Torq Resources (TSXV: TORQ | OTCQX: TRBMF) is a junior exploration company building a premium copper and gold portfolio in Chile. The company’s management team has raised over $650M and monetized successes in three previous exploration companies. Executive Chairman Shawn Wallace shares that Torq has recently appointed a top-tier, veteran geological team and will soon be announcing the acquisition of Chilean copper and gold exploration projects with major potential.

Executive Chairman Shawn Wallace explains why investors should consider Torq Resources: “I think that they should take solace in the fact that you were a known entity, working in a known jurisdiction (Chile), we have the success we have behind us. I’ll put that record up against anyone’s. We’ve been very fortunate. We’ve also worked extremely hard, and we’re very disciplined. So I would love for anyone to come along on this ride with us. And we’ll be putting out lots of information so that we can make sure everybody understands what’s happening and why, and when, and so forth.”

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

0:00 Introduction

1:18 Shawn’s background and expertise

5:04 Torq Resources is reemerging with Chilean Copper-Gold project(s)

9:18 Project acquisition finalization imminent

9:56 Torq geological team

11:48 Share structure and key shareholders

13:02 Final thoughts

TRANSCRIPT:

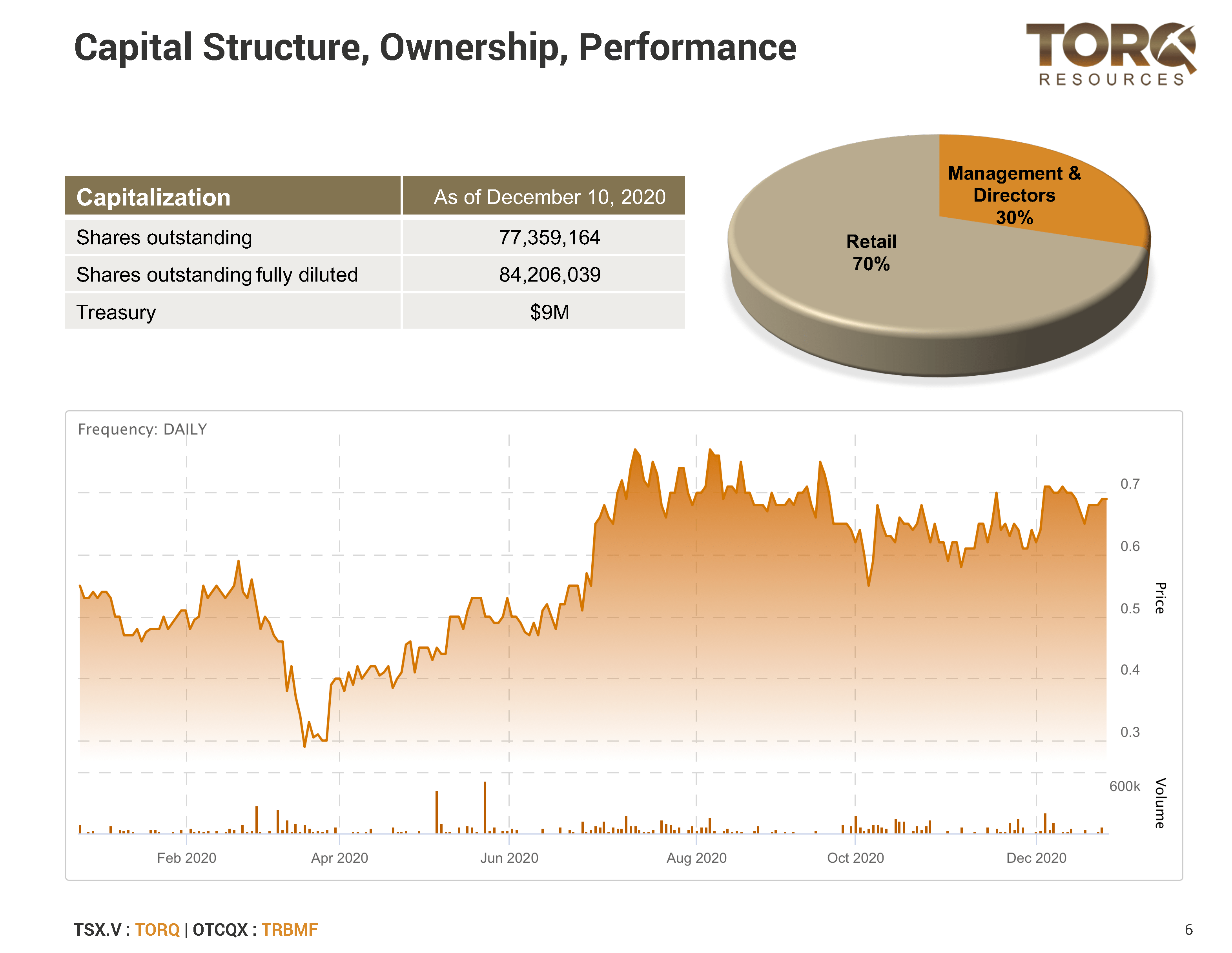

Bill: In today’s show, you’re going to be getting an introduction to Torq Resources. The website is torqresources.com. And this company has been dormant the last few years, although they have $9 million Canadian sitting in the bank, and they are about to re-emerge. They’re a new show sponsor. And this is a company affiliated with Ivan Bebek and his group. Joining me today is Ivan’s partner, Shawn Wallace. And if you’ve been listening to this show for the last two years as I’ve been interviewing Ivan, he would often mention “My partner, Shawn.” Well, you get to meet Ivan’s partner, Shawn today. He is the executive chairman of Torq Resources. So Shawn, welcome onto the program for the first time.

Shawn: Oh, thank you very much. Happy to be here.

Bill: So Shawn, give us a little introduction to yourself. What’s your background and expertise in this sector? How did you meet Ivan? And for those that don’t know, talk a little bit about your success that you’ve had working with Ivan.

