An Update on Auryn Resources’ Numerous Projects in Both Peru and Canada

In this interview, Executive Chairman Ivan Bebek provides an update on Auryn Resources’ numerous projects in both Peru and Canada. He shares that there are numerous upcoming catalysts at several of the company’s projects. Ivan also comments on Peru as a mining jurisdiction and how Auryn is advancing its projects while serving the local Peruvian communities. Furthermore, Ivan addresses what moves the share price of Auryn Resources and offers his key takeaway from the recent Beaver Creek Precious Metals Summit and Denver Gold Forum.

In this interview, Executive Chairman Ivan Bebek provides an update on Auryn Resources’ numerous projects in both Peru and Canada. He shares that there are numerous upcoming catalysts at several of the company’s projects. Ivan also comments on Peru as a mining jurisdiction and how Auryn is advancing its projects while serving the local Peruvian communities. Furthermore, Ivan addresses what moves the share price of Auryn Resources and offers his key takeaway from the recent Beaver Creek Precious Metals Summit and Denver Gold Forum.

Auryn Resources is a technically-driven, well-financed junior exploration company focused on finding and advancing globally significant precious and base metal deposits. The Company has a portfolio approach to asset acquisition and has seven projects, including two flagships: the Committee Bay high-grade gold project in Nunavut and the Sombrero copper-gold project in southern Peru. Auryn’s technical and management teams have an impressive track record of successfully monetizing assets for all stakeholders and local communities in which it operates. Auryn conducts itself to the highest standards of corporate governance and sustainability.

Click Here to Listen to the Audio

Continue Reading at MiningStockEducation.com…

0:05 Introduction

0:45 High-grade silver grab samples at Sombrero South (Ccello project)

3:52 Newly-acquired Sambalay and Salvador concessions in southern Peru

7:57 Sombrero Main copper-gold project update

13:12 What moves Auryn Resources’ stock?

17:40 Discussing Peru as a mining jurisdiction

21:24 Auryn Resources’ Peruvian projects have no contentious water issues

25:13 Homestake Ridge gold project update (Golden Triangle in British Columbia)

27:34 Committee Bay gold project in northern Canada

29:50 Observations from the Denver Gold Forum and Beaver Creek Precious Metals Summit

TRANSCRIPT:

Bill: Ivan, welcome back to Mining Stock Education. You had a press release today from your Sombrero Project in Southern Peru. Please about you walk us through this.

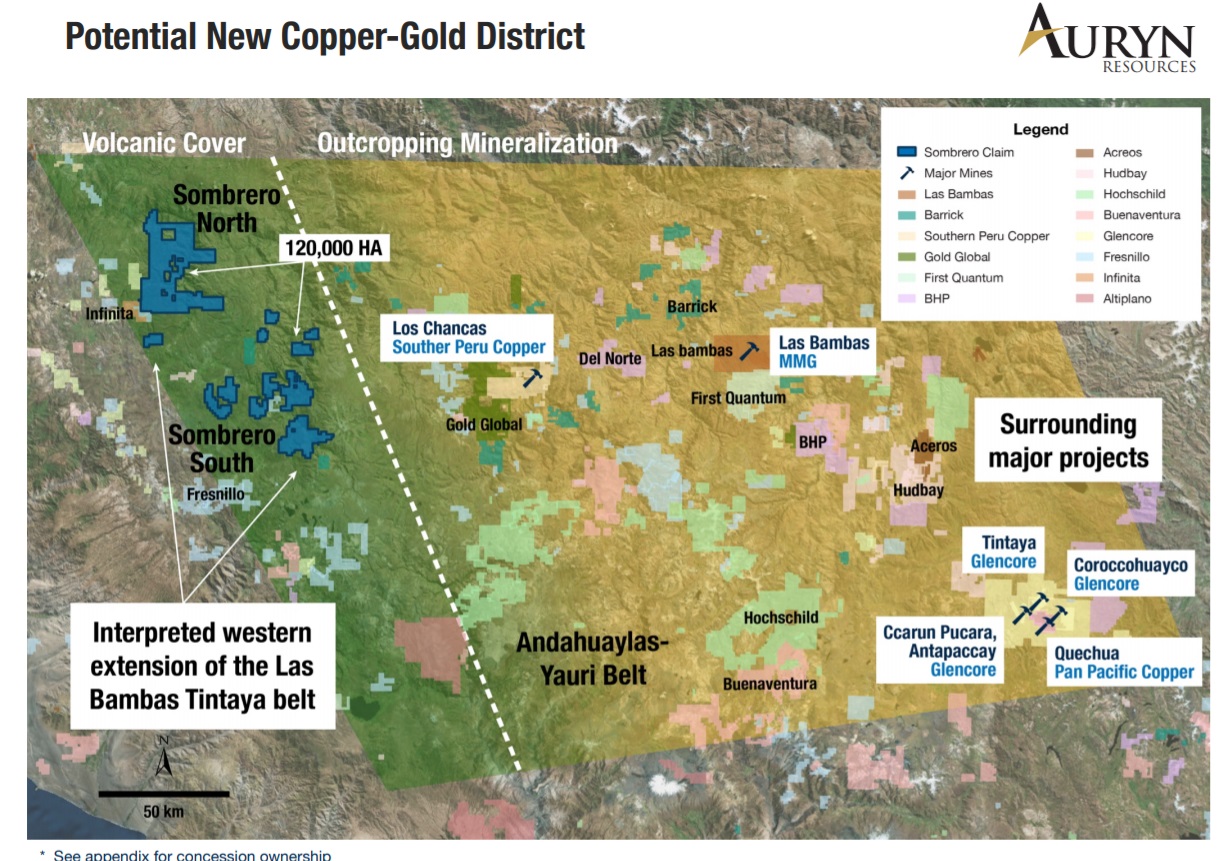

Ivan: Yeah, for sure. Thanks very much. It’s been some time but great to be back and I think just real full disclosure on our recent trading, and what’s happening and not been happening is we’ve been waiting on a lot of news that didn’t happen in Q3 that’s starting to happen in Q4, as you see today. As you know, we’ve put together a district scale land position on the Western side of the Las Bambas Tintaya Belt and a big breakthrough for us and globally, we’ve caught the attention of all the major mining companies in the world. Everyone’s coming to talk to us, and have reviewed it, and are looking at it. And the common feedback’s been this is a tier one exploration opportunity, which we most certainly agree with. As we have gone down and screened 7,000 square kilometers, we acquired about 120,000 hectors.

