Imagine the following scene playing out at work tomorrow:

You arrive in the morning to find a note reading ‘HR wants to see you’. About what?, you wonder.

Seeing your HR manager already in the conference room with the door closed, you fidget as you wait. A knot begins to form in your stomach that gets tighter as the minutes tick by.

Suddenly, the door opens. A colleague stumbles out, looking ashen-faced. Then the HR manager’s head emerges, notices you and says “Ah, please come in”.

“I’m sorry to tell you that the company is letting you go,” she begins. “Sales have slumped and we simply can’t employ as many people. It’s nothing personal.”

And just like that, your job is gone.

You’ll get a month’s salary as severance pay, plus two-weeks more if you sign a ‘non-disparagement’ clause. And they’ve just handed you a pile of forms that supposedly will guide you through the process of applying for COBRA health coverage and unemployment benefits, should those be necessary.

And that’s it.

Oh, they’ve already taken your computer back to IT. You’ve got 15 minutes to collect any personal items and say your goodbyes. But please don’t linger. We’d hate to get Security involved…

Thanks for your service! And best of luck in your next venture!

What would you do if this happened to you tomorrow? Really chew on that for a minute.

Would you feel surprised? Liberated? Petrified?

What would your job prospects look like? Are you confident you could get re-hired quickly? Or are you looking at months (or longer) of unemployment?

What will it do to your household finances if you’re out of work for a prolonged time? Are you the primary breadwinner? Do you have other income or substantial savings that can sustain you? If not, how would you plan to make ends meet?

Most people are caught flat-footed by layoffs. There’s a complacency a steady paycheck offers that’s instantly ripped away by a pink slip. Few people are ready — emotionally, professionally, or financially — for the abrupt ending to the status quo a layoff brings.

Mike Tyson once eloquently quipped: “Everybody has a plan until they get punched in the mouth.” Similarly, everybody can afford to be optimistic about tomorrow until they get canned.

Have ‘Layoff Anxiety’? You’re Not Alone.

If the thought-exercise above gave your stomach butterflies, you’re not alone. Nearly half (48%) of US workers report experiencing ‘layoff anxiety’.

And, this is during the “good times”, folks. Officially, we’re still in the longest economic expansion in US history.

What’s it going to be like when this long-in-the-tooth expansion ends, as all inevitably must?

And as we’ve been furiously covering here at PeakProsperity.com, it sure looks like the end is fast arriving. The inverted yield curve in US Treasurys, slowing US growth and negative growth rates in major European economies, anemic global shipping volumes, and a raft of other dependable indicators are flashing warnings that the world economy (including the US) is plunging towards recession.

A recession that corporate America is woefully unprepared for, due to record levels of debt.

9 Trillion Reasons To Reduce Headcount

In response to the past decade of extremely cheap and plentiful credit supplied by the world’s central banks QE (quantitative easing) efforts, company executives have borrowed much more aggressively than in the past. Often to repurchase their company’s own shares in hopes of boosting its stock price (and thus their stock-based compensation packages).

And a worrisome number (hundreds of $billions) of such corporate loans made over the past several years have been low quality, high-risk, and covenant-lite.

As a result, today’s US companies are as or more dangerously leveraged than ever before. More than $9 Trillion of debt now burdens the balance sheets of America’s corporations:

As growth continues to slow and corporate profits decline, debt service takes up an ever-greater percentage of cash flows. At some point, headcount cuts become unavoidable.

The Robot Took My Job

On top of that, as we’ve been long warning about here at PeakProsperity.com, employers currently have a tremendous perverse incentive to automate and replace human labor with technology.

The simple and harsh truth is that it’s expensive, and becoming more so, to employ humans. Wages, health care, retirement benefits, workers comp, OSHA regulations, lawsuits, training, vacations, sick days — it all adds up. Machines free employers from all of those costs, headaches and potential liabilities.

Meanwhile, technological advancements in robotics and AI (artificial intelligence) are on an exponential track. Capabilities are skyrocketing and costs are coming down. With the ability to borrow at rock-bottom interest rates, is it any surprise that companies are investing in automation as fast as they can?

White-shoe consulting firm McKinsey predicts that 50% of current work activities are at risk of being automated by 2030, and that by that time, 400-800 million workers worldwide will be displaced by technology — creating “a challenge potentially greater than past historic shifts”.

A historic transition away from human towards automated labor is underway. It’s happening in every industry and will impact every job function, at every level of the org chart.

And unlike with outsourcing or off-shoring, once these jobs are successfully automated, they’re “gone” as far as human workers are concerned. They’re never going to be un-automated.

