Gold Terra’s Executive Chairman Gerald Panneton is known for his tremendous success at Detour Gold. But what the market may not fully realize is that Gerald is actually more excited about Gold Terra’s current Yellowknife project than he was his previous Detour Lake project.

At Detour Gold, Gerald acquired the Detour Lake gold property in 2006 for C$75M and 20M shares when the project only had a resource of 3.4M gold ounces. Fast-forward about six years and Gerald had the project in production with 15.5M gold reserve ounces. Detour Gold was recently sold to Kirkland Lake Gold for almost C$5B.

Click Here to Listen to the Audio

So why is Gerald more excited about his current opportunity at Gold Terra? In this interview Gerald explains that last year as he was considering joining Gold Terra and engaging in his due diligence he concluded: “‘Gee, this project is more exciting than Detour Lake.’ Why? Because it’s high grade, also because it’s untouched, un-drilled. And there are so many follow-up intersections, that were never followed up. Just for example, there’s an intersection that we release about two months ago publicly: eight grams per ton gold over eight meters drilled in 1961. It has never been followed up in more than 60 years. That’s why I’m excited, because I know this potential is there and it just need to be drilled.”

Gerald believes that the current 735,000 resource has the potential to grow to over 5 million gold ounces or more. Thus, Gold Terra will be engaging in 20,000 to 25,000 meters of drilling at its Yellowknife City Gold Project from now until next April as it seeks to further discover and delineate Canada’s next large, high-grade gold deposit. If Gerald and the team at Gold Terra are successful, there will be a lot of happy Gold Terra shareholders and Yellowknife in the Northwest Territories will be re-established as one of the premier gold mining districts in Canada again.

https://www.goldterracorp.com/

TSXV: YGT OTC: TRXXF FSE:TX0

0:00 Introduction

0:53 Executive Chairman Gerald Panneton’s previous success

2:29 Gold Terra’s Yellowknife project is more exciting than Detour Gold

5:57 Why hasn’t this gold district been further developed already?

7:43 Key team members you’ve brought with you into Gold Terra?

10:04 Low cost of drilling / Year-round drilling possible

11:12 Nearby Con Mine (1M AuOz at 20g/t & 5M AuOz at 16g/t)

13:02 Drilling the Crestaurum high-grade target

13:55 Gold Terra controls approx. 70% of Campbell Shear

14:17 Starting 20,000 to 25,000m of drilling from now through April 2021

14:49 Fully permitted and fully funded for this drill program

16:18 Updated resource by year end in addition to new drill results

17:08 Share registry and “skin in the game”

19:26 Three mines permitted in NWT in past five years

TRANSCRIPT:

