each, can be very good contributed to the mill.

So when you look at a company that has so much land and establish some time and operation based on a 2 million ounces deposit of high-grade nature, whatever satellite deposit that can be trucked into your mill is incremental feed that adds very much value to the project. And for some people, maybe they’re not the core of our exploration because its low-grade, but you look at Crestaurum you got 100,000 ounces near surface by open pit. And then you can go on and go underground with a ramp for another 200,000 ounces. These deposits can be very economic if they don’t require necessarily to build a mill for them. But if the mill is there and you bring them in, they’re almost like free ounces.

Bill: So the core of your exploration anticipation is on the Campbell Shear, just south of the Con Mine. This is a past producing major high-grade mine. Walk us through what you’re looking for here again, and when should we expect some results?

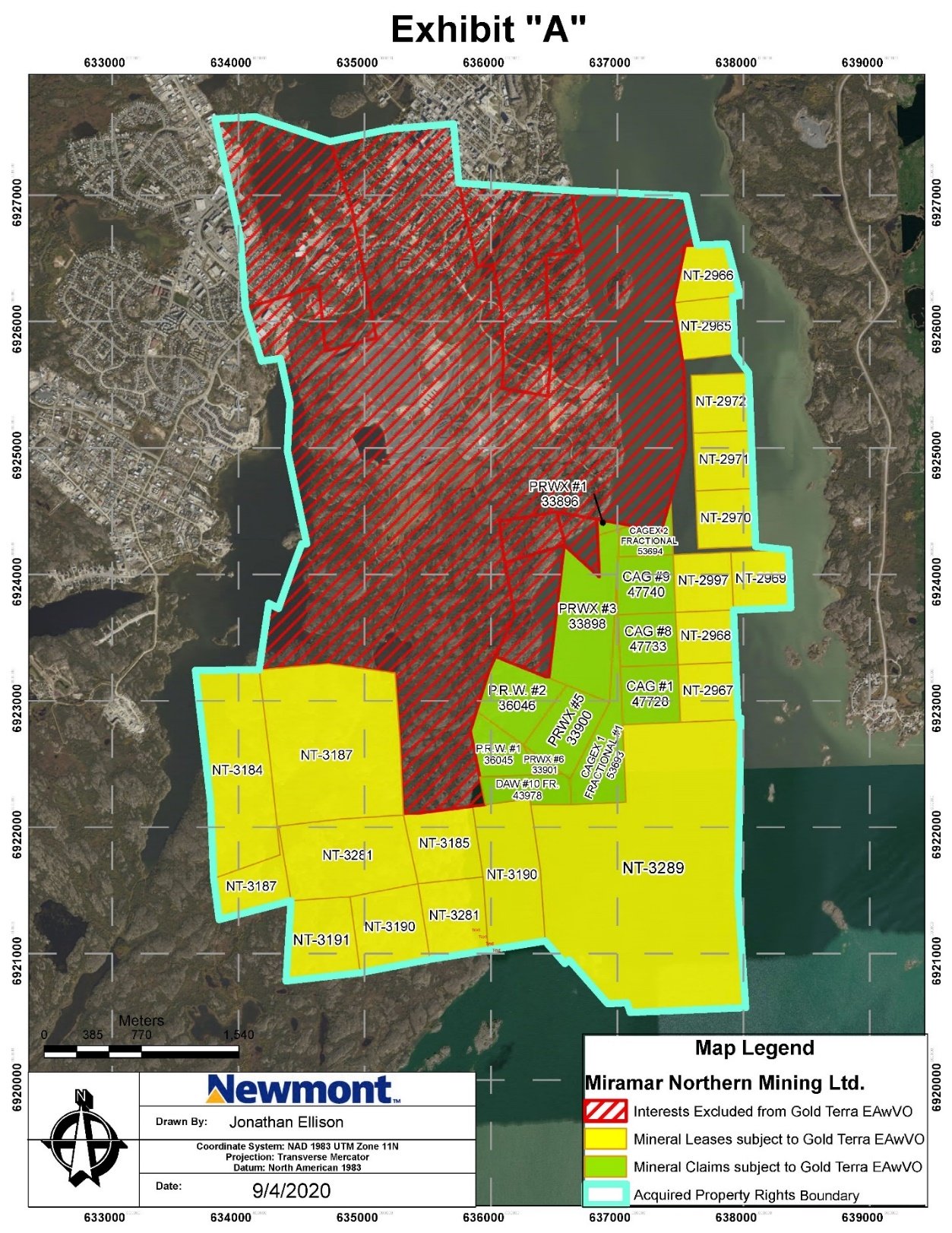

Gerald: As you probably heard or remember from previous conversation, we took nine months to negotiate a deal with Newmont and put a foot onto their ground in the Yellowknife camp. And Yellowknife produced 14 million ounces, 13 of those 14 million ounces was produced on the Campbell Shear itself over seven kilometers or five miles strike length. The Campbell Shear extends for 20 miles to the south and 40 miles to the north. We control all that land. And it was very important for us to get our feet close, as close as was possible to the Campbell Shear of the Con Mine to be able to continue the exploration that was left behind 20 years ago by Miramar. No one has ever explored the Campbell Shear than us 20 years plus. So these deposit and these zones that have been discovered in the past, along the Campbell Shear, South of the mine, the yellow, red zone, the Kam Point north and Kam Point south zone are along that Campbell Shear.

It’s just need to be drilled. So it’s an exercise of taking a piece of plywood that strike for 20 miles to the South and start drilling every 200 meters from surface to depth along the strike length. And we just started that this winter just before Christmas with two holes. And then we continue at the end of January and we’re going to do approximately another 12 to 14 holes for a total of about 8,000 meters.

And then we’re going to have a breakup in April, but the first pass that we’re doing now is very, very important because it gives us a lot of information because we don’t have access to that core and the target there is very simple. It’s one to two and maybe more 3 million ounces high-grade nature, smaller zone, four, five meters, but plus 10 grams gold. The average grade of these mine was 16 gram, half an ounce. In today’s value half an ounce of gold is almost $850 an ounce per ton. You do mining in today’s world at $200 a ton. So there’s a huge benefit. There’s a huge profitability for underground high-grade deposit that are three, four or five meters wide width plus 10 gram gold.

Bill: And we should expect the first results within the next month or so would you say?