It Has Already Begun

Remember the mass layoffs of 2008 and 2009? When thousands of people instantly lost their jobs as companies started jettisoning workers?

Well, they’re back.

In 2019 so far, we’ve seen reductions-in-force reported across a number of industries from the likes of HSBC (4,750 jobs), Nissan (12,500 jobs) and Deutsche Bank (18,000 jobs). Other well-known brands letting employees go include Siemens, Uber, US Steel, Kellogg’s, Ford, Disney, and United Airlines.

At this stage, it’s not (yet) like the carnage seen during the Great Recession. Remember how god-awful scary this was, as hundreds of thousands of people were laid off every month for two years?

8.8 million jobs were lost during this period. When layoffs are that widespread, it’s just a numbers game. Amongst yourself, your family, and your friends — at least some of you are going to fall victim.

How bad could things be next time? Bad enough to take protective action, we think.

And it’s not that hard for us to make the argument that the future wave of mass firings may be substantially worse. So don’t rest on your laurels.

Signs Of Trouble To Watch For

What early-warning indicators can you monitor to assess whether your company, or your specific job, is at risk?

Company Risk Factors

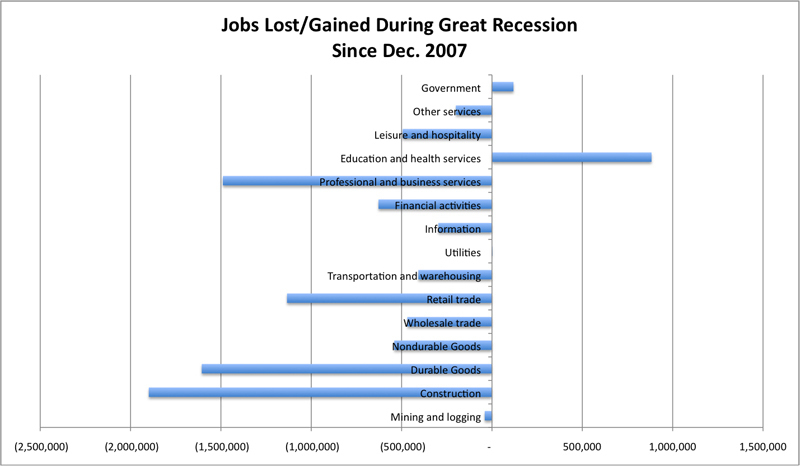

First, it helps to look at the industries that shed the most workers during the Great Recession. History doesn’t repeat itself exactly, but it often rhymes:

Do you currently work in one of these industries? If so, the above chart should give you a general sense as to how yours will fare relative to others should we indeed re-enter recession soon.

But not all companies within an industry are created equal. How can you tell if you’re currently employed by one of the more vulnerable players?

Here are classic signs of trouble to look out for:

- Declining financials — Does your company have a higher Debt/Equity ratio that its industry peers? Are revenues and/or earnings flatlining or decreasing? Are Accounts Payable increasing as a percentage of total Liabilities? All are potential indications of a company on shaky ground.

- Freezes — Has your company announced a freeze on new hires, budgets and/or bonuses? These are all signs of tightening pursestrings, and they constrain prospects for future growth. It’s rare for sizable layoffs to be announced before any, if not all, of these is tried first.

- Postponement of key projects — similar to freezes, big deployments are often pushed back or shelved completely in attempt to reduce costs before headcount cuts are considered. Of course, once you reduce your planned projects, you then realize you don’t need as many people…

- Consolidation — this is when business units are collapsed together for ‘greater efficiency’ and ‘cost savings’. This is a sign that pennies are starting to be pinched, and soon “cost savings” starts to look an awful lot like “employing fewer people”.

- Being acquired — in good times and bad, employees at a company being acquired are at greater risk. Acquisitions are intended to unlock “synergies”, which often is a fancy way to say “if we combine our companies, we can fire all the people who have redundant jobs”. Since they don’t have relationships with the power players at the acquiring firm, those being acquired are usually the first to be shown the door.

- Your company is “pivoting” — “pivoting” is the new smokescreen term for “What we’re doing isn’t working so let’s try something else”. True, it’s wise to abandon a doomed path. But not if you’re just trading it for another half-baked idea. While there are examples of pivots that turned a failing enterprise into a world-class success (did you know that YouTube initially started as a dating site?), those are the exceptions.