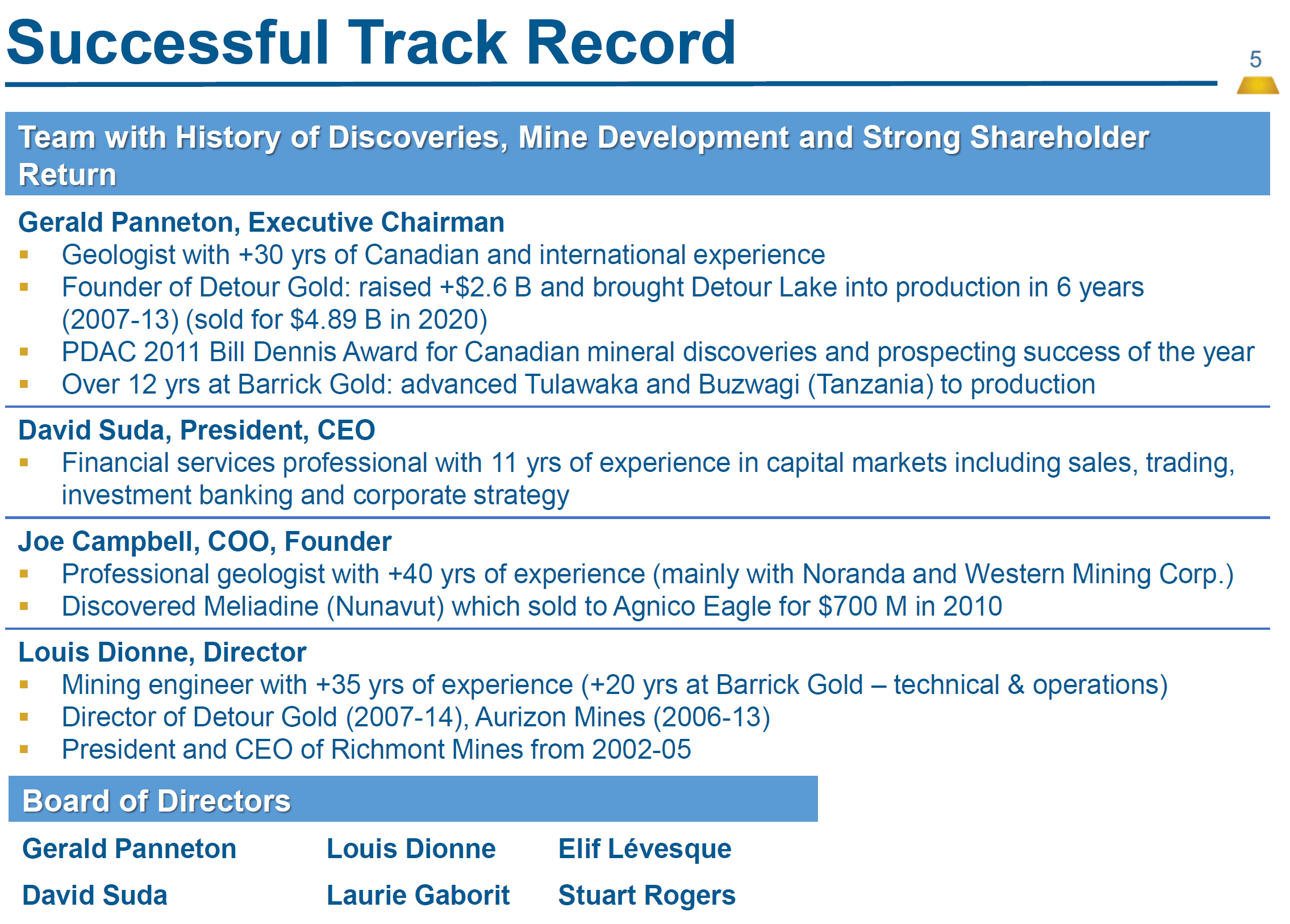

Bill Powers: Joining me today is Gold Terra Resource Corp.’s Executive Chairman, Gerald Panneton. He has a multi-decade success in the mining sector. For over 12 years, he worked for Barrick and advanced a couple mines to production. So he understands not just geology, but what it takes from an engineering standpoint to actually bring the mine into production. Gerald also has over 30 years of experience in Canada and all over the world. Most recently, he’s been in the news as the founder of Detour Gold where he raised over $2.6 billion. Detour Gold was recently sold to Kirkland Lake Gold for almost $5 billion.

So it’s my privilege to be able to speak to you today, Gerald. And as Gold Terra is your new company, I’m curious to learn what motivated you to join Gold Terra, and what did your due diligence process look like when you were considering taking the helm of Gold Terra?

Gerald Panneton: Thank you, Bill. It’s interesting because we always learn something in mining. So being part of mining education is always something we learn every day, because we discover a new thing. To answer your question, how do you get involved in a project like Yellowknife? And I think the main reason is because Gold Terra, the Yellowknife project, can create value for shareholders. We’re at the beginning of a story. I know the story is maybe six, seven years old in the hands of shareholders of TerraX Minerals. But I just started last October. And before I joined, the main thing was “Okay, what can Yellowknife offer to the investors?” I asked the same question at Detour.

And when I bought Detour in 2006, for roughly $75 million to get a 100% of great potential, I did the due diligence. And it was very quick from a geological point of view, that the potential was there and it was not just drilled properly. The same thing again, in Gold Terra, the Yellowknife project is a project that bears the same similarity as Detour Lake, except it’s high grade. And the main focus over the last six, seven years have been almost in the wrong place.