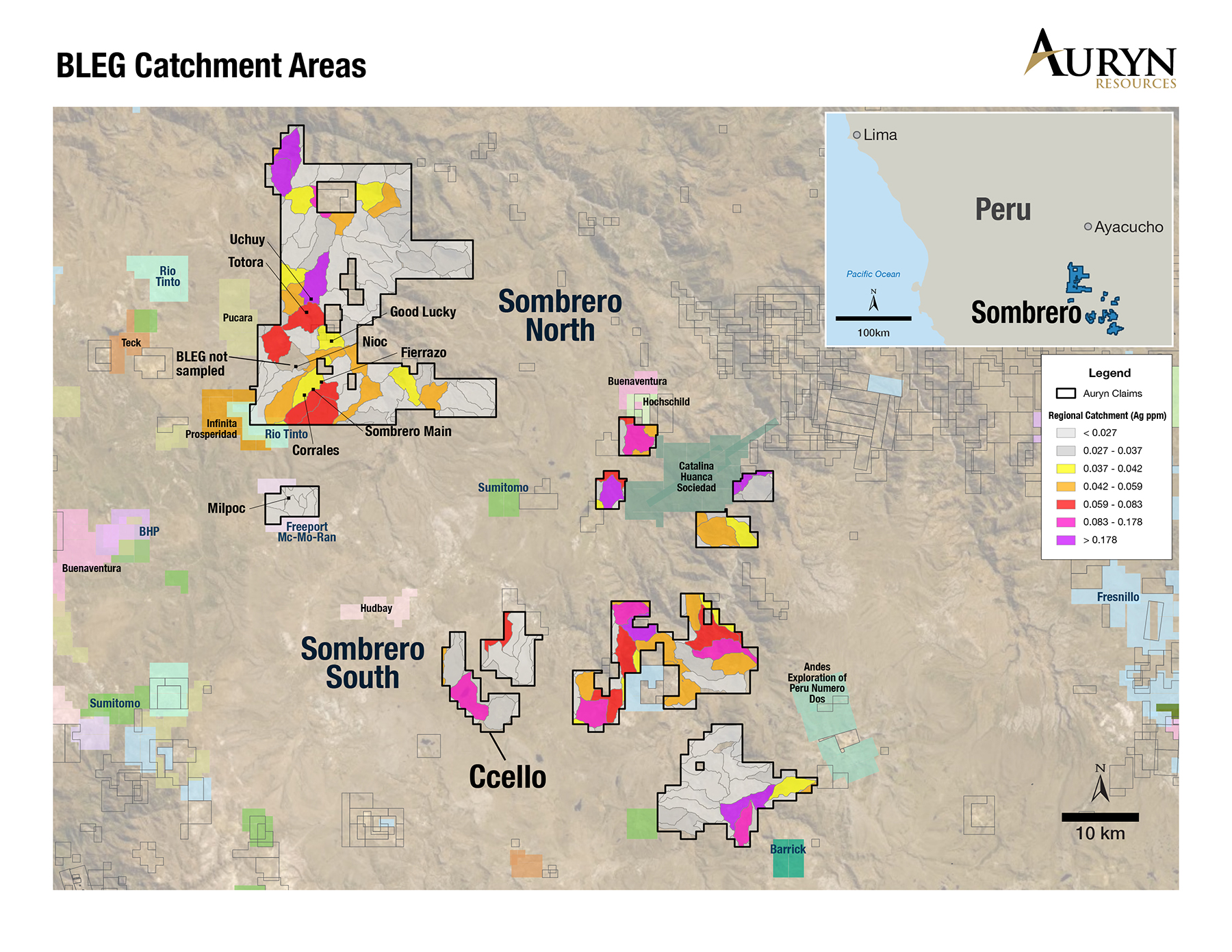

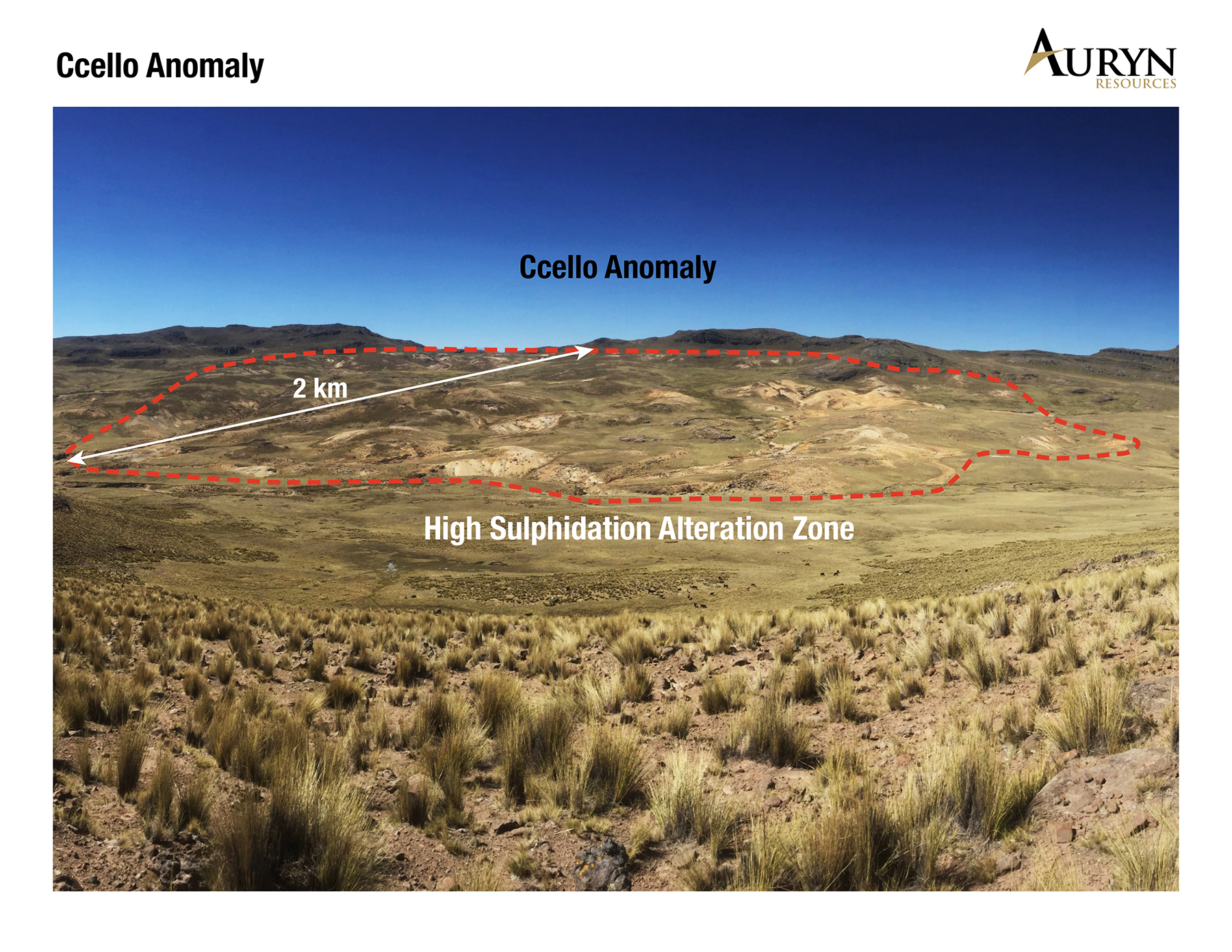

And so during this time of waiting on drill permits, we went down to go start sampling some of the ground in the south and looking to see if there’s any more big copper, gold or precious metal systems. And what we announced today was that is pronounced, “hey-o” prospect. Ccello is how it’d be spelled C-C-E-L-L-O but it’s pronounced “hey-o”, which makes it difficult for us. But that’s the name of the prospect. What we found here was two kilometers by one and a half kilometers of a very big, high sulphidation system with massive alteration. And so we saw incredible grades of silver up to basically a kilo silver, as well as something that people aren’t talking about, but really high grades of arsenic and antimony. Over 5,000 grams of arsenic and 7,700 grams of antimony, which, if you follow precious metal systems, would be really integral indicators that you might be on to a potential silver, gold type of a system.