Gerald: We started drilling at the end of January. Again, it takes about a week to drill the hole. Then you have to log to sock up, have it sent to the lab. The lab is kind of the bottleneck in 2021, due to the pandemic, there’s less people working. It’s more difficult. They have to be more precaution. So our delays are is about six weeks to get the assays. And that was the same thing in 2020. And so you could expect a result on the Campbell Shear by the end of March. And we look forward to share them with you guys, because we’ve been very impressed to look at the core and we look forward to getting the result out in the market as they come.

Bill: And on that note, we should know that you’re not just an entrepreneur, but you’re a geologist. So you know what you’re looking at when you see the core, right?

Gerald: Well, the guys that are outside, they’re geologists. They see the core, they pass on to the pictures. We know we’re on the Campbell Shear. The Campbell Shear is 100 to 200 meters in width. It’s a big shear zone. It strike for 70 kilometers, 50 miles. There was two big mines over five miles. So it’s like only 10% has been explored. So we look forward to explore it to the south and to the north. The current stretch is barely just one mile strike length that we’re drilling, but it’s immediately south of the Campbell mine, or the Campbell Shear Mine of the Con Mine and that yielded 5 million ounces. We’re not in the boonies, we’re just continuing to explore for extension of Campbell Shear mineralization Immediately south of a past producer.

Bill: Gerald as you know, when a junior mining speculator analyzes a company, you always got to see what do they have in the bank and how quickly they’re going through it. You just raised about $3 million. Your costs of drilling is about $200 a meter. So is this $3 million going to allow you to explore more here?

Gerald: This is a very good question Bill, because recently we just put $3 million and the most important thing it came from one investor. So one investor bought $3 million or 8 million share was issued at 36 cents, if I remember correctly, and this allows us basically to extend our drill program and secure the full 2021 drill program. When we started the year, we finished a year with about just under $4 million Canadian. So we knew we could do 10,000 meters, no problem. And by raising the money at this point in time, because this investor believes in the Campbell Shear and we went and got $3 million more, which secure another, roughly 15,000 meters of drilling for 2021. So this is a very positive thing. We don’t have to go to the market to raise money for 2021, our budget is secure with that influx of money, which we’ll allow us to drill all the way to the end of 2021.

Bill: And your mode of operation is to raise money without warrants as you did here, right?

Gerald: Yes. This is the one thing that I’ve always believed. I know a lot of investor loves warrants. Warrants is a ceiling, basically, that’s all it is. If your stock goes to that price, we’ll give you more money. So we don’t have to pay that much more. When there’s a warrants there’s a ceiling. And so the less ceiling there is on a stock, the better it is.

from Kerry Lutz Podcasts – Financial Survival Network https://ift.tt/2NxcrGm