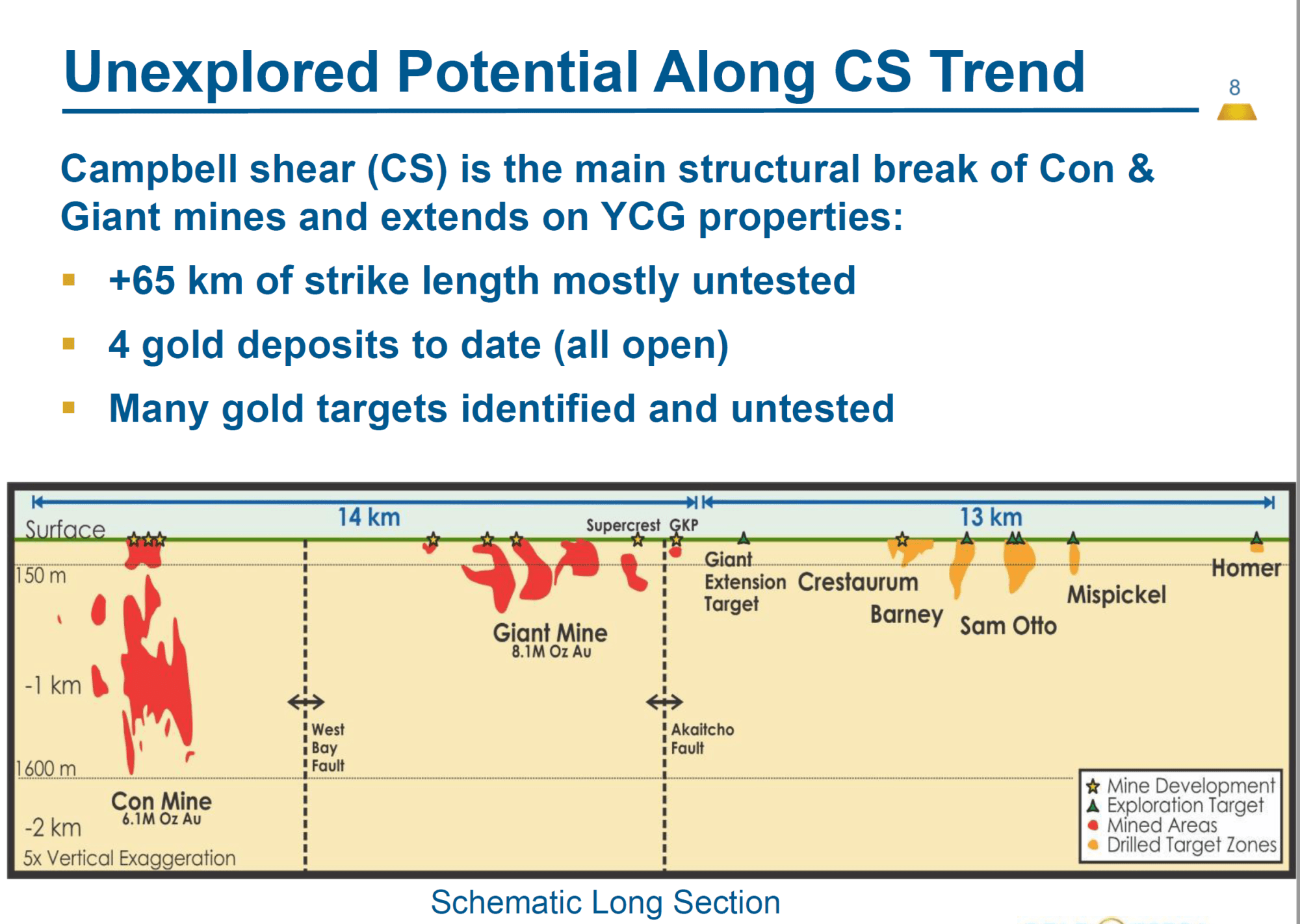

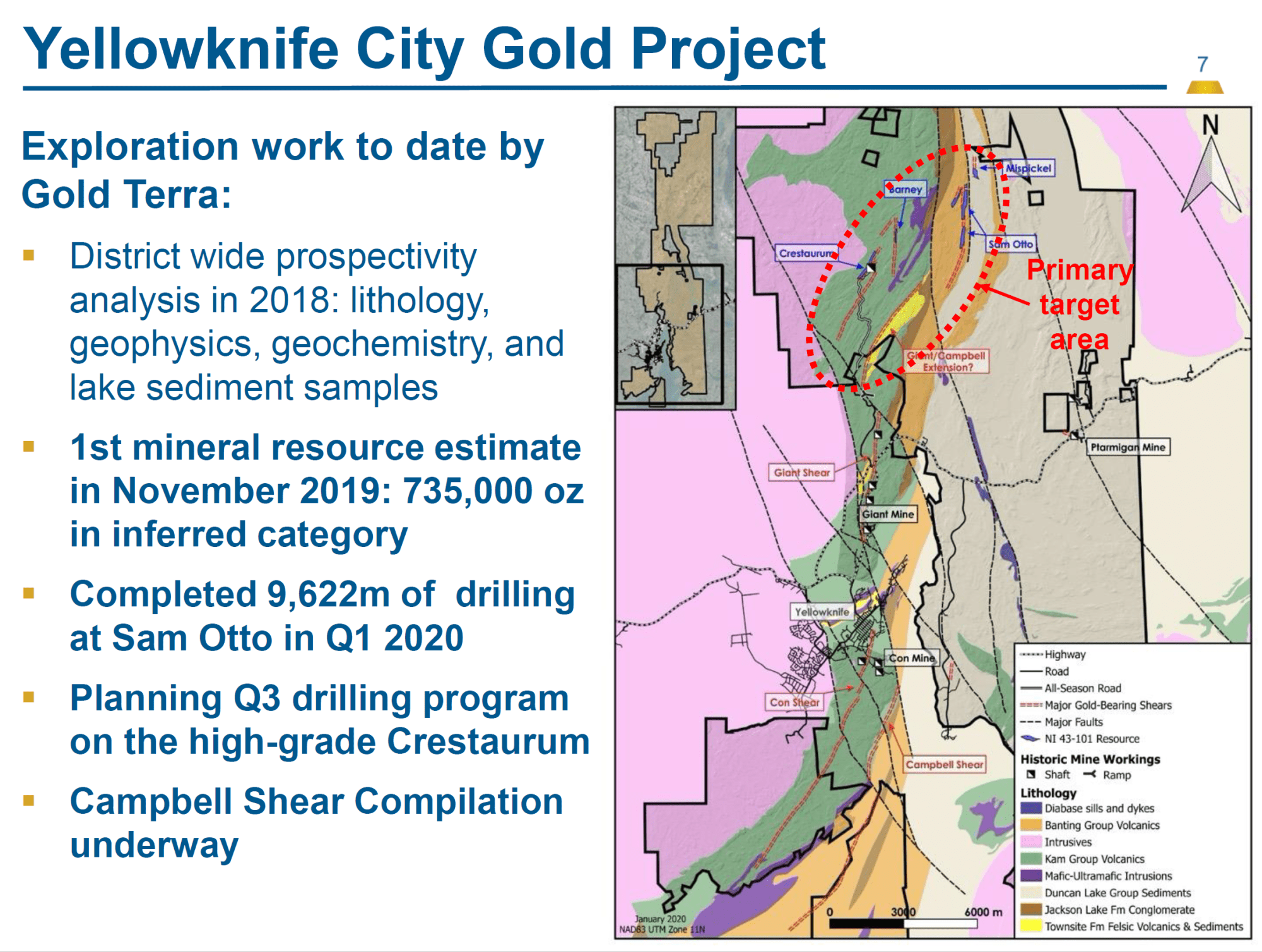

Yellowknife produced 13 million ounces of gold over five kilometres of strike length between the Giant and the Con mine. South of it. North of it. We control all of the land and basically the Campbell Shear extension that has been sporadically drill, with very good intersection that we released not long time ago of eight grams, over eight meters, for example, that has never been follow up properly. When we look at projects, we get excited as geologists about sometime the potential. And of course, when you have a low grade deposit like a Detour, you could be excited if you get to 5 or 10 million ounces, and you end up at more than 16 million ounces in reserve, and you put the money in production, and it produced 500,000 ounces a year.

It’s a great achievement, but when you start thinking that I look at Yellowknife; in May of last year and after my meeting, and by spending more time doing more geological due diligence, I realized that: “Gee, this project is more exciting than Detour Lake.” Why? Because it’s high grade, also because it’s untouched, un-drilled. And there are so many follow-up intersections, that were never followed up. Just for example, there’s an intersection that we release about two months ago publicly: eight grams per ton gold over eight meters drilled in 1961. It has never been follow up in more than 60 years. That’s why I’m excited, because I know this potential is there and it just need to be drilled.