- Bad news/too many rumors — “Where there’s smoke, there’s fire”. When your company is unfavorably covered by the trade media for long enough, it’s usually for good reason. Just ask the folks who work (or used to) at Sears, Theranos, JC Penny, Toys “R” Us, or Forever 21.

- Senior management leaving — when the rats at the top start leaving the ship at the same time, it’s time to worry. They know a lot more than you do about your company’s condition. Right now, I’d be really worried if I worked at a place like Tesla…

- Sudden stock drop — a strong stock price makes up for a lot of operational deficiencies (such as, in the example of Netflix, Uber or We Work, losing billions in cash flow every year). But when investors abandon the dream underlying your company and the stock starts tanking, life can quickly get a lot worse. Profitability and positive cash flow suddenly becomes matters of life and death. Those working at a high-flier Tech unicorn or starry-eyed start-up need to be attuned to how quickly things can turn should investors sour.

Is There A Target On Your Back?

Layoffs are like tossing sand bags out of a sinking hot-air balloon. You throw a few overboard to see if that stops the fall. If it doesn’t, you chuck out a few more.

They tend to happen as a sequence. In the first wave, the obvious underperformers are let go. That’s the easy decision, and may even be positive for morale. But if the company is still in trouble, another wave –maybe more — will be needed.

So, how can you tell if you’re at risk for the next wave in the series?

Here are some common predictors:

- Your workload is lightening — workers with spare capacity offer a lower ROI (return on investment). Either your company’s throughput is diminishing (a bad sign) or your boss is re-directing your work to other people (a very bad sign).

- Increase in status reports — if you’re suddenly being asked to rationalize and report on all of your activities, it’s usually a sign that someone higher up the chain from you is trying to “justify” the resources in your department. It’s a signal that the future of your department — or you, specifically — is under review.

- “Too” young — historically, younger workers are often the first let go in a layoff as they have the least work experience and the least seniority within the organization. During the GFC, unemployment among young workers nearly doubled from 5.4% in 2007 to 9.2% in 2010.

- “Too” old — in a growing number of industries (Tech, in particular), it’s increasingly common for older workers to be laid off first. Younger workers often are more familiar and facile with the latest software and technology, and they’re often substantially cheaper to employ. They’re willing to work longer hours for less pay and don’t have the benefits footprint that older workers with families do. ‘Ageism’ is fast becoming a common legal complaint in today’s layoffs.

- Your boss suddenly departs — while this may or may not be a sign that your department is losing status within the company, it often means you’re losing your strongest champion within the organization. If your boss leaves abruptly, be sure to connect with her privately to get the inside scoop. Now that she’s not speaking for overall management, she’ll likely to be fully transparent with you about the company’s condition.

- Friction with your boss — while never a promising sign, if you and your boss aren’t getting along, chances are you won’t be at the top of his list of employes to fight to keep during a RIF (reduction in force). In fact, if you’re suddenly experiencing badwill where there was none before, it could be that he’s trying to build a case for making your layoff an “easy call”.

- Being ‘asked’ to take a pay cut — this is a pretty clear sign that you’re less essential to the company than you were previously and/or that your company is *really* hurting cash flow-wise. If you’re ‘asked’ this, take it as a sign from the universe to start updating your resume.

- Being asked to train someone else or an outside firm on your responsibilities — this is another clear “wake up call” that your job is likely on the chopping block. Unless you know for sure you’re getting promoted, take this as a message to expect a visit from HR soon.

- Your spider-senses are tingling — companies are social institutions by design; they’re made up of people (at least, they still are for now). If you notice the execs and senior managers looking stressed or spending a lot of time huddled in conference rooms, if the water cooler talk revolves around company problems, if perks start quickly disappearing, if people start shunning you — these are all warning signs you should heed. Don’t ignore your gut.

How To Reduce Your Vulnerability

After taking an honest assessment of your job situation, would taking some precautionary measures against a layoff make sense?

[Spoiler alert: if you’re one of the 132 million full-time employees currently working in the US, the right answer is pretty much always “yes”. There’s simply no good reason to trust your primary/only income source to blind faith.]In Part 2: The Layoff Survival Handbook, we detail out the steps to take now to reduce your vulnerability to a layoff, and the critical steps to take right away should you become laid off.

Many of these will enhance your career trajectory and satisfaction even if a pink slip never arrives. But should one do, you’ll be far better off for having taken them.

Given the mounting recessionary risks ahead, we all need to prepare for what’s coming.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access).

The post Mass Layoffs Are Back. Are You At Risk? appeared first on Peak Prosperity.

from Peak Prosperity https://ift.tt/34eSis4