Shawn: Oh, certainly thank you. Well, for myself, I began working in this business when I was a university student, just breaking rocks in half in the bush, trying to make enough money to put myself through university. And I was very fortunate that my tutelage and everything I’ve learned came with the illustrious Hunter Dickinson group. And I was very proud to be a member of that group for about 20 years, prior to meeting Ivan. I won’t go on and on about all the successes of Hunter Dickinson, which I was so grateful to be able to share in, but they’ve had many, and they’re well-known. And it was really beneficial to me. I always say that that was actually the university I went to. When I went to college and so forth, that was great, but what I really learned that is working for me today was the time I spent with Hunter Dickinson.

And how I learned was by just doing everything, from like I just mentioned, starting from splitting rocks in half, to then overseeing drill programs, to raising capital, to then getting in on the corporate side and being part of all the big deals they did like Northern Dynasty when Taseko Mines took over and so on and so forth.

So I’ve been exposed to everything that someone needs to know for this end of the, I’ll call it the food chain. We didn’t really do super Hermes state stuff, but we’d take things where maybe a discovery been made or somebody got started and they stumbled somehow, and Hunter Dickinson were very good and famous for coming in and grabbing it from there and taking it to the development stage. And often that would result in a transaction, a buyout.

And that’s the part of the evolution of a project or an asset that I’m most excited about. And that was one of the things that brought Ivan and I together. We’re like-minded, in that value creation was the most exciting for us. And it was what got us up in the morning and got us jazzed. And that remains true to this day. I’ve been doing it for about 30 years. I’m 50 years old now. So I started at 18, 32 years of doing this mining stuff. It’s been great. And as I mentioned being with Hunter Dickinson, I got all the background I needed to go out on my own after 20 years of learning. I did so with Ivan in the early 2000s. About 2003 or 2004 we met each other, doing the same job; he was working with a group with the Sutton Resources.