What we have here at the Campbell Shear, the target of the Yellowknife Camp, is you’re looking at half an ounce per ton, 15 gram, 16 gram, 22 grams. High-grade potential and a lot of potential actually untapped to the south and to the north. It’s a small footprint. It’s two kilometers by two kilometers. That’s your Campbell sheer deposit. So yes, definitely the grade is the big bonus in repeating Detour Lake with high-grade.

Bill: With some remote projects, we can understand why there’s not more exploration done, just because of where they’re located. But this project, you can literally go to Tim Horton’s in the morning, get coffee, drive out in your own car or truck, and see the project. Why was this property and this district not further explored and developed in the last decade or so?

Gerald: Their history is a bit similar. The camp, which was run by Miramar in the late 2000, 1990 to 2005 was a Miramar, the Con Mine. And it was shut down when gold price hit $250/oz in 1999. So basically a lack of exploration, a lack of sustained development. They shut down the mine, flooded the mine. And I know a couple of anecdotes, which I’m not here to say that people wanted the mine shut down, and they were tired of going into Yellowknife. But look, we’re in a city of 20,000 people. We have road access, we have power. We have people, mining people. We have support from the community, support from the government. It’s sad to see a mine shut down, but at the same time, thank you because everybody after did not focus on the right thing for about 15 years.

