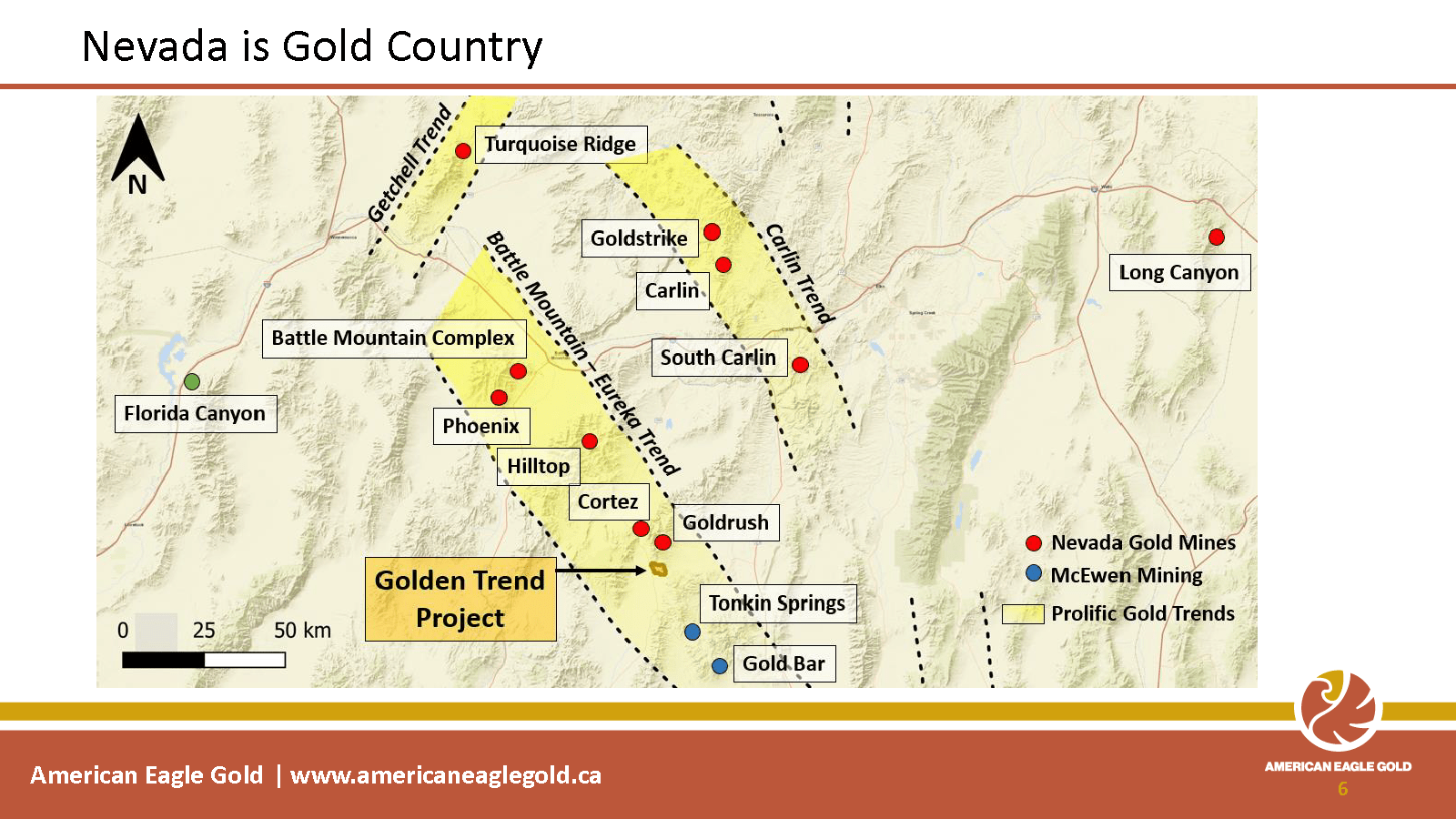

American Eagle Gold (TSXV:AE) is focused on exploring for a world-class gold deposit on its flagship property, Golden Trend. The property is located on the Cortez Trend, next door to Barrick Gold and Newmont Mining’s Goldrush and Cortez Mines, which host over 27 million ounces of gold. The company is pursuing a Goldrush 2.0 type discovery and the exploration is being lead by Mark Bradley, the very geologist who was the project team leader during Barrick’s discovery of Goldrush. American Eagle Gold will be going public any day now pending exchange approval. Drills are expected to be turning on the flagship Golden Trend project in September 2021. In this interview CEO Tony Moreau describes AE’s investment value proposition, upcoming milestones and plans for growth.