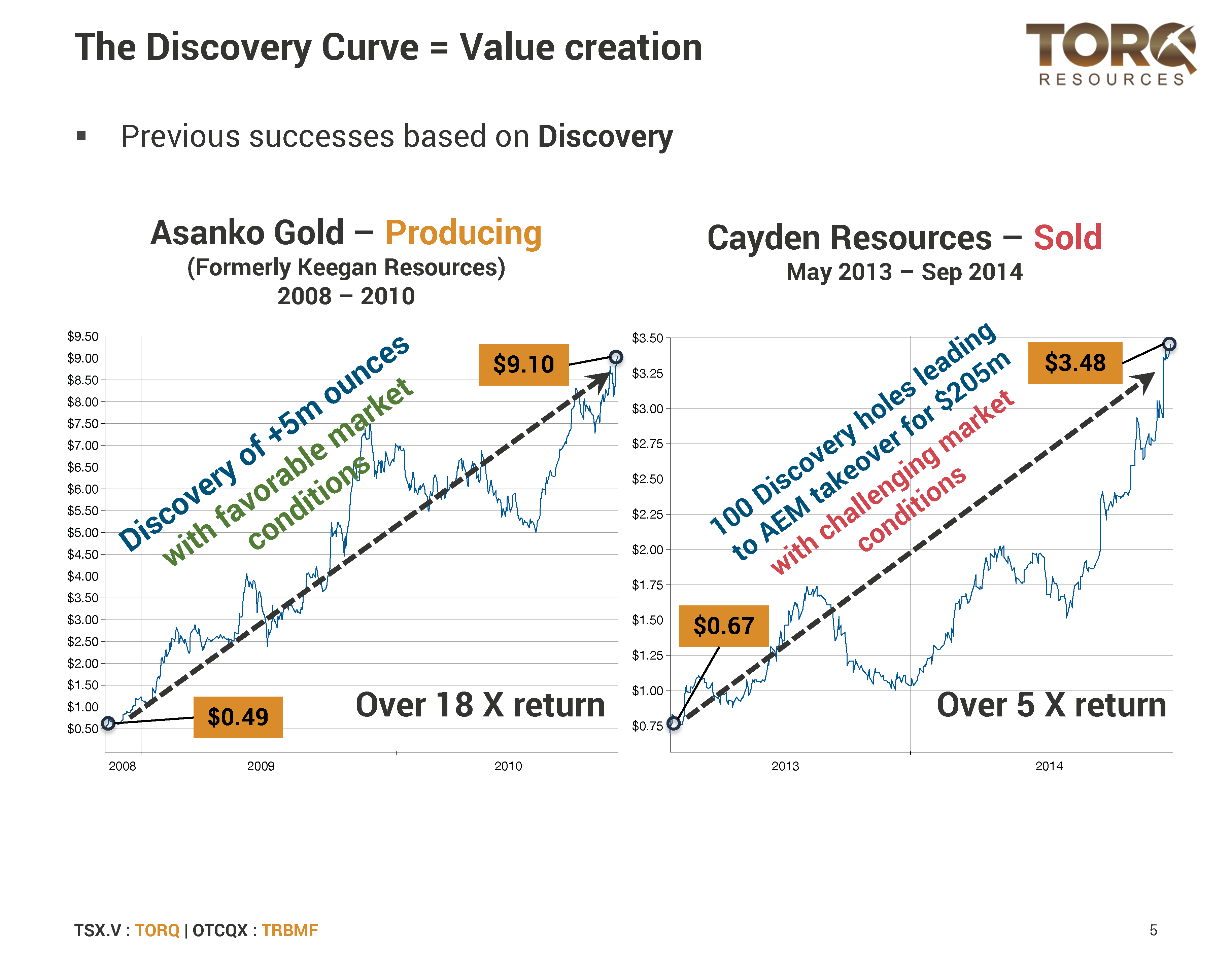

So, we’re just a couple young guys, had some big dreams, and so we started a company called Keegan, and we found 5 million ounces of gold as it turns out, in Africa. And that I’m still on the board of that company now, although it’s called Galiano Gold and they’re happily producing a quarter million ounces a year. And it hasn’t been easy. That was one that we had hoped to transact, frankly, but when you can’t sell it, I guess you got to build it. And that’s what we ended up doing. Obviously we brought in people with expertise. We’re pretty heavy in exploration expertise and all the science and so forth that goes with that. The development construction, that’s a whole other discipline. So we brought on a really sharp mind, building crew from South Africa. They did a fantastic job putting those two assets together and getting them up and run smoothly and so forth.

So Ivan saw that as our first success. And then we went on and did Cayden and so forth. And I’m sure your viewers have heard all about those successes. But Ivan and I did those together, and we continued to do that. Ivan and I are working on Torq now together, and we’re really excited about the future for it.

Bill: So Torq has, as I mentioned in my introduction, Canadian 9 million dollars in the bank, but you’ve been dormant the last couple of years. You’re a publicly listed company, so listeners can trade this stock or buy it. But why did you go dormant for a few years?

Shawn: Well, dormant is an interesting way to look at it. Dormant, from the sense of having something to share with the investing public, certainly. Dormant in that we put something on the back burner, that’s not correct. It’s very, very difficult to find the quality assets that we seek. And we’ve been in many different jurisdictions, many, looking at many different big opportunities, and for one reason or another, they didn’t come to fruition. It’s funny how you look back on some of the things you thought you missed though, and how they turned out so far, everything that we missed, it’s turned out that that was probably a good thing.

So, obviously too during this time, we’ve had a pandemic, which has changed the way that we have to do business, the way that we are able to do business. Generally if we go to other jurisdictions in other country, we would send down some of our people and they would work with the local experts. Some countries have good mining infrastructure, human capital, people who can move these projects, and then other jurisdictions don’t. The ones that don’t now are probably almost unattainable because if you can’t work on something there’s no way we can create value. We can purchase things and back-burner them, but we certainly can’t be creative and adding value through technical work, which is our modus operandi.