And when TerraX purchased the property in 2013, the worked on the property for six years without having to focus on the Campbell shear. So they left what could be the result of a mother load discovery in Yellowknife, if we just drill the Campbell shear south and north of the mine. And that’s exactly what TerraX before us did not do it. And that we’re planning to do in 2020/2021. So within the next two years, we could be sitting on a 5 million ounces deposit, a success rate, one chance out of two, 50% because it’s there.

Bill: I can recall, as you’re talking Gerald, a comment I heard Rick Rule say once where he says, “Sometimes success takes putting the right eyes on an old project.”. And that’s what you’re doing here, but it’s not just your eyes. Because you have an excellent Rolodex with your success at Detour in previous decades. Who else have you brought into this company, that’s going to help you move this forward?

Gerald: The team is always important. When I joined in October, I was looking at the board, and I look at the directors, what they were bringing to the table. There was too many geologists, and there was too many people that has been around for a number of years, and it was time for a new reset. And I brought my mining companion, mining associate of 27 years, which is Mr. Louis Dionne. Louis Dionne was senior VP operation at Barrick Gold. My 12 years at Barrick Gold are very simple. I’ve got two mines put into production but 12 years of schooling, 12 years of looking at more than 200-300 gold deposits. Working for the same mentor, Alex Davidson. And Alex was a tough guy to work with, but a great guy to work with at the same time.

We saw eye to eye. He never refuted my judgment call when I used to go and due diligence, or completion, or whatever property I visited. And when you go to all those property, one after the other one, and you eliminate the political risk and the legal risk, the metallurgical risk, the mining risk. Mining is risky on so many aspect, but with the experience I gained from Barrick, and then to Detour.

I was able to build Detour because of my 12 years at Barrick. I don’t think I would have been able to do what I did at Detour Lake, without my learning curve of Barrack. Of course project size makes a big difference. We know that if we get over 5 million ounces, that Yellowknife is going to be tough to keep it for ourselves, because we will be one of the largest discoveries in Canada. And in my mind, that’s the reason why this camp has a lot to offer, because it does has this potential for another 5 million ounces, no question, maybe more. I still remember the first time I looked at Detour Lake. I thought there was 5 million ounces potential there. And we ended up with 16 million in reserve. So you gain access to the project, to what it could deliver, and we just need to drill it. It’s very simple.

Bill: And your drilling costs, I would assume, are quite lower than other areas of Canada, because the town is right next door, as you already mentioned.

Gerald: Yes, they are definitely. This is not a place where you spend $300–400 total cost per meters. We’re averaging, last winter, 225. Winter is a great time to drill. We can drill all year long, not everywhere, but the ice allows you to drill everywhere, for approximately the month of December all the way at the end of early April. COVID did not stop us this year. Mining is essential. Exploration is essential in Northwest territory, and we were able to drill and finish our program up to mid-April. And the good news is that we’re just about to go back and start drilling in August. Before mid August our drill will be turning on our high grade Crestaurum deposit, where we intend to take our quarter million ounces deposit that around seven gram, and bring it to possibly three quarter million ounces. A million ounces eventually with our drilling. The potential is there. Imagine it’s a deposit that was found in 1938, and it has not been drilled below 200 meters vertical.

Bill: And I was also reviewing some of the numbers, the Con mine, if I’m correct, produce about 1 million ounces of gold at 20 grams per ton, is that right?