American Eagle Gold CEO Tony Moreau stated, “Where our property is, it’s right next to the Goldrush deposit. What’s the Goldrush deposit? It’s coming to production in 2021…it has 15 million ounces of gold in the ground, averaging 10 grams per ton. It’s the biggest and best new gold property that’s coming online in the world right now. So where better to be than five miles next door to this property? If you look right now, there’s seven of the largest 30 mining properties in the world are located either in the Cortez or Carlin camp. Three of those properties located in the Cortez camp, and Pipeline, Cortez, and Goldrush. We’re right next door. We’re on the same fault system as Cortez. So people say finding gold is very tricky. Well, at least we’re taking our chances of finding it a lot better. We’re right in elephant country, and I believe that we’re going to find it.”

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Note: This interview was recorded before the TSXV exchange issued the ticker symbol and confirmed the IPO date. Thus, that part of the discussion is dated. $AE began trading on the TSXV on 5.3.21 and will be listed on the OTC soon.

0:00 Introduction

0:47 Public listing very soon

2:05 Mark Bradley discovered Goldrush & will lead AE’s exploration

4:00 Exploration progress

6:16 Looking for strategic NV project acquisitions

6:42 Treasury and burn rate

7:16 Share structure

7:47 8,000 feet of drilling in September

8:04 ORX shareholders dividended AE shares

TRANSCRIPT:

Bill Powers: In today’s show you’re going to be getting an update from CEO, Tony Moreau of American Eagle Gold. This is a company we featured at the end of last year when it was not yet listed. The listing date is coming up. We profiled this company with Stephen Stewart of the Ore Group because American Eagle Gold is part of the Ore Group and Tony’s coming back on the show today to give us an update of the company’s progress that they’ve made since we last talked, and when we could expect a listing. So Tony, welcome back onto the program and please bring us up to speed with what’s going on with American Eagle Gold.

Tony Moreau: Bill, thank you very much for having me. So just to give you an update on American Eagle Gold. I believe when we did our last webinar or podcast, I said it’d be a March listing. We’ve actually been slightly delayed about a month, but we’re looking to be listing any day now towards the end of April. That month delay is actually really good. I got to hand it to our team, our legal side, and the exchange. We’re dealing with a pandemic right now, and the fact that we are still listing within a month of our target, I think is a compliment to everyone involved. In terms of the updates for the company, we’ve still been full steam ahead. We’ve been mapping the property. We’ve been developing an exploration plan.

The two things that I’m really proud of is that we actually hired Mark Bradley. Mark was the individual that discovered Goldrush. He led the team at Barrick that discovered Goldrush. Our main asset, Golden Trend, is five kilometers Southwest of Goldrush. It’s what we imagined our property being. So we have a great property that is attached to Nevada gold mines, and we have the guy that actually understands the rock that made that discovery. So we’re next to the best mine to be coming online in the next 20 years, and we have the guy working for a company that discovered it.

In terms of our philosophy, we’re not in a sit back and wait approach. There’s a lot of companies out there. They have a 500,000, 1 million ounce resource. They’re waiting for gold to come to them. We are proactive. We want to put drills into the ground. We don’t want to discover 1 million ounce deposit. We want to discover a five to 10 million ounce deposit. This phrase is over-said, but we really are in the land of elephants, and we are targeting a giant deposit that will be economic whether gold is 1,000 or $2,000. Again, we’re right next to Goldrush and we have the very best guy in the world to be discovering it.

Bill: Can you give us any more of the backstory of how you were able to pull that acquisition off, because someone like that is going to have a lot of opportunities, I’m sure, posed to them?

Tony: Well, one of the reasons why I joined the Ore Group, we’re very upfront with investors, with our employees. We have strong financial and technical expertise and we let the experts do their job. Mining’s all about knowing people, having the proper connections with them, and I hit it off with Mark Bradley. Steve Stewart, who’s the chairman, hit it off with him, and we told him our plan. We told him our philosophy and we said, “Listen, you do your work in terms of exploration, we’ll make sure that you have the funds to make that discovery.”

Bill: What progress is being made in terms of permitting, lining up drill rigs, things like this?