Not to discount the possibility that there could be a porphyry nearby because of the nature of this belt. But this truly is something that came by complete surprise. It’s the only thing we’ve looked at in the southern concessions. We have some extremely robust anomalies to go follow up on. But what we’ve done here collectively as a group is, we didn’t just acquire a good project within Sombrero. We were the first movers on the western extension of a belt that holds some of the world’s largest mines next door. And this gives us a chance to potentially go make three or four of those kind of discoveries on this belt in a market where people aren’t making major discoveries. It’s truly a huge, huge positive for us to be able to get a land position like this and starting to work, and finding these kinds of grades and technical opportunities there. It’s truly spectacular.

Bill: For new listeners, please go back and listen to my interview with Ivan from February 2019 to get an overview of the Sombrero and Committee Bay projects. Ivan, you also picked up some more land at your Sambalay project. That was announced about six weeks ago. Could you give us an update regarding this also?

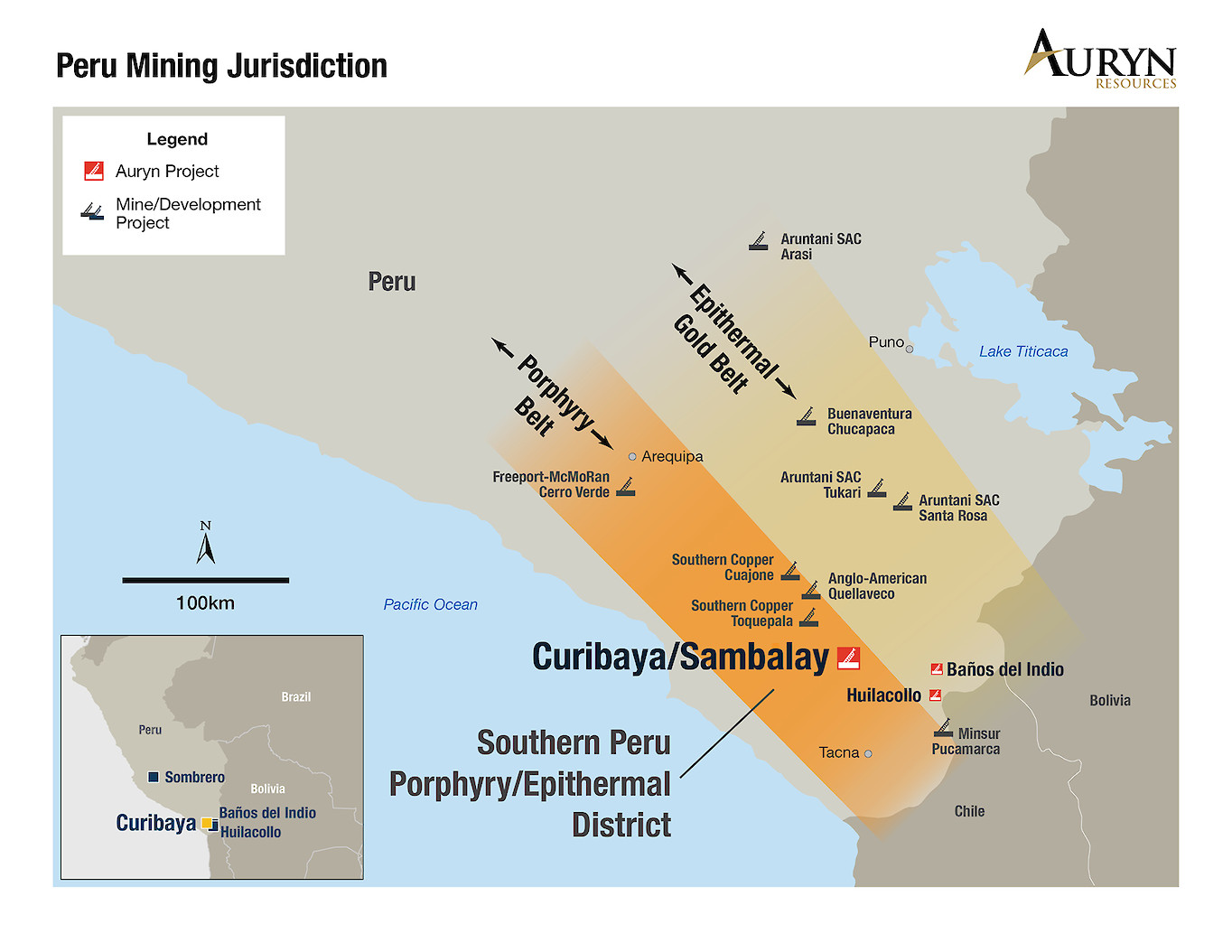

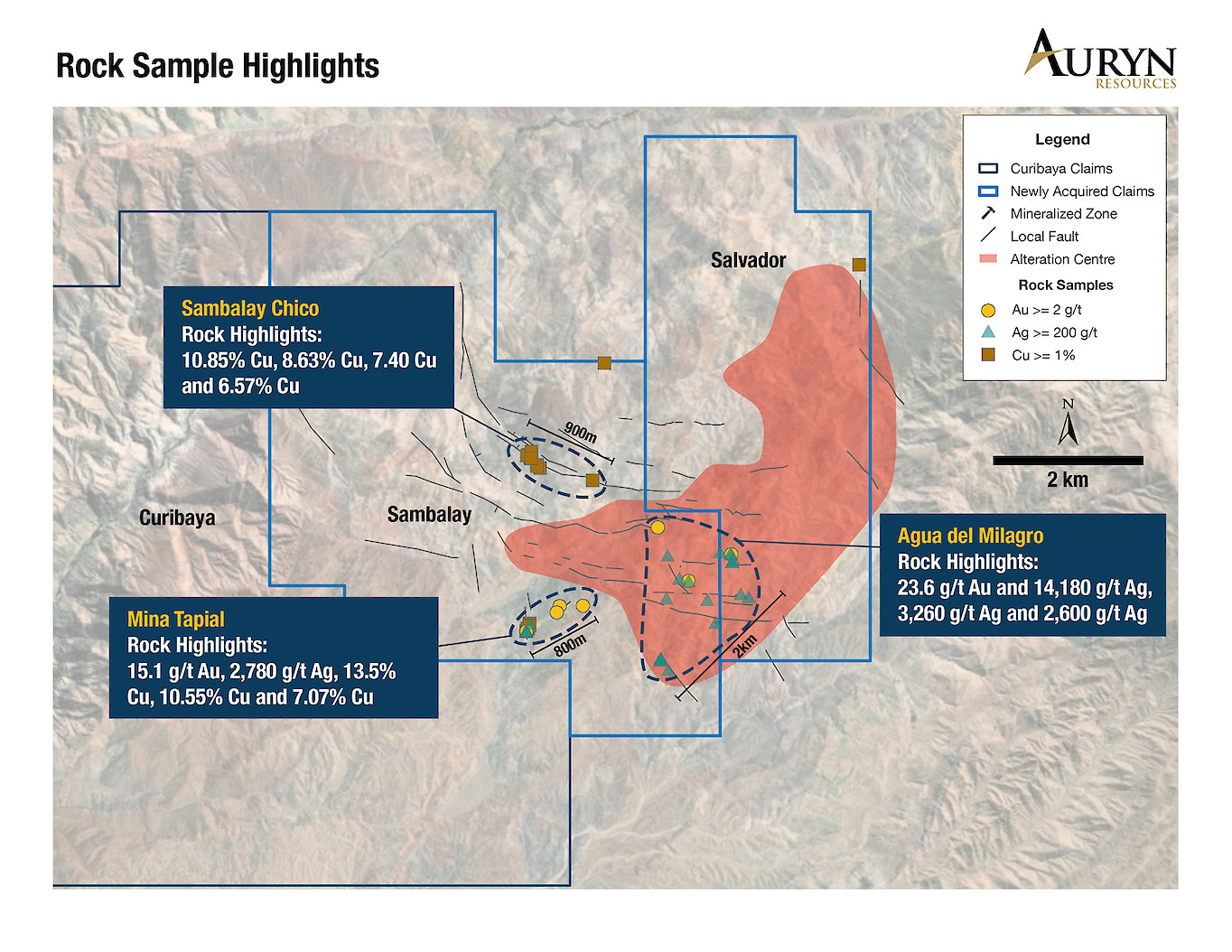

Ivan: Sure. This one is another belt in Peru. It actually has Cerro Verde, Toquepala, Quellaveco, some of the largest mines in the world, again occur on this belt. It’s by the coast, so it’s west of our Sombrero Project. We’ve been trying for four and a half years to get the Sambalay and El Salvador concessions to complete the consolidation of our Curibaya land position that we wanted when we first entered Peru. Not only are these some of the world’s largest mines along the trend of this belt, but the grades of silver, there was maybe 15 samples over a kilo silver in that press release on surface. There was another, probably, the same amount over a gram to 23 grams gold. And then there’s these huge faults coming through, carrying between 1 and 13 and a half percent copper. So this trend is predominantly a base metal trend with copper and gold, but we’re on the edge of the belt where you’re also finding an epithermal system.

I believe right now we have a three by three kilometer, which is substantial, footprint running about a gram gold or 90 grams silver in an average of all the 600 samples that were taken on the property. What’s important there is the footprint of such high grade of gold and silver obviously is, real layman’s terms, you look to go drill underneath things like that. But for them to mean something, you have to look at your geological setting. Are you nearby major deposits Or are you completely in a new area? In this case we’re right next to some of these world-class mines and then the copper story here, in these type of systems, you generally will find a big porphyry next to the precious metal potential discovery or deposit. And so seeing the 1 to 13 and a half percent copper faults coming into the system, right next to this big precious metals footprint, is truly spectacular by opportunity.

So you referred back to a previous interview we did when we talked about Sombrero and our general business plan for the company. And what we’ve defined ourselves at is, on the back of two really great successes since 2005, we wanted to go find tier one discoveries. And it’s not for the faint of heart. It’s the kind of discovery that every investor dreams about having. And one thing I will say, in this market, Bill, and it’s important for everyone to understand this, metal prices is not the challenge. Raising money is not the challenge. Finding metal and finding these big discoveries is going to be the hardest thing that we face as an exploration group for the industry for the next 30, 40, 50 years. We’d like to think that the easy deposits in the good jurisdictions have been found, and it’s going to take a lot of going outside the box to go find these.