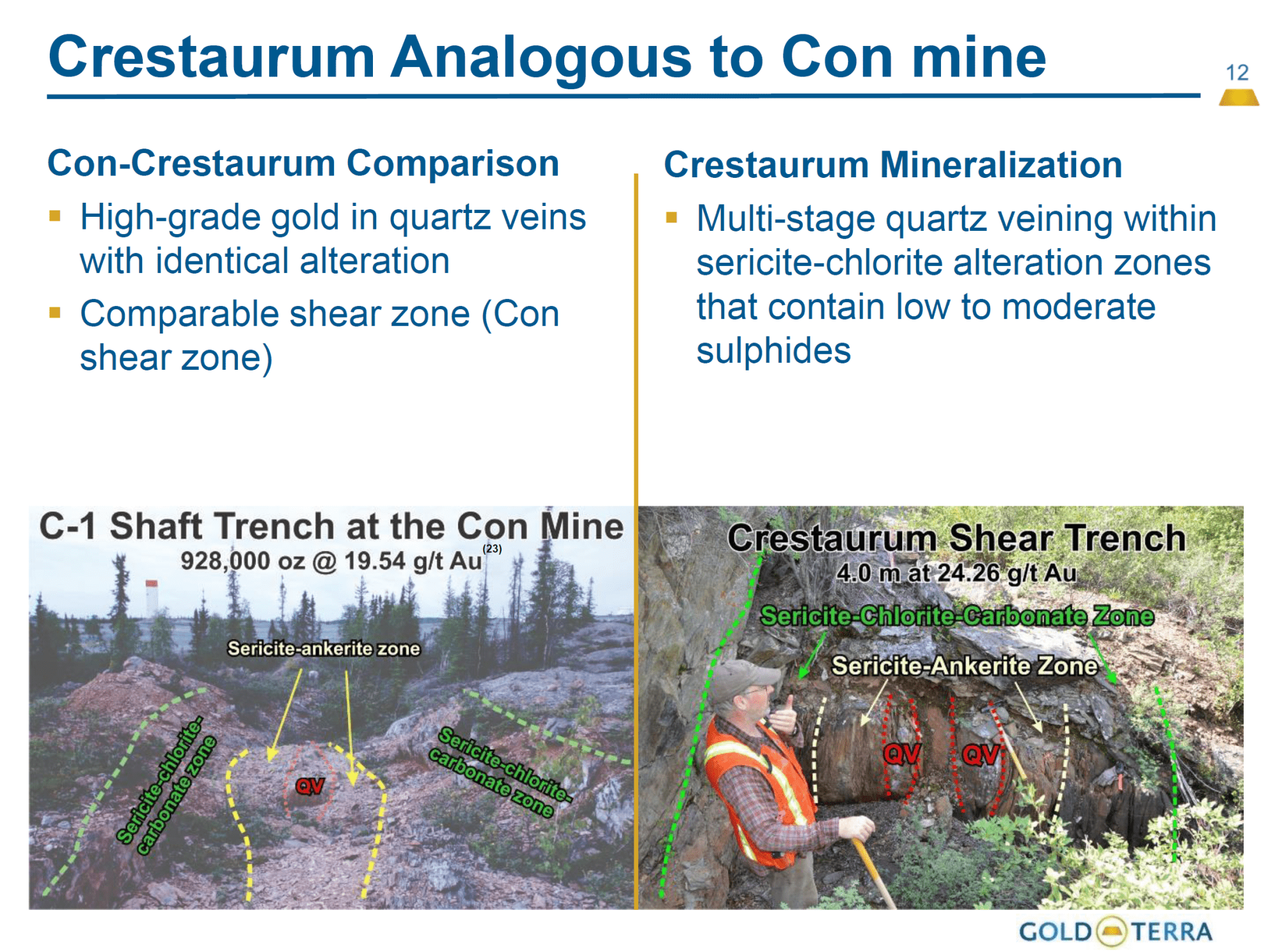

Gerald: The Con Mine is two deposits: the con shear, which was a million ounces at 20 grams per ton, which is actually a very similar shear zone as the Crestaurum deposit that we’re going to start drilling in August. So those two are almost like twins, the Campbell shear, which is the other part of the Con mine, mined 5 million ounces at roughly 16 grams per ton in width of up to a hundred meters wide. So the weight of the deposit was from five meters to 100 meters wide because of a folding situation. So the doubling of the deposit, and that’s exactly what is the Campbell shear. The Con Shear is like a small subsidiary of the Campbell shear. So they’re about a kilometer apart from each other Con Shear was very rich, three to five meters in width, a million ounces at 20 grams per ton. Very similar to Crestaurum geology and structural setting.

But the Campbell shear goes up to a hundred meters in width, because it’s a much bigger shear zone. And everything that was associated with quartz vein, which is very important at the Con mine was free milling. So anything that says, “Oh, I don’t like Yellowknife because it’s refractory.”. That’s the Giant mine, which became a bankruptcy and now is in the hands of the government. But the Con mine, which is currently still owned by Newmont after the acquisition of Miramar, is a great example of a mine that had a lot to yield at very good grade. And that’s why it makes this camp being in the city, having all the support from the community, from the manpower, I think an access road. If we develop a project again in Yellowknife, will not be as difficult even as Detour Gold or anything else that is remote.

Bill: And the Crestaurum deposit that you’re going to be drilling here shortly. Your best hit so far, wasn’t it 4 meters of 24 grams a ton gold already?

Gerald: Yes, there are some, some spectacular hits on the Crestaurum deposit. We also have 7 meters at 10g/t, 60 meters of 3g/t. There’s a 20g/t over 5 meters, 34g/t over 3 meters, 63g/t over 5 meters. It’s a high grade target. You hit the structure, you have quartz vein. You’re going to have at least an ounce or two in that shear zone. So we know that Crestaurum is not going to be a five million ounces target. For me Crestaurum is 1 million ounces or better as a target, but it’s a very good target as a satellite deposit that can be drilled, until we move the drill onto the Campbell shear, which will happen later this year.