So we looked really hard at all the stuff we were looking at it. And fortuitously, with the stuff we were seeing that we liked the most, it was located in Chile. What attracts us to Chile is it’s a well-known stable mining jurisdiction, that’s got a long history of success with major mid and junior companies. It’s not easy, nowhere is. You still have all the stringent environmental and community work that you have to do, which we’re very well versed at, and see that as the modern way to run a mining company going forward. So, that doesn’t fuss us. However, it’s just onerous. But we’re well ready to accept that challenge.

And so what we did, we set our sights on Chile, but we knew, to do what we do we needed it almost a ghost or a mirror team of people like ourselves in Chile. Because who knows when we can freely come and go, like we’ve enjoyed through our lifetimes of being able to go travel anywhere, anytime. Now that’s not the case. So we worked really hard to put together this team. We’ve got a number of really exciting acquisitions we’re going to make, and with some of them being, in my opinion, quite imminent.

Bill: And those are copper-gold acquisitions?

Shawn: Yes. You mentioned our success previously, and one of the double-edged swords of success is that you up the bar for yourself. We’ve got some pretty big successes, so there’s an expectation of the types of things that we’re expected to be able to put together. And there’s a lot of moving parts to be able to pull that off. It’s not quite as simple as just plugging and playing. The good news is, the experience lets us know when we’re onto the right thing, because we’ve been there before.

So yeah, at Chile really we have this feeling of that we’re in the right place at the right time with the right people, the right commodities. I’m very bullish on the copper market right now, and we’re bullish on gold as well. I think that in particular though, the copper market is coming into a time where just the simple metrics, they’re easy to follow. Gold’s a little bit harder. As more ideas will go more restaurant people’s, personal proclivities and opinions. Whereas copper is more, you just crunch numbers and go, we’re going to need more copper, here we go. And I’m very, very bullish on the opportunities for copper companies, right?

Bill: So with the project acquisition, without holding you to a concrete timeline, could you give any more clarification on that, what investors should expect?

Shawn: Well, you’ll start seeing us becoming very active in earnest here in this first quarter. I feel very, very safe in saying that. It’s imminent. I use the example, it’s like when your partner is pregnant, you have a due date, but there’s forces outside of yourself that are going to dictate the exact date. So we know our targets, and we’re very confident that we’re going to hit them, or be very close.