So Curibaya, which now consolidates Sambalay and Salvador into one land position, we’ve been after this for four and a half years. You have to think about that as an investor today. They spent four and a half years trying to get this. Why did they do that? Our technical team is all former Newmont global experts. Our threshold of what we’re looking to achieve is something world-class and Curibaya most certainly, much like Sombrero and Committee Bay, it checks that box considerably for us.

For me in my career, having done this over 20 years, getting around a five million ounce discovery, that was our first success. We found one from zero to 5 million ounces. We sold the company in the middle of the bear market. But to wake up in the morning and have multiple tier one exploration opportunities in one portfolio truly was something … I never dreamed of getting this kind of real estate that has this much prospectivity going into the bull market. So truly once in a lifetime opportunity for us. And I think that shareholders can look forward to, if we get it right, one of the three or maybe more than one, a world-class discovery that would be extremely, extremely profitable for shareholders.

Bill: Yeah, and when we’re talking about Sombrero Main with that project, the potential buyout price, just for the listeners’ sake, we’re talking about multi-billions of dollars, if this copper, gold discovery, if the exploration thesis proves out. Right now, Auryn’s market cap is about 160 to 170 million dollars Canadian. And when you compare that to other exploration companies that have one or maybe two projects, sometimes they start out in that 15 to 30 million dollar market cap range, and then with the discovery go to about 150 to 300. But Auryn has seven-plus quality projects all over. And then if Sombrero Main in particular hits, you’re looking at billions of dollar of value that’s created. With that being said, Ivan, could you give us an update on the Sombrero Main project?

Ivan: Yeah, so the Sombrero Main and the analogy you’re using, we like to point towards Las Bambas. Las Bambas was sold for eight billion dollars in 2014. About six billion was the value of the metal content in that transaction, which I believe had a gross metal value of $60 billion. When we’re talking tier one potential discoveries, that’s what we’re referring to. So Sombrero Main has everything that it has is a great analog to Las Bambas. It has the same age rocks, the same type of rocks, but instead of copper molybdenum, which are the two metals that make up Las Bambas, it’s copper and gold. We spent the last two years gaining access and doing surface work to really show the world that there’s hundreds of meters of 0.55% or 0.7% copper gold equivalent on surface and in surface sampling, channel sampling across the surface. We found some historical drill holes on the edge of the system, which included 116 meters of 0.58% copper gold equivalent near these surface trenches that have been done, which gave us a full fingerprint for the entire area that we plan to drill.

When you’re looking for these deposits, you can use electrical currents, geophysics or magnetic currents into the ground to see what’s conducting or resisting to show you where you might have more copper and gold occurring. Real simply, the few drill holes we were able to achieve and announce in June, they gave us a fingerprint to the entire system of where we plan to drill. So we are very ambitious for more reasons than just some good work on surface. There’s a drill hole or a couple drill holes there that give us a lot of confidence. And what we’ve been doing is we’ve been waiting for our drill permits to come in and that’s where the entire market has been patient. But we’re going to go through some softness as these things take time. I can promise you, Bill, that we’re past the 50% point.