Bill: And how much of the Campbell shear zone percentage-wise do you own?

Gerald: I would say that with our north belt property and our south belt property, we probably own approximately 70% of the Campbell shear.

Bill: Are you pretty much the dominant player right here at Yellowknife?

Gerald: On Yellowknife ground we are the dominant players on the Campbell shear.

Bill: You’re going to be drilling. How many meters are we going to be looking at? And when could we expect results?

Gerald: We are going to start at 10,000 meters drilling. Of which 50% is going on to Crestaurum. Following this we’ll be moving the drill on to the Campbell shear on the south belt, and carry on with drilling all winter long. And we should expect somewhere close to 20,000 to 25,000 meters of drilling by April of next year.

Bill: So constant news flow basically for the next nine months?

Gerald: And if we’re successful, we’ll bring a barge into Yellowknife, and drill through the summer on a barge.

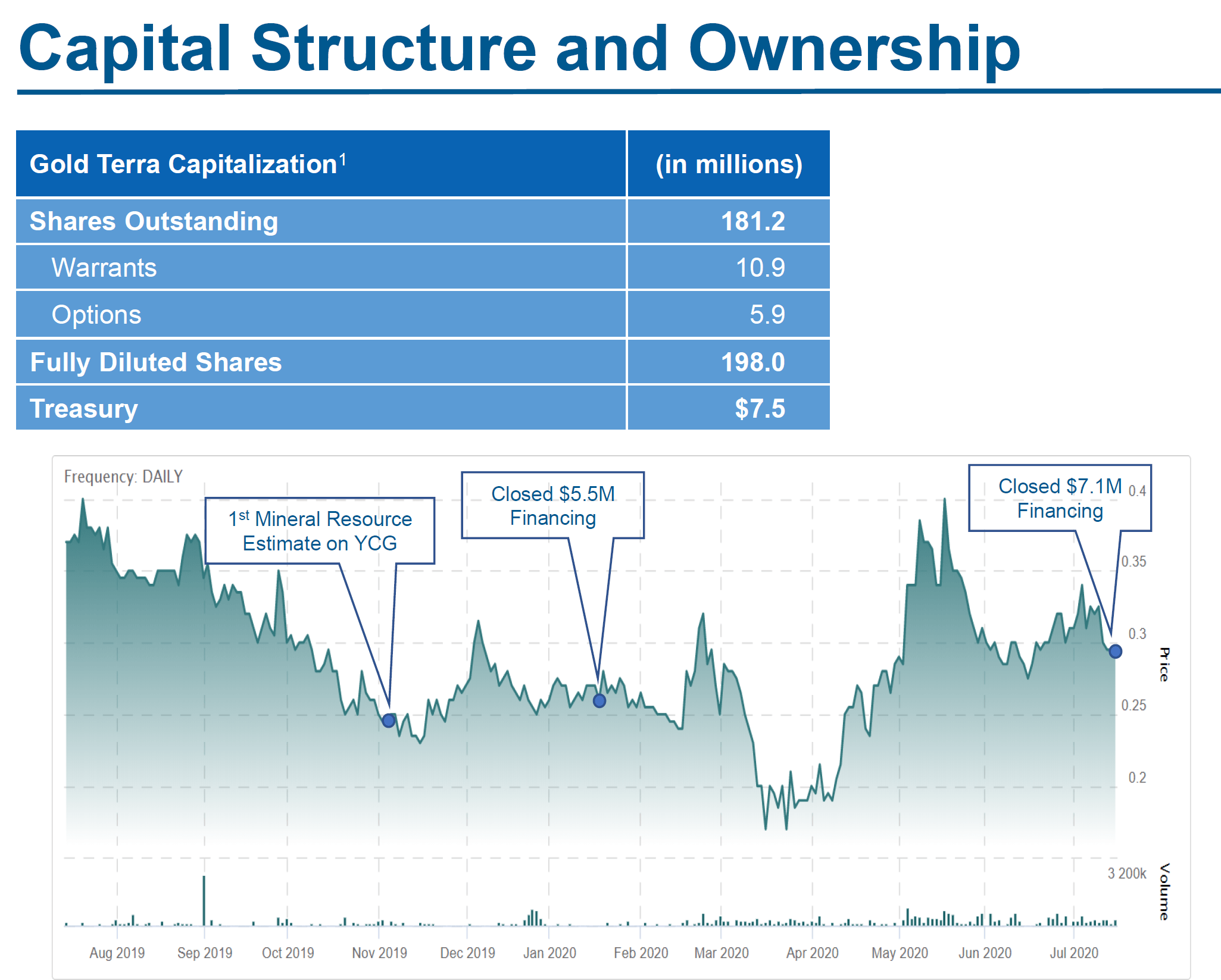

Bill: You just raised $7 million. So what is our treasury at, and how far will that take you?