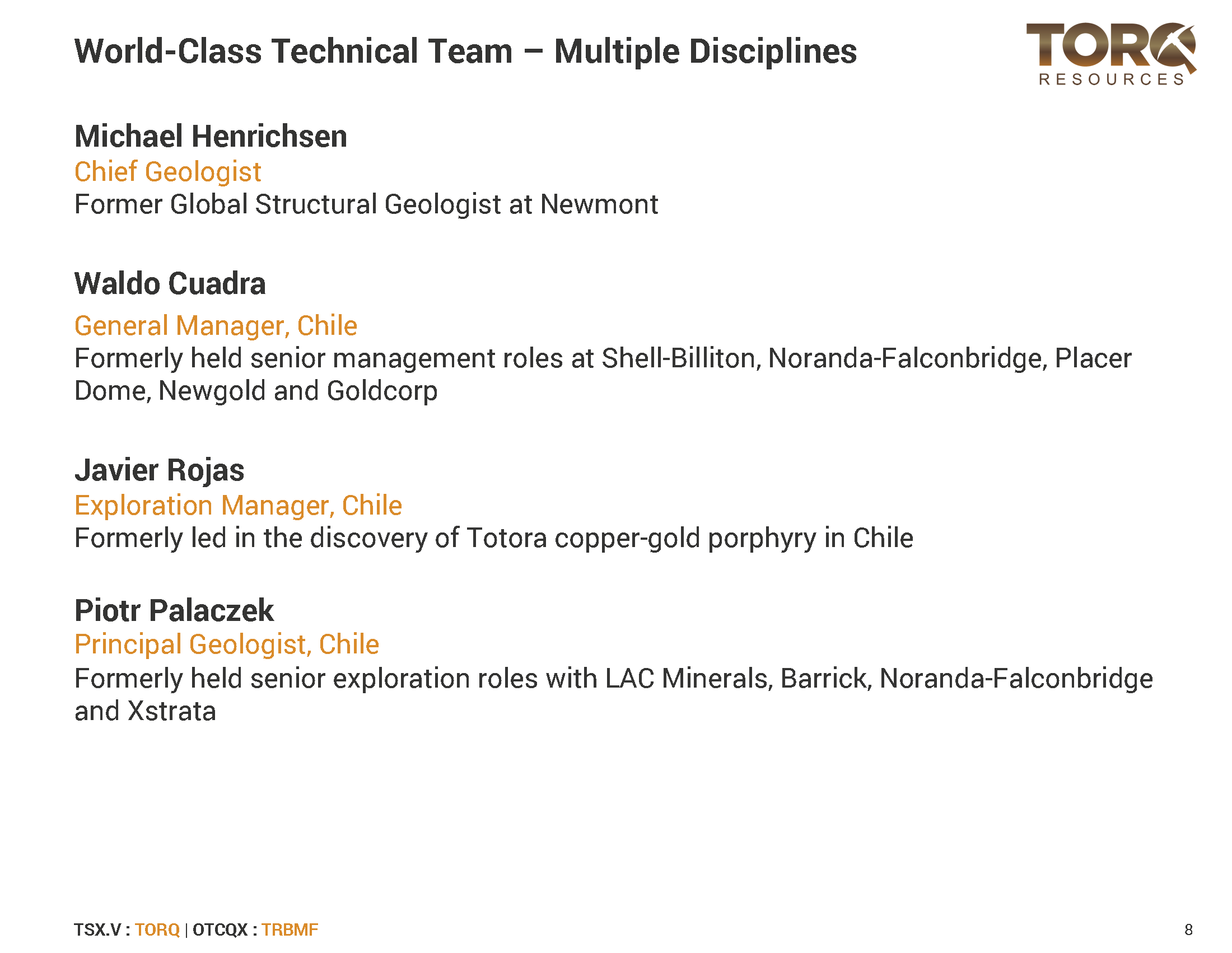

Bill: Like you said, because of your past success, you’ve set the bar high for yourself. But as you go after this copper gold target that you’re acquiring in Chile, you’ve assembled a team. That was your last press release. Talk to us about some of the key players on your geological team.

Shawn: Yeah, well it’s a whole group of people, and led by Waldo Cuadra who has 34 years experience. They kicked over every rock in Chile. They’ve been part of teams that did development, the acquisitions. It’s actually very serendipitous. We feel really good about having hooked up with these people. And as you get to know the people you’re working with- and people in our group, I’m getting to know them, but Michael Henrichsen who is our chief technical person, a geologist, he has known of them or people closely associated, for many, many years through his work with Newmont and so forth.

So we looked at the type of technical work that they’ve done and the quality of it, and it meets our standards. That’ usually a big hurdle for us. In this case it happened quickly and naturally and organically, although I hate that term. But in any event, that’s how it has happened. It’s been very good. And since the addition of them to the team, we’ve noticed the pace of things we’re trying to accomplish, they’re picking up. And that’s precisely what we were hoping for when we made this move. This is unprecedented for us to give somebody that much power or influence over what we’re doing, that isn’t already an integrated part of our group. But they’ve quickly become an integrated part of our group, and I feel like I’ve worked with them for a whole lot longer than we actually have. And so that gives me a lot of competence, which is important.

Bill: Shawn, could you go over the share structure and some of your key shareholders? Talk that through for us, please.

Shawn: Well, sure. I don’t have the exact number in front of me right now, but I think we’re 85 million shares or something, fully diluted. We got about $9 million in the bank, like you say. We have some disables, but I think they’re all out of the money right now. So our big shareholders are ourselves, frankly. Most of the cash that’s in the company right now, we’ve wrote those checks ourselves. And a lot of our close, big shareholders who are private investors. It’s certainly one of the things that’s going to happen when we make an acquisition is we’re going to work on the share registry and getting some of the institutional shareholders that need to own a story like this, once we get it up and running.

So I wouldn’t characterize our shares as being tightly held. That’s something that Ivan and I over the years are very militant about maintaining, being non-dilutive, because that’s just headwinds that you don’t need. You always have to be very picky about who you want to have as your shareholders, and want to make sure that you’re aligned with your shareholders, that your shareholders understand what you’re trying to accomplish and that they’re up for going on that journey with you. Particularly in a business like ours, it’s very complicated. And there’s a lot of moving parts.

Bill: Shawn, the next press release investors should look for would be the announcement of the final acquisition of this project we are alluding to?

Shawn: Yeah, the next substantive news release probably will include an acquisition.

Bill: Okay, and anything else investors should know right now?

Shawn: Well, I think that they should take solace in the fact that you were a known entity, working in a known jurisdiction, we have the success we have behind us. I’ll put that record up against anyone’s. We’ve been very fortunate. We’ve also worked extremely hard, and we’re very disciplined. So I would love for anyone to come along on this ride with us. And we’ll be putting out lots of information so that we can make sure everybody understands what’s happening and why, and when, and so forth.

from Kerry Lutz Podcasts – Financial Survival Network https://ift.tt/2XxoJQi