We do anticipate the two phases of permits that we need, one to most certainly complete this fall. That’s called the DIA. That could be as early as October, within the next month, as late as, conservatively, I think, mid-November would be a conservative outlook. Then the second part of this, you would need a social consulting, community consulting part of the permit, where the communities and the government both agree on a social basis. We’ve undertaken about $580,000 U.S. worth of community programs that have been done in conjunction between ourselves, the Peruvian government, NGOs as well as the local community. We’ve brought in Australian lambs. We’re bringing in French cows we’ve employed several women within the communities. We’ve helped the community to cultivate its meat and manage it a lot better. A lot of people may not be aware of this, but the actual Andean towns at that elevation, there’s a big iron deficiency, because there isn’t a lot of red meat up there.

So this is something that will sustain long after we leave. And the reason why I’m telling you all this, because once we get the DIA portion of the permit, we’ll look forward to getting the blessing from the community. Our relationship is pristine and the work we’re doing is a lot more than the typical company would do. And the best part about is it stays whether we leave, or drill, or find something and on it goes. So we think in a very reasonable period after we get the DIA, we think realistically middle of the road conservative would be around February, that we’re turning drills for the first time ever in this massive, massive opportunity.

So, I’d say for the listeners, expect some permitting updates here in the next few weeks, possibly in the next month and a half. And I think once we get through the DIA, you’ll start to see the speculation come back into the stock, because two months later you’re turning a drill. That’s a very short time period. Something we do well is we like to share what we’re up to globally with everybody. But the bigger it is, the bigger the opportunity, the more confidence you have, the bigger audience you’ll want to get to. So for us, we find it’s going to be challenging to get a chance to see everybody and show everybody what we’re up to between now and when we turn a drill potentially in February. But just an exciting homestretch here to get the drill out and go find a major deposit.

Bill: You mentioned the speculation coming back into the stock, and on that note, I’d like you to talk about what moves your stock, because as I’ve observed, especially with gold’s rise the last few months, there are the momentum traders that come in. They look for stocks that have high beta to gold and when the generalists come in, that’s one of the key things that they look for. Auryn’s shares have not performed the way some of the other gold stocks have, but that’s because the DNA and what your story responds to is different. So could you speak to what moves your stock?

Ivan: Sure. I mean, the first six months of the year in June, we were the number one performing junior exploration company on a performance basis, on a percentage basis. Right? And this was with the revealing of Sombrero. And that momentum was really, really, really strong. And all the other companies were trying to find their footing. As we went into the robust move in the gold price, we started to experience a entirely different market and this was where the shareholders became a little impatient, because we weren’t participating with the gold move. We did not have movement on our permit. There was a stagnant month or so of no news that’s just starting to kind of get resolved here. So you asked me what moves our share price. You know, I think for me, I do care immensely about the share price, but I care more about what we have in front of us as an opportunity.

I’m not too worried about short term volatility at all actually. I think the entire market’s going to see it, because we’re going into an election year. If you have the goods and if you have a tier one exploration opportunity in front of you, and I think we’re probably one of the few on the planet that have this kind of opportunity as big as it is and as mature as the opportunity is. I think that’s a great place to resonate with what you own, not so much how it’s bouncing back and forth. I mean in Canadian prices, we were a a $1.90 two days ago, three days ago. We’re $1.60 today. There’s volatility. Gold came off 20, 30 dollars. Is is a gold impact, or is it a general market impact or is it that we’re not doing something enough of anything?

What I can promise you, Bill, and everyone listening is our fundamentals have improved dramatically in the last few months from the first six months of the year. And the reasons why we were trading at CAD$2.40 twice, two different times per share this year in the summertime have gotten better, not worse. So I think as far as an investment standpoint, if you’re an accumulator, a buyer, if you want exposure to something that could deliver a tier one discovery, that multiple 10 or 20 times your share price, your entry points are real obvious. Buy on the down days, buy on the red days. I think that if you’re long the stock and you see it bouncing back and forth, this is just the way we all trade as exploration entities. I will say though, as a final comment towards the share price, we need steady news flow to maintain consistent interest, and to keep the volatility at a minimum and build momentum in the share price.

We have several catalysts as I mentioned, that will happen in Q4. We anticipate various things to start coming out. As you’ve seen today, additional discoveries, the resumption of work. There is talk of some asset sales that we’ve considered. They may transpire here in the next 30 to 60 days. There’s a lot of things going on behind the scenes, as most companies most certainly have, but in our case they’re quite substantial in terms of milestones and again, we’re within a month, month and a half from getting the DIA portion of the permit. And I think at the back of that you will see a tremendous amount of speculation come back into the story, if not sooner.

The interest again has been incredible from corporate entities, from very, very large investors, and the question people ask is, “Well, why isn’t your share price higher if that’s the case ?” We’re doing okay with market cap. At $160 to $200 million is the range we’ve been kind of trading in. I think without having drilled a hole yet ourselves, that’s a pretty good performance, but I still think that even at $2 a share Canadian, we’re drastically undervalued with the opportunity in front of us. But the extra news that the getting of the permit and drilling it will most certainly sort that out, I think, when the time comes.

Bill: You mentioned Peru and your work, what you’re doing, they’re socially, helping the community. There has been some pretty hard critiques on Peru and big open pit mines. I even emailed you what one newsletter writer wrote. And the newsletter writer said, “At this point, any big open pit project in Peru is looking like a nonstarter, but that writing has been on the wall for years.” Obviously, you’re pursuing a massive open pit mine right now in Peru. So what would be your response to this comment?

Ivan: Oh, sure. I think that writer’s talking about the Tia Maria mine. Tia Maria is the mine that’s gotten all the attention lately. And what happened in that situation, is really confidential towards the history there and it started probably 10 or 15 years ago. And there’s been multiple owners that have come through that project and there’s been various different handlings of the communities. It’s the only one that’s having these issues that I’m aware of. I don’t see any other open pit mines being encumbered by that. I do see a general theme of people being worried about that. But as far as that goes, I think we strongly believe each opportunity to go and find a mine, whether it’s open pit or underground in Peru, is going to be isolated to what the community thinks and how you handle the community.

So we’ve taken our time and we’ve done the community part, the social impact part extremely, extremely carefully. And I don’t know how, these other places that are having issues, I don’t know how they’ve managed themselves. I’m not saying they’ve done anything wrong or maybe they’ve missed somebody, I don’t know. I cannot comment directly towards that. But not everybody’s having these problems. There’s a few isolated events that are very particular to certain circumstances. And I think the investing crowd or some of these letter writers, they want to get excited that it’s going to be a blanket generalization across Peru. Regarding copper, I think Peru’s number two in the world of production of copper, it’s a massive portion of their GDP. And I think the government would be or is very sensitive towards that. And if mines aren’t getting built, the country’s going to face some serious issues going forward, and lack of jobs and an impact on their economy.

So I think everyone wants to see a better relationship between projects, and open pit mines and communities. And we are most certainly taking that route, but we are not deterred by one moment. We’re actually looking to acquire some other substantial assets in Peru. As I talk to you today, we have no fear that you can permit an open pit mine and Peru if you do things properly. So I’d have to say that letter writer, maybe they got caught in a stock or a story that’s getting impacted by it. I don’t know how much they know or don’t know about the specific, general areas of Peru. But from our experience, it’s all been isolated per communities around per mine. And that’s something that I think that people have to look at and say, “How were Auryn’s relationships with its communities?” And I would answer we’re extremely well received.