Gerald: Treasury is full. Somewhere around $7 million. 10,000 meters will cost approximately $2.5 million dollars. So we can easily do 20,000 meters with $5 million, and I think our treasury will take us all the way to April of next year.

Bill: And you have all your permits in place?

Gerald: Yes, we do. You have all the permits in place. We have our water permit intake, which is good for five years. Our relationship that was acquired through TerraX with the local permitting agency has been very well. We’re an environmental example of doing the right thing. We go on the ice in the winter, and even line picket are being taken off before the ice melts. So we clean our stuff. We are a 2020 junior exploration company that cares for the environment.

Bill: And you’re based out of Toronto, is that right Gerald?

Gerald: Myself, yes. We have a small office in Vancouver, and of course our people are on the ground. So our geologists looking after the project, Ryan and Aaron are located in Yellowknife. So we have direct employment locally in Yellowknife.

Bill: And I understand though, you can even take a direct flight right there, versus some of these remote projects.

Gerald: We could to Yellowknife, but as you know, the airline industry has been cutting back significantly. The route to go usually is through Calgary, Edmonton, or Vancouver, which has also flights into Yellowknife.

Bill: We should mention too, you have a resource of over 700,000 ounces already defined at the project. Will you be working to further develop that resource, as you’re releasing these hopefully high-grade drill results?

Gerald: We already did part of that resource increase last winter, when we drilled the Sam Otto open pit target. We were very successful extending the realization at depth. The market should expect an updated 43-101 for Sam Otto, and for the Crestaurum deposit by year end. Definitely those two deposit should bring more ounces. So three quarter million ounces or 735,000 ounces is just the beginning. And once we start turning our rigs on Campbell; Campbell’s should have his its own 43-101 next year. So we look forward to creating more value for our shoulders as the drilling continue to progress.

Bill: Gerald, I was introduced to your company by one of your larger shareholders, who has high expectations for your success. Can you share anything more about the share registry, and what type of skin in the game have you contributed to this project?

Gerald: I could start a bit with myself. In a sense, when you want to create value, it’s for all of your shareholders. And I think the best way to show that is, as an Executive Chairman, I decline to have any stock options in the company, and basically put dollars into the ground. And my current situation now is almost 5 million shares that were all purchased through the different financings, from my private company, to the financing in December to buy on the market, and again on the last financing to maintain my position of almost 3%, I bought another 600,000 share during the financing that we closed in July.

I firmly believe that the best way to show how much I believe in the project, is by being there as a share holder and as an investor as well. And in a sense we can talk about what’s on the registry, which is public on Bloomberg.

Our goal is to increase our institutional follow up. We’ve been able to attract very good people, very good shareholders that are there for the longterm. One of our shoulder that we have in Toronto owns approximately 6 million shares now. Every time we finance, they buy 2 million share. They understand very well what we’re doing. If we refer back to a press release on the Campbell shear compilation that we did in June, they were very happy with our strategy. Our strategy is very simple, and we know that within the next two years we can create this value.

So just imagine our market cap today, which is not even US40 million. If we find 5 million ounces, and the value you gave us for that 5 million ounces, high-grade is $100 an ounce. 5 million ounces times a hundred is $500 million. So it’s a tenfold. This is how you create value. You create value by finding ounces that are mineable in a town that has all the full services. So this is low risk environment, high-grade zone in the perfect setup.

Bill: That’s excellent. And the Northwest Territories I believe has permitted … What is it? About three mines in the last couple of years?

Gerald: Mostly diamond mines in the remote location, but yes. They are all permitted from recent years. And I went to the permitting of three projects in my career. I know how to permit a project from A to Z. There are local rules, there are federal rules. You follow them, you deliver, you respect the environment, you respect your permit, and usually your track record will help you get through the next round of permitting.

Detour Lake went up with no problem on permitting. And the same thing can happen in Yellowknife, because in a remote area like Yellowknife you close the diamond mines, which were to be closed within the next 5 to 10 years. What’s next? It’s probably another mine. There’s nothing else than this. So mining is very important in Northern Canada, whatever you’re talking about, Ontario, whatever you talk about Northwest Territory, or British Columbia, or Yukon. This is a supportive country that has the resource to be offered for mining, and the expertise as well.

Continue Reading at MiningStockEducation.com…

from Kerry Lutz Podcasts – Financial Survival Network https://ift.tt/3inQKm3