Tony: Well, can you believe it, Bill, this property had never been properly mapped, so we mapped it. We built our exploration plan. We’re doing some front end exploration work. We’re looking at MT surveys. We’re looking at seismic surveys to properly understand the architecture that is there, and then we’re going to do some deep drilling and we’re looking at probably September for drilling. We’re looking at going at least 2,000 feet underground. We want to hit the lower plate rocks. That’s where the mineralization is. Right next door, Goldrush, the initial discovery holes were made in 2009. There has never been a deep drill hole below 2,000 feet where this mineralization is since the discovery of Goldrush.

What that means is that people never really understand the architecture of the mineralization of the rocks in the ground, so we are really at virgin ground next to one of the greatest mines in the entire world, with one of the best experts of this type of Carlin Trend that we could find. So I think we’re in very good position. Our market caps going to be approximately $10 million. There is a lot of upside for shareholders, and I’m really excited for hopefully finding a discovery.

Bill: And Goldrush, we should point out, it’s 15 million ounces of gold at 10 grams per ton, right?.

Tony: Exactly. Now, what’s really interesting about this, you’ve got a lot of trends, you’ve got the Carlin Trend, that’s the older sister of where we are. We’re on the Battle Mountain-Eureka Trend. Then there’s the Cortez Trend. It gets really confusing. So what I like to tell people is the Battle Mountain-Eureka Trend, look at that as Beverly Hills. The Cortez Trend is Rodeo Drive. You want to be on Rodeo Drive. We have the shop right next to the Gucci, which is Barrick, and if you look at the trends of discoveries there, Carlin Trend really was discovered in 1961. The Cortez Trend, the main area where we were, look at 1991. That’s a pipeline discovery. They have 20 million ounces there. That’s all open pit. If you go just south, 10 years later, 2001, you got Cortez Hills, 15 million ounces. That’s open pit and underground. If you go just a little bit south, you got Goldrush. That’s all underground. That discovery hole is in 2009. So now you’re looking at 10 years, 10 years, 10 years, we’re along trend, and hopefully we’re that next big deposit along the trend.

Bill: All right. You previously spoke about in our last interview, possible acquisitions. Have you made any progress on that front or because you’re not even public yet, you can’t discuss?

Tony: Well, because of the exchange and the rules and regulations, we have to stay as is, but we are actively looking for smart, creative acquisitions that will create value for our shareholders. We’re always on the lookout, but we want to make a smart deal.

Bill: You’re pre IPO financing was at 20 cents. So what is the treasury at right now, and how far will that take you?

Tony: We’ve approximately $4.1 million of cash on hand. We believe that will take us well into the end of next year. The one thing that I learned of many at IAMGold is always to have a strong balance sheet. I always got prepared for a rainy day, and our plan is always to have at least one year of cash on hand. That means changing your plan accordingly, but we plan to have eventually good results and we plan to be able to raise more money and always have a strong balance sheet.

Bill: Okay, so 54.5 million shares fully diluted I believe your most recent presentation said, so that’s what investors that are looking to buy in the open market should expect?

Tony: Exactly.

Bill: And then the float, what would the float be of that?

Tony: The float’s approximately 16 and a half million shares.

Bill: And ticker symbols, we don’t have that yet, right?

Tony: The thing with the exchange, once we get the go-ahead, we’ve got a Supreme Court approval. We got exchange approval. Any day now we should be able to get our ticker symbol and we should be trading by the end of this week or next week.

Bill: And you said drilling September-ish is what we’re looking at?

Tony: We’re going to be finishing our upfront exploration mid-summer. Then we start permitting between 60 and 90 days, and we’re looking to do a drill program of approximately 8,000 feet starting in September.

Bill: Tony, they’ll be Orefinders’ shareholders that are listening to this conversation that didn’t participate in the pre-IPO financing, but they actually get some shares of American Eagle Gold, don’t they?

Tony: Yes. Us going public was part of a plan of arrangement, so it’s sort of like a dividend that’s given to Orefinders shares to allow us to start trading on the exchange. So yes, they get their shares and approximately for every share of Orefinders you get about 1/40th of a share of American Eagle Gold.

Bill: And any other final updates as we conclude here?

Tony: We’re full steam ahead right now, and one thing I just want to emphasize, Golden Trend, it’s located next to a world-class deposit in Goldrush, and we have the guy that discovered that property that we hope is going to discover another world-class discovery at Golden Trend. So thank you very much for having me, Bill.

from Kerry Lutz Podcasts – Financial Survival Network https://ift.tt/3efP8v9