Congress actually recognized our community federally with an award for how we’ve interacted with the NGOs, the government NGOs, as well as the local community in our own contributions to set up the social programs we’ve been doing. And so I think there’s work to be done, and both on the perception of how to manage yourself in Peru for all of the mining companies, but most importantly, I think people have to think of them as isolated events, not as generalizations.

Bill: Two things a mine has to have is electricity and water. As I read some of the reports coming out of Peru regarding the anti-mining protests, at issue with some of them was water and how the farmers would be impacted with water. Is there anything you can say about the Sombrero Main Project and how does the water situation look there?

Ivan: Well, so a couple of things. Our water situation is great. The water that we would use would not be impacted in a negative way and affect the community or their agriculture. We’re supporting agricultural programs. It would be a contradiction to support programs that would be hindered later by a potential mine. Right? So we have a very good plan for use of water at this time that would not impact the agriculture, to be quite general about it. Now in these Peruvian minds that are complaining or these communities in some parts of Peru that are complaining about the water, I read a report recently that before the mines were even existed in the groundwater tables, just like our southern prospect, if there’s arsenic and if there’s antimony and arsenic in the ground, it’s going to contaminate water on its own. Mines don’t necessarily come in and bring that.

If the rock’s already there containing arsenic, the water’s going to be contaminated. In fact, we will clean more water probably as miners, than we will contaminate based on water already not being drinkable in certain areas. And I think there’s a little bit of education needed when you go out and you do your ground table water survey. And that’s why the government and the environmental permit makes you really do this thoroughly, is they want to make sure that you’re not going to impact the quality of water. Most certainly in our case of drilling and finding something, we don’t use any chemicals. There would be nothing there for anyone to worry about, but in the event that it becomes a mine plan that’s going to proceed, there’s a lot of room and a lot of areas around the project where a very non-impactful, toxic scenario can be created. And it can be managed without any kind of risk to the agriculture.

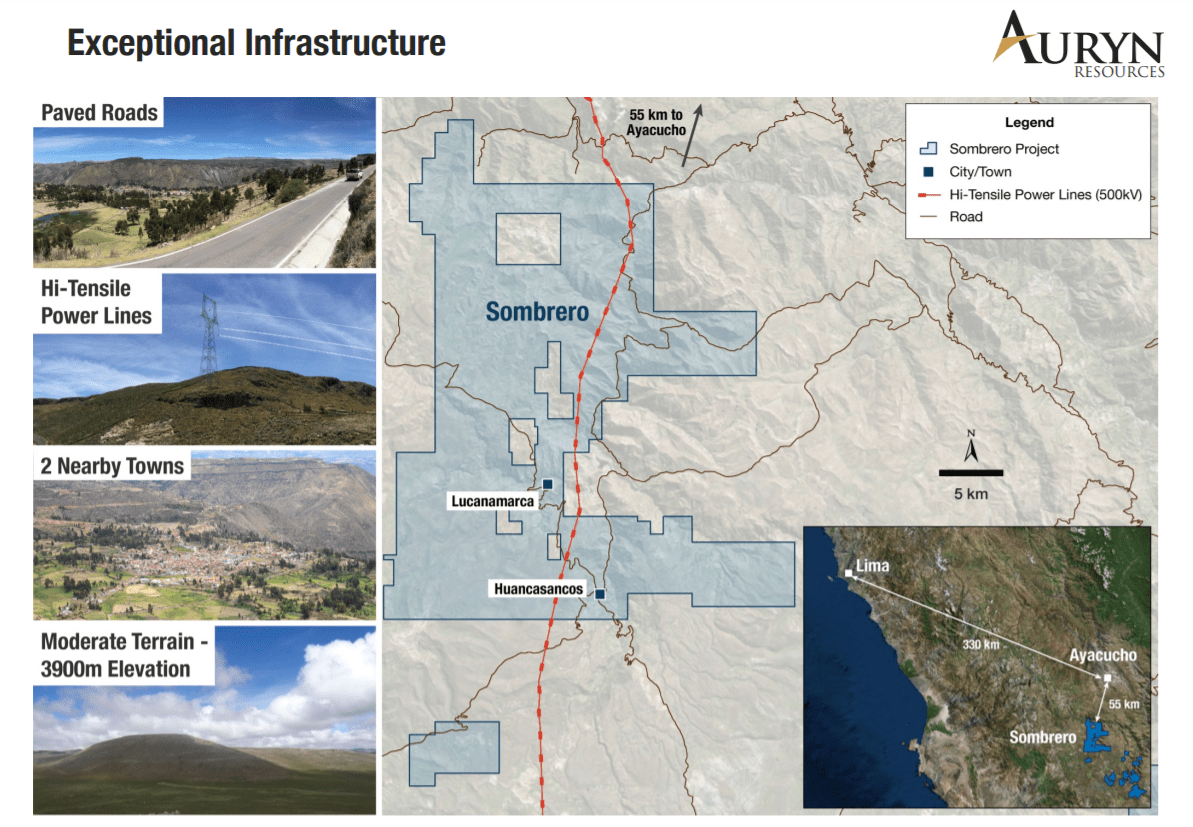

So first point there is a lot of areas are already contaminated, because there are arsenic rocks in the Andes, full stop. And so if anything mining companies will end up putting a water filtration plant to clean that. Secondly, you talked about power, and talking about something, we’re at 3,900 meters elevation with Sombrero. You talk about, “Where are you going to get your power?” Well, since we’ve had this project, the government has built 500 kilovolt power lines on top of our property. You can actually hear them buzzing when you’re taking rock samples. And we have internally joked about plugging in a extension cord. If you go to our PowerPoint on our website, you’ll see that you access this with a paved roads to within five kilometers of our property. You’re driving down a highway.

So in terms of infrastructure, in terms of modest environmental impact, in terms of not impacting agriculture, in fact, supporting agriculture in the region and improving that, we put in a trout farm the other day as well, or helped to design one that’s being built. These kinds of programs and the opportunity for infrastructure is about as good as it gets, not just in Peru, but globally. I’ve never seen a project that had line power right on top of it, as well as access to plenty of water and lay back areas to go build the mine right out the gate with a bunch of high grade copper and gold all over the surface. It’s truly a spectacular opportunity for us from that perspective. And I think, in terms of those general concerns, they’re extremely great questions, but we’re very, very, very comfortable with the situation. We think we’ve gotten extremely lucky with how we’re laid out.

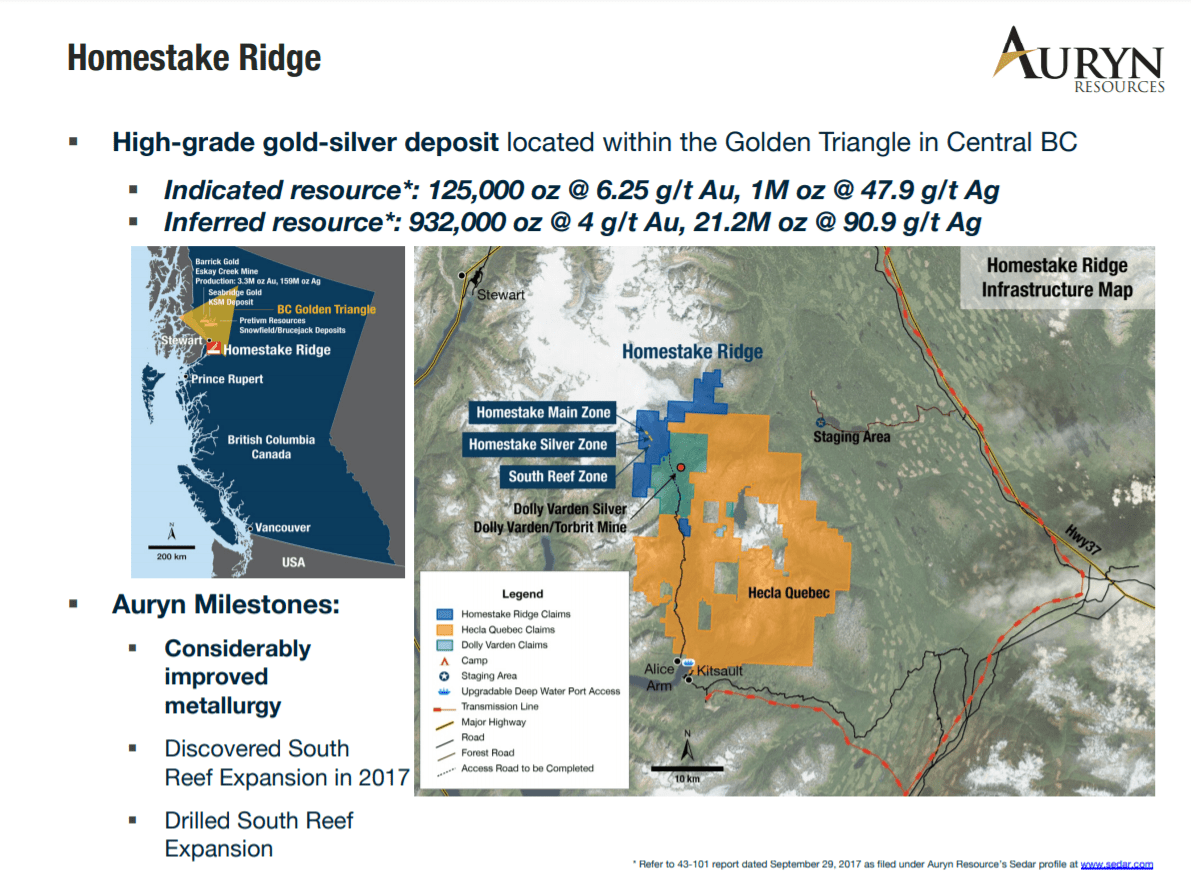

Bill: As I mentioned earlier, Auryn is a multi-project company. So let’s head north of the equator to Canada and touch on two of your projects there. What’s going on with the Homestake Ridge project in British Columbia?

Ivan: Yeah. Homestake Ridge, we had it for a couple years. We went out there and we looked to extend the high grade gold deposit. There’s about 1.2 million ounces of seven and a half grams gold, silver equivalent. That’s an incredible high grade for that part of the world. You’d produce concentrates and there’s infrastructure nearby as well, and you’d be selling a high value concentrate. Our first goal was, can we start to make this thing bigger? Is there some extensions to the existing deposit? The second goal, which is really important is, where’s the blue sky to double or triple this deposit? So this summer we spent $800,000 going out there and doing all the surface work, geophysics in a couple new areas that have yielded half kilos silver, several ounce gold, and they had never been followed up on previously. We did the detailed work. We’ll come out with some pretty robust targets from what I’m hearing and we’re going to have some pretty big opportunities in an area like the Golden Triangle to go find another million or potentially 2 million more ounces.

Some of the holes drilled in Homestake Main, 96 meters or 94 meters of six grams per ton gold or 73 meters of 21 grams per ton gold. If you’re familiar with the Golden Triangle, it’s truly a spectacular place for endowment when you get it right. So in our own perspective, we’re finally going to add the layer towards that project, which would be the blue sky, which we believe was missing not just for the market but from us. And we’ll have some pretty robust drill-ready targets next year.

The project’s gathered a lot of interest because of the mature state that’s in. It’s our closest project towards development, and the metal prices going up make it a very attractive project for people to potentially buy it. We’re not looking to divest it in a fire sale kind of environment. We think or we believe strongly that there’s a lot more value to be realized here at current metal prices and future forecast metal prices. So unless we see something extremely competitive on the buy side, we look forward to making it a lot bigger and potentially monetizing it in the rising gold market.

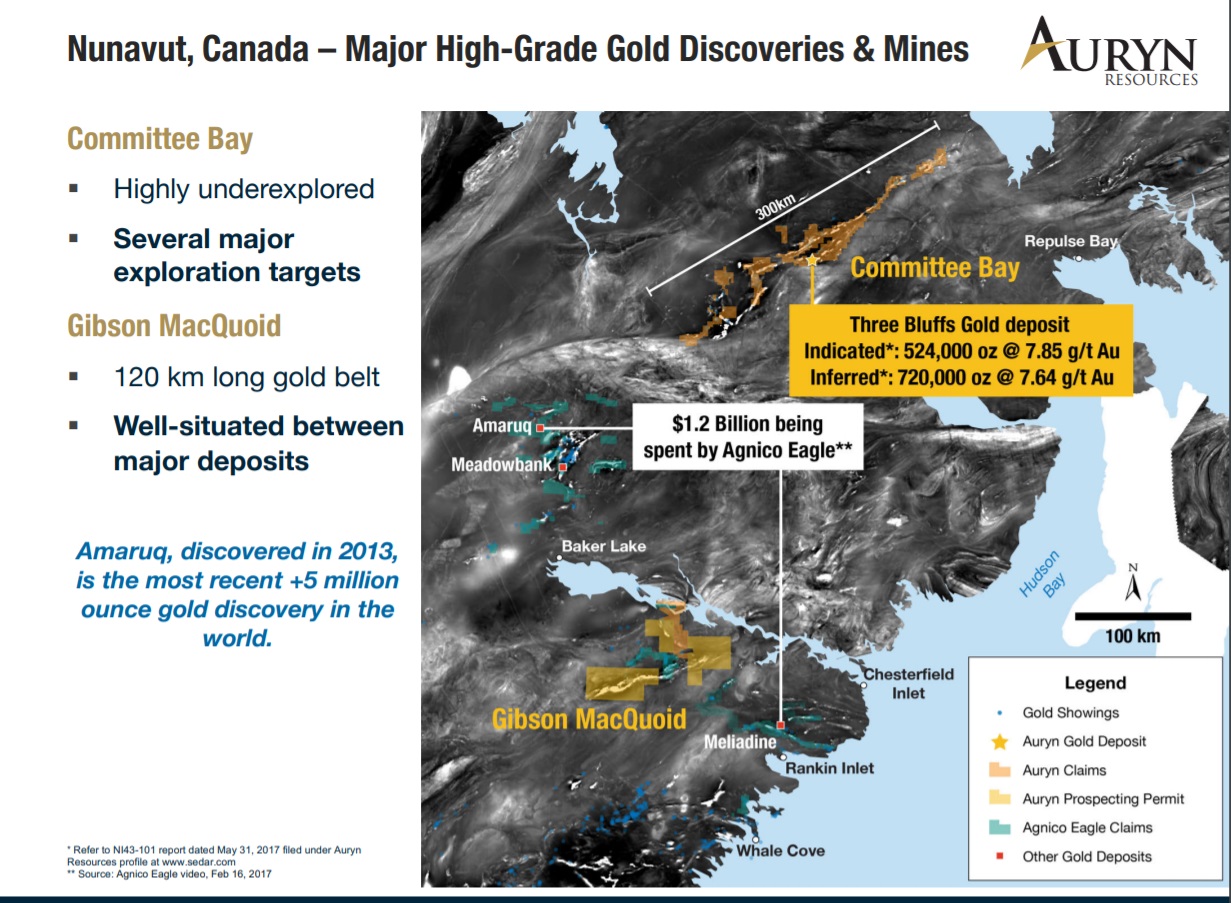

Committee Bay, it’s our tier one gold swing. This is a 300 kilometer long gold belt. For those of you who aren’t familiar with it, there’s about 67 high grade gold occurrences along this belt. It’s just North East of Amaruq, which is the last major gold mine found on the planet in 2013 that’s now gone into production. It’s got a 1.3 million ounce, eight gram per ton gold deposit in the middle of the belt. To make a mine work up here, this is Nunavut, you would need at least five or six million ounces of six grams per ton or more to be standalone. So we have 1.3 of eight gram per ton to start. And we focused in the middle of the belt nearby the 1.3 of eight grams per ton gold, so we could end up putting it all together as one if we start to find something and get through that threshold quite quickly.

The year before last year we drilled a hole of about 12 meters of five grams per ton. The rock looked like boring rock. It didn’t look like it was going to have gold in it. Last year, we went back and drilled around that and we saw the most beautiful rock, the same as you would see at Three Bluffs or Amaruq or Meliadine, some of the major mines up there, but we got to the result of not enough gold in those drill holes. They didn’t have enough grade to support something. So this year, we went up, we did a small program, because we made a very late year decision and you need some lead time to set up to go drilling up there. And so we did a small program of seven drill holes, which were fairly high-risk holes, but obviously high risk holes could give you a big reward. And a few of these holes, which we anticipate in the next couple of weeks to come out, have a really good shot at extending or potentially finding the mineralization or the grade that we didn’t find last year.

It’s a project that if we get it right, we have a chance to find 10, 20, 30 million ounces over the next decade easily. But it may take some time. And so you have to be patient with it. To have Committee Bay in the background while we have Sombrero, where you’re walking on copper and gold for two days straight when you come toward the project, it’s a lot easier to drill something you’re walking on versus exploring in the Arctic undercover in shorter seasons. But the upside of both projects is what we really enjoy as tier one opportunities in the portfolio, both precious and base metal.

Bill: Ivan, you were at the Beaver Creek Precious Metals Summit and then the Denver Gold Forum in the last few weeks. What feedback can you share with my listeners regarding the resource and the gold sector in general as a result of being at those conferences?

Ivan: Well, I’d say the general first comment comes to my head was, there’s a lot less social events. People were a lot more serious. There was a lot less drinking, commiserating over a bear market. And I think people are getting ready for this bull market to come back. I look at the current metal price and first call you get as an exploration company is, “Hey, Ivan, $1,500 gold or $1,550 why isn’t your stock, why isn’t the market on fire? Why aren’t all the juniors flying?” The majors have certainly started to do well, so have the mid-tiers, but if you know how cycles work, the juniors usually are the third phase that usually pick up later in the system. And so I’d say we’re at the end of the bear market in that transition to the bull market.

And I would say, what I saw down at Beaver Creek and Denver was a lot of pencils being sharpened. A lot of people are getting ready to make moves in terms of M&A and possibly invest into these companies again. And I’d say it’s not quite there. You would see it on the tape, but it’s coming. I think that the one thing that I’ve educated a lot of our shareholders with that ask for my opinion, advice and about the market is you have to pace yourself. You have to pace yourself into a bull market, because the metal prices and the bigger companies will perform first and the juniors will follow. As long as you are patient into the bull market, you’ll do extremely well. If your expectations are too high, and you don’t see the performance you want, and you decide to leave and it’s not the bull market, you likely will sell at a low point and revisit at a much higher point down the road.

And so just be patient. Pace yourself. It is most certainly coming. There was the most interest I’ve seen across funds, corporate major mining companies, towards becoming busier in the space in a long time. And I do have to hang out with that very generalist comment…There was a lot less people drinking and socializing in the social events. There was a lot more serious undertone with a lot more sobriety if I can make that comment. And so, for me, it was a really good indicator that we’re on our way back. And so look forward to a continual growth in the precious metal followed by the base metal sector. And I think again the same denominator came back to me as it has the last four years. I don’t see any other tier one exploration swings out there, like Sombrero, and I’m not saying this as a bias to compete or self promote, but I don’t see somebody with an analog to Las Bambas.

I don’t see somebody taking those swings, and screening 7,000 square kilometers and trying to extend an entire belt, world-class belt in Peru. I don’t see that happening in other places. I’d be an investor myself if they were pointed out to me. There is a few discoveries that have happened such as Great Bear Resources. They’ve done extremely well. And some of these guys are having luck, but these aren’t big mines yet. These aren’t five, 10, 20 million ounce discoveries. And I think it’s just going to be a lot harder for us going forward. So when you get onto something as good as we’ve gotten onto with Sombrero, I think you have to look at how rare that is. A major mining company commented to us that it may be a decade or infinite before they ever see a Sombrero again.

And that’s a true comment. It’s probably the only one I’ll ever see in my career. And that’s something that we’re very proud that we’ve gotten into, because we’ve spent four or five years and about a hundred million dollars getting here. And now we have a metal market that we’re going towards, that I think we unanimously can agree on, is going to be a lot better in the next 18 months than it has been in the last 18 months that we just experienced. And I think that’s where you can look forward to some great returns on modest or substantial discoveries. Depends on what you get into.

Bill: And if you hit significantly in a bull market, the share price will multiply many times. I’m just thinking back to SilverCrest Metals in 2016 as silver went from $14/oz to $21/oz and they continued to put out good holes. That little junior went up, I believe, 40 times.

Ivan: That was an incredible, incredible success, and that just shows you how it can happen.

Bill: As always, Ivan, it’s a pleasure talking to you. Thank you for coming on Mining Stock Education today.

Ivan: Thank you so much. Appreciate it, Bill.

from Kerry Lutz Podcasts – Financial Survival Network https://ift.tt/2